Citi puts FMG on a SELL – What do we think?

A lot to digest for the first day of the trading week with news around Amazon’s purchase of Whole Foods in the US ensuring that Woollies was kept under pressure today with the stock down by -3.7%, the market continued to BUY Bellamy’s with the stock running by +12.95% to $7.94 following last week’s acquisition and capital raising while Citi has taken an axe to their call on Fortescue reducing the price target from $5.80 to $3.90 after cutting their forecasts for Iron Ore – more on this below.

A decent open this morning, a soft middle and a bumper close is probably the best way to describe the trading action today, with an overall range of +/- 37 points, a high of 5806, a low of 5769 and a close of 5805, up +31pts or +0.54%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

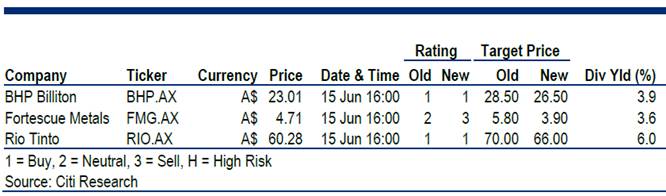

Citi, Iron Ore & FMG; Citi slapped a sell of FMG (from HOLD) with a very bearish price target while they also reduced their price target for BHP and RIO but maintained their BUY calls. Here are the details;

The obvious question that springs to mind is, has the horse already bolted? We own all 3 stocks and together with Oz Minerals and Newcrest they form 20% of our portfolio. Clearly we have a vested interest here however a few points worth highlighting.

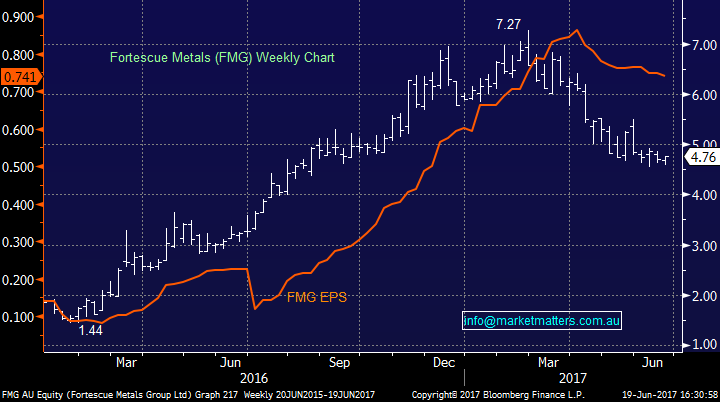

To be clear, we think this call is late and the mkt has already factored in lower Iron Ore assumptions – you can see in the graph below which overlays FMG share price with estimated earnings. The mkt has viewed analysts forecasts as too high and have adjusted the stock price accordingly over time. FMG had a peak at $7.27 and a low of around $4.55 and was actually up today despite the big downgrade.

FMG versus Expected Earnings – analysts late to revise forecasts on way up – Ditto on the way down – share price already factoring lower earnings

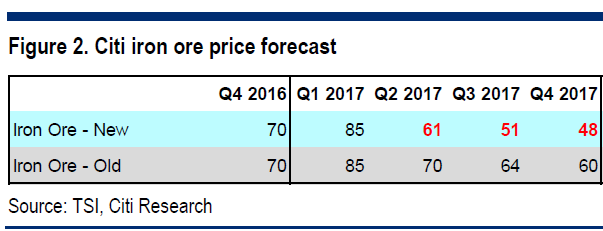

Citi Iron Ore price forecasts

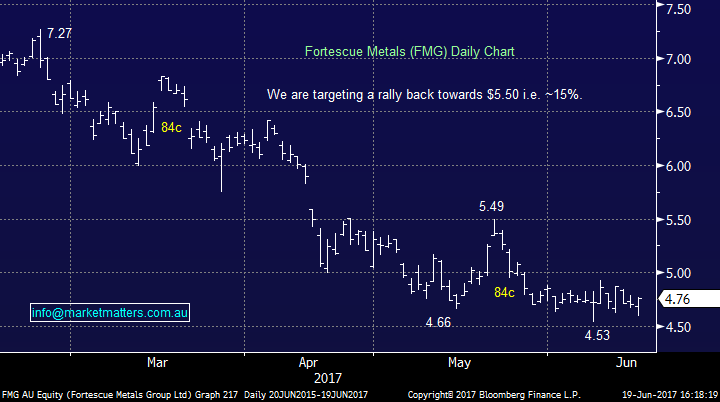

Obviously Citi has taken a knife to their expectations for Iron Ore prices but they’ve also sighted the price discounts being applied to FMG’s lower quality Ore. This is a known known with the discount becoming more pronounced in weak markets, and getting less when things improve. In terms of discount, the low here seemed to be in April and the discount has narrowed since then implying the trend is improving. We own FMG from $4.665 and remain comfortable holders.

Fortescue Metals (FMG) Daily Chart

Staying on resources for a second, I did a quick interview with Martin Crabb from Shaw last week about earnings growth etc, and the lower expectations for FY18. A few questions on this today, however the short answer in that earnings growth in the miners was very strong in FY17 and simply cools in FY18. It’s hard to maintain such a pace however the Iron Ore price has also tanked and as we’ve seen from Citi above, analysts are downgrading their expectations here and this has a negative impact obviously on the earnings of the sector.

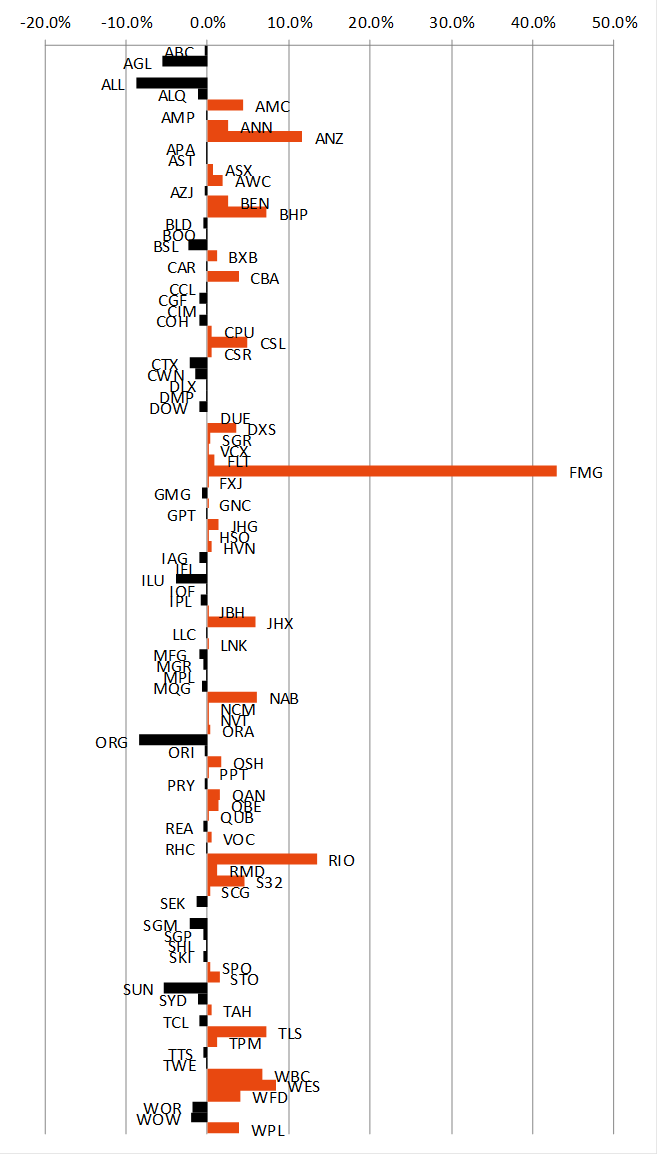

For instance, and this is from Martin Crabb at Shaw, the earnings per share (EPS) of the mkt peaked on or around the 26th of April and we have fallen 1.7% since then based on 12 month forward. So who are the culprits? Well the forecast profit of the ASX100 stocks is down by $1.3 billion over the period. Fortescue Metals (FMG) makes up $417m or ~40% of the fall. Other larger contributors are shown. (Positive number means a fall in profits).

Source; Shaw and Partners

So the deteriorating earnings profile of the market seems to be driven by the iron ore miners in particular as we cycle forward to lower iron ore prices.

Woollies (WOW) – hit today by -3.7% to close at $25.33 with most of the damage done on open. Amazon’s 13.7bn acquisition of Whole Foods instantly puts the e-commerce giant into 100’s of brick & mortar stores selling groceries. As we said in the Weekend Report & again this morning Walmart was smashed over 7% at one stage on the news as AMZN gave a clear direction to one part of their expansion plans. This is now concerning for both Woolworths and Wesfarmers (Coles) who enjoy BIG margins, well in excess of most supermarkets globally and this makes them ripe for disruption IF Amazon can get their logistics network humming!!

Woolworths (WOW) Daily Chart

Bellamy’s (BAL) – continues to run today adding almost 13% after last week’s news of a capital raising + purchase of a canning facility for $28.5m. In simple terms, BAL got into trouble by relying on others in terms of production and licensing which essentially drove them into a corner and almost ruined them as demand declined.

The deal last week affords them independence to can their own infant formula powder products + it gives them the ability to underpin sales cash flow with contract canning deals with other processors – something they will push for. The cap raising helps their balance sheet but importantly, the canning deal gives them flexibility around production which is crucial with a product with limited shelf life.

All up, the technical picture has improved with BAL and it’s one we’ll put some more time assessing over coming weeks.

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here