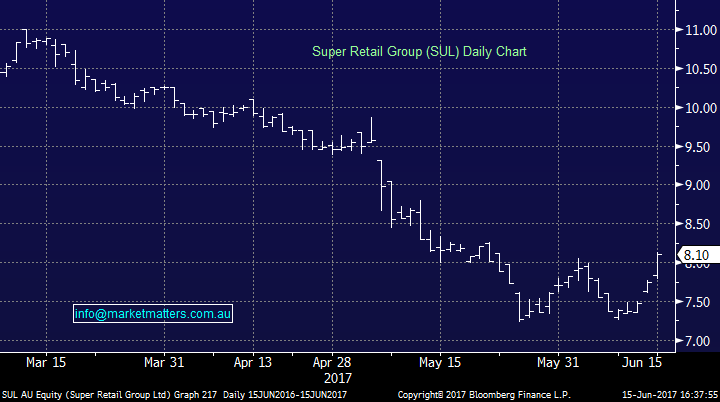

Retailers find some love in a weak market

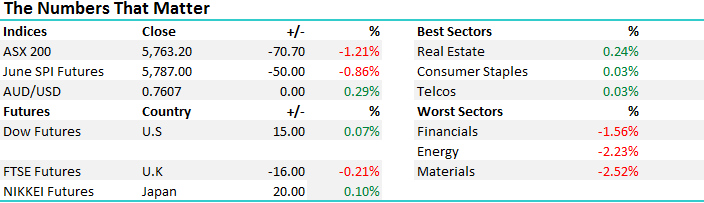

A fairly aggressive sell off today after a couple of days of strength with the Material stocks feeling most of the pain– BHP off by -2.87%, RIO lost -3.69% while Fortescue was off -3.29% closing at $4.71. Weakness in the oil price weighed heavily on the energy stocks and we continue to have no real interest there at the moment, although Crude is coming back down to the bottom of its range around $US40/bbl.

The US Fed raised interest rates overnight, yet US bond yields dropped following a weak inflation print. The Fed is saying low inflation is transient and this will pick up shortly – however the market doesn’t believe it. Falling bond yields helped the ‘yield trade’ today – Syd Airports, Transurban, the REITs etc at the expense of the financials. Westpac the weakest of the majors dropping by -2.65% while CBA was OK down just 0.73% to close at $81.70.

On the broader market today we had an overall range of +/- 67 points, a high of 5819, a low of 5752 and a close of 5833, off -70pts or -1.21%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Retail stocks were interesting today following good employment data out mid-morning although there was buying around yesterday as well. Some obvious bottom fishing playing out in that area of the mkt which is worth keeping an eye on. A lot of these names have been smashed over the past few years – particularly those on big multiples that started to struggle with margin compression. Now the threat of Amazon is ‘clear and present’ but it’s also well-known and could very well be priced in. JB Hi Fi (JBH) the pin up in the sector has gone from a big premium to the market to now trade around 11 times which is about a 30% discount. Still though, we tend to think there remains a reasonable amount of risk to those earnings and we’d rather buy something that is really cheap – such as the Reject Shop (TRS).

They’ve had some big issues of late with a profit downgrade in April following some very poor merchandising decisions – and particular weakness in WA and the ACT. The market dislikes them and they do have some balance sheet pressures, but on 6.9 times value is clearly there.

The Reject Shop (TRS) Daily Chart

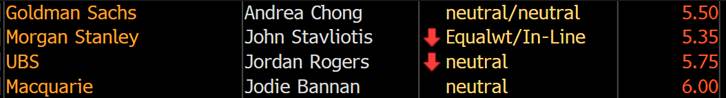

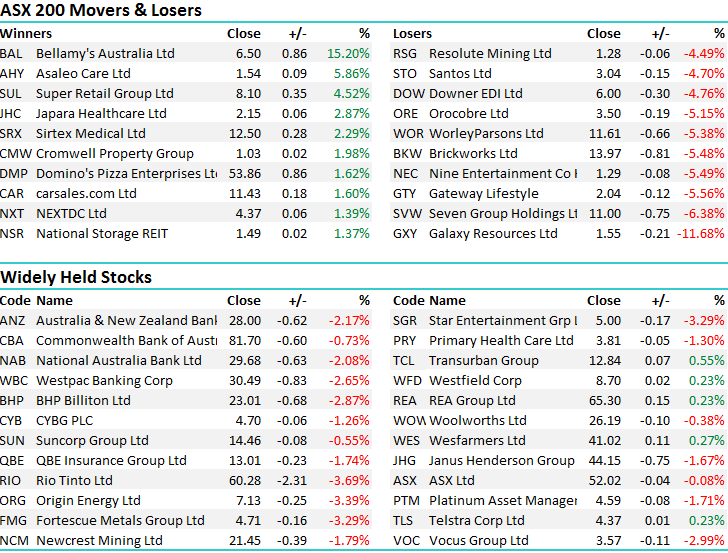

Another in the sector that has struggled in recent times is Super Retail Group (SUL), however it’s had a good few days, following a presentation at the Morgan Stanley Emerging Companies Conference yesterday. The stock has now rallied +10% this week from its recent lows and their take on ‘global competition’ was interesting, particularly how they position their business for it.

To give some background, below are their brands.

They reckon the key is around operating in areas of ‘high involvement’, simply referring to advice on product. If you think about JB and electrical goods, one of one advice is probably less important. They sell a lot of product to the younger demographic which typically sources information online. In terms of Super Cheap and their brands, they do provide advice for a lot of what they sell but they also provide a unique retail experience, something you don’t get online. Rebel Accelerate Stores an example of this while Supercheap will fit your product for you – something buying through Amazon won’t offer.

Clearly there is a lot playing out in the retail space in Australia, however value is value, and using the overseas experience as a guide, it’s seems now might be a good time to start picking through the rubble. We’re starting to sniff around this sector for opportunity!

Super Retail Group (SUL) Daily Chart

Just back to energy stocks for a minute and we wrote in recent notes that these stock continue to look like a short….we have no interest in both Santos and Origin at current levels and aggressive traders could short them.

Santos (STO) Daily Chart

Origin (ORG) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here