3 of the stocks we like at current levels

Another day in the sun for Aussie stocks with the mkt backing up yesterday’s bullish move with another +60pts on the upside today. In May / June the market pulled back by -5.5% versus the average pullback since the GFC of -6.9% - so a little shallower than usual but certainly in the range none-the-less. As we wrote this morning (and yesterday afternoon), On balance, we believe the seasonal pullback is complete and the market is well positioned with July, the seasonally second strongest month of the year, only a few weeks away – we will maintain this positive stance while the ASX200 holds over 5690.

Ten network appointed voluntary administrator’s today after their major shareholders failed to guarantee company liabilities – obviously a sad story and one that shows that the guys with deep pockets also make mistakes – costly ones at that. The fate of Ten now largely rests with the Govt and whether or not they’ll change archaic media ownership rules which restricts both Murdoch or Gordon from taking the company over. Right now, Gordon can’t buy Ten due to the 'reach rule' which prevents a television network from broadcasting to more than 75% of the population – while Murdoch can’t buy Ten because of the 'two out of three rule' which prevents the ownership of a TV network, a paper and a radio station in the same market.

That legislation is clearly outdated given the huge number of ‘new media outlets’ that have cropped up. Whatever the case, if the law can be changed then Ten is clearly in play and could be privatised in time by Gordon and Murdoch - however the timing is the issue. For equity holders, probably too little too late.

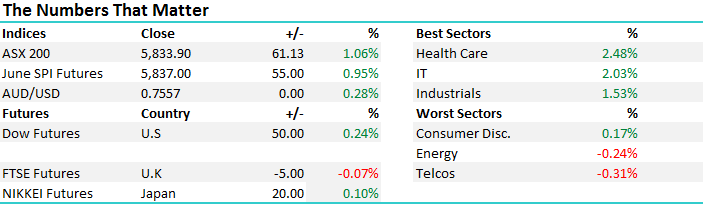

A quick chart of the media space in Oz over the past few years. Ten , Nine and Seven – the fate of Ten has been well documented for some time and clearly should not come as a surprise – however it’s hard to be optimistic on any in the sector given clear structural headwinds.

Media Stocks Daily Chart – Normalised

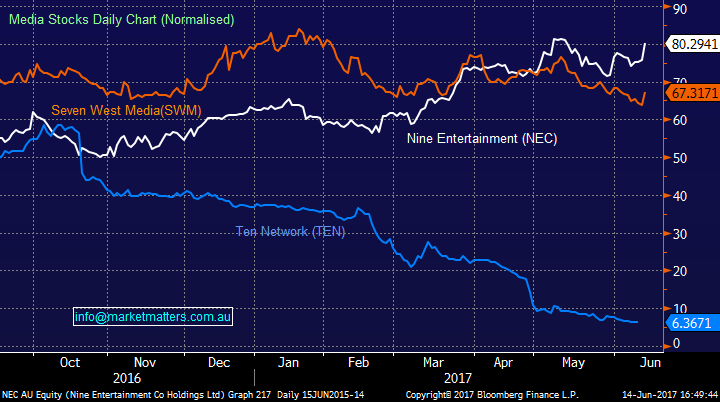

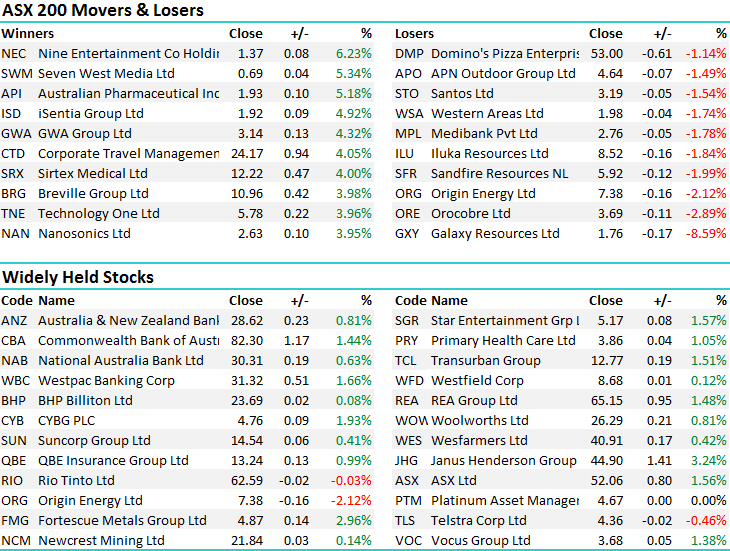

On the broader market today, it was the healthcare stocks that really stood out with the likes of CSL, Ansell, Resmed all having corkers while our friends at Telstra led the Telcos in the wrong direction – dropping by -0.46% to $4.36 - an overall range of +/- 63 points, a high of 5836, a low of 5773 and a close of 5834, +61 pts or +1.06%. – a good day across the board and again some obvious pent up buying demand playing out.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Stocks we like at the moment from current levels…

Suncorp (SUN) has been one of our favourite stocks since MM commenced and it’s our largest holding in the portfolio – we remain bullish, targeting the $16 area i.e. over 10% higher however in line with our recent comments on the overall financial sector, we do intend to realise profits when / if SUN reaches our target area.

Suncorp (SUN) Daily Chart

Fortescue Metals (FMG) – a stock we bought recently going against the grain and it continues to look good for a shorter term move. We paid $4.66 targeting mid $5’s with the stock closing today at $4.87. Today we had a negative move in China + weak Iron Ore price early on yet the stock rallied. A good sign and we continue to see value here…

Fortescue Metals (FMG) Daily Chart

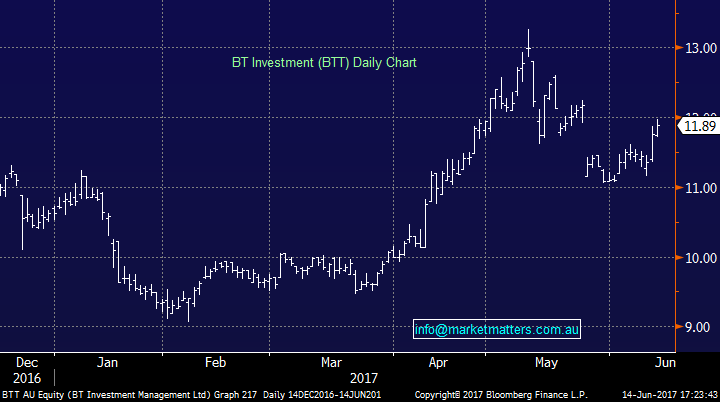

We reduced Janus Henderson from 8% to 5% and added 5% of the MM Portfolio in BT into the recent Westpac induced weakness, and from current levels, this is a stock we continue to like. JHG is less compelling now than it was at lower prices hence our more bullish stance on BTT from here.

BT Investment Management (BTT) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here