Market starts new year on back foot

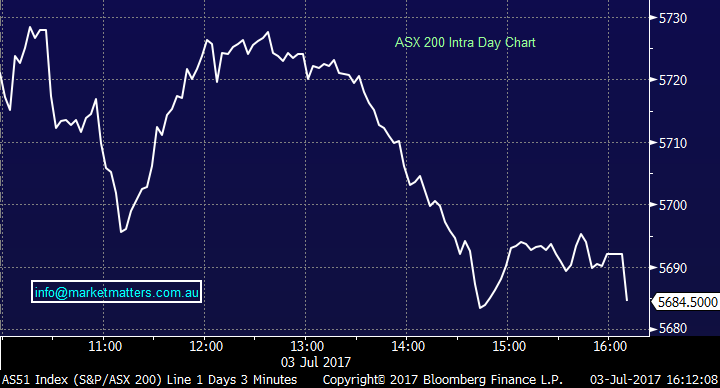

The market opened higher this morning buoyed by some tentative buying in overseas markets while it seemed Fridays aggressive selloff was overdone, however despite better than expected manufacturing data over the weekend from China and again today from the Caixin read the market still struggled to hold onto those early gains, and sold off into the close. An early close for the US market tonight and Independence Day tomorrow (no trade) will ensure volumes and most likely conviction remains low, while we’ve also got school holidays for the next two weeks which is great for traffic in from Manly but not really for volumes on the mkt.

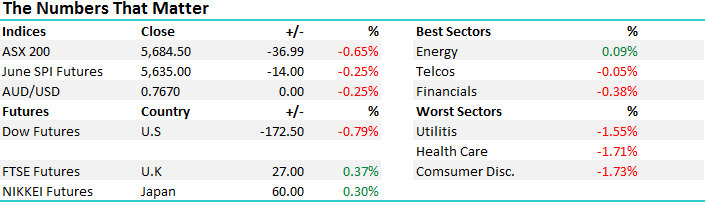

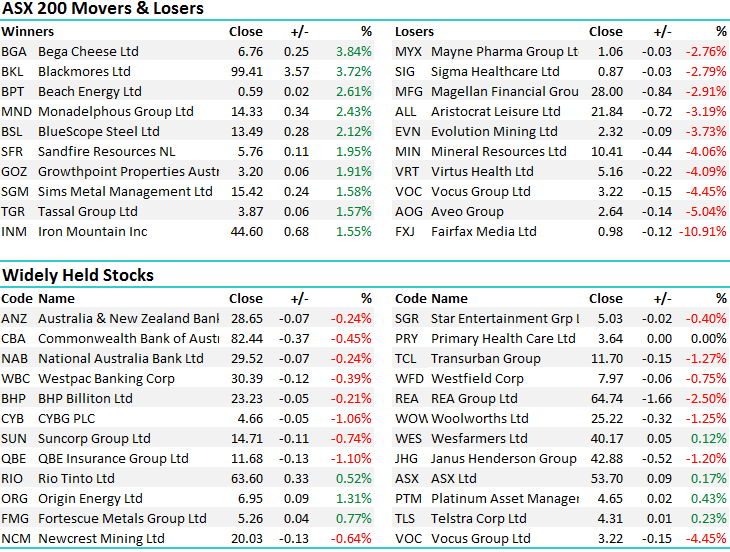

On the broader market today, the Energy stocks took their lead from improvement in the Oil price while the Telcos and Financials rounded out the top three sectors. On the flipside, consumer discretionary was hit as were the Healthcare stocks with profit taking in CSL, Ramsay and the like. An overall range today of +/- 46 points, a high of 5729, a low of 5682 and a close of 5684, off -37pts or -0.65%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

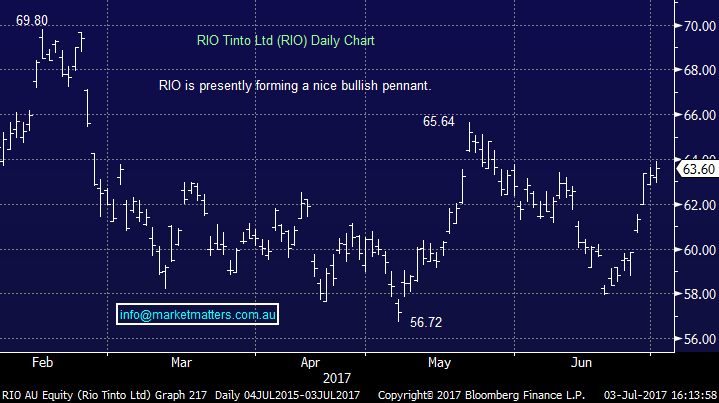

The flow of Chinese Data has clearly been improving of late and today was no exception, with the Caixin PMI (Manufacturing Data) printing 50.4 versus 49.9 expected, which is a positive for the resource stocks and we saw them mostly higher today in a weak session – FMG for instance added 0.77% while RIO was up by 0.52% to $63.60 - we hold both in the MM portfolio.

Rio Tinto Daily Chart

Fairfax confirmed that the private equity bidders had walked, unable to make a deal stake up for the complete company – instead they’ll go down the path of spinning off domain and we’d look for information here in the coming days. Domain is a good business and is making ground on REA. FXJ could be an interesting play here sub $1.00.

Fairfax (FXJ) Daily Chart

Elsewhere, it looks likely that VOC will reject the KKR bid and this has the stock tracking backwards. We doubt that KKR would have put their best foot forward in offer 1 however they’ll need to see some competition enter the fray for them to up their offer. What the stock does will likely depend on how the bid is rejected. If they say the bid is highly conditional and materially undervalues the stock, this means no bid is good enough and expect the stock price will fall materially, if they are more constructive in their response, keeping the doors open, then the stock is unlikely to get dumped (too much).

Vocus Communications (VOC) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/07/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here