Shag on a rock!

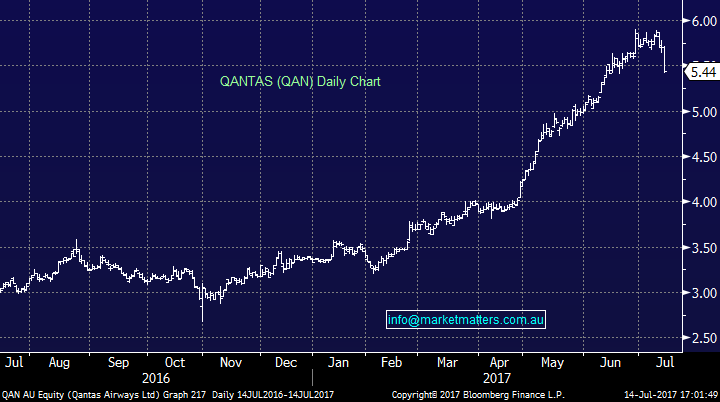

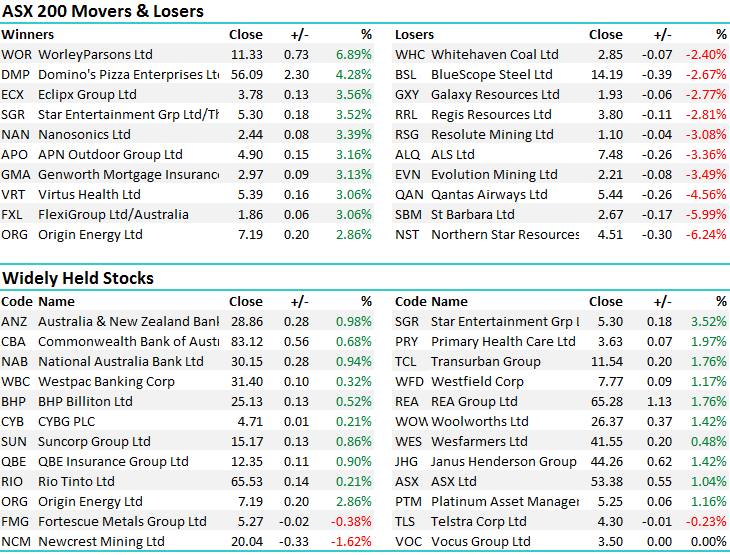

A positive session to wrap up the week with the Energy stocks benefitting from a resurgence in the Oil price - which closed out around $US46/bl. This put some solid pressure on Qantas with the stock down -4.56% to close at $5.44 – the biggest decline in more than a year. QAN would get interesting under $5.00.

Qantas (QAN) Daily Chart

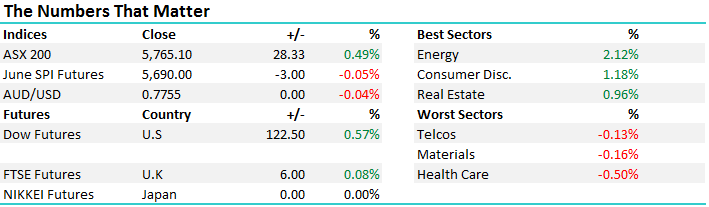

On the broader market today, we had a range of +/- 39 points, a high of 5779, a low of 5740 and a close of 5765, up +28pts or 0.49%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Star Entertainment (SGR) – a stock we’ve been running the numbers on for some time now, traded back into our range yesterday and we were keen buyers around $5.10 this morning, only to see the stocks open at $5.20 and roar up +3.52% to close at $5.30. We continue to like SGR however will await better levels…

Our rationale from this AM!

Star Entertainment (SGR) – $5.12

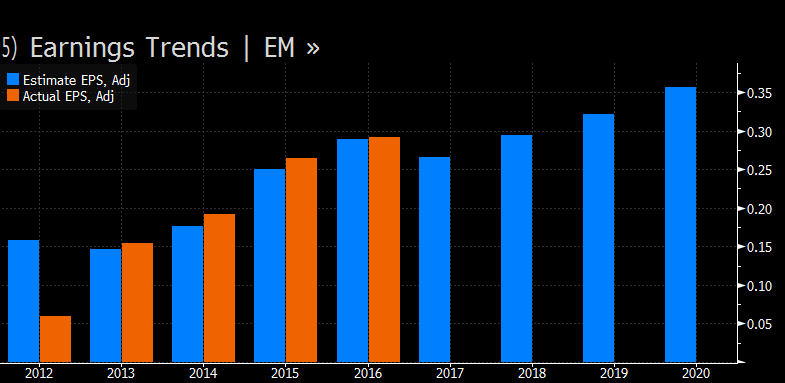

We’ve owned Star Entertainment in the past, buying in February of this year at $4.76 and selling in May at $5.61 - we also picked up a nice 7.5c full franked dividend along the way for a total return of +19.43%. Star is once again looking interesting after trading back down to the low $5’s, closing yesterday at $5.12. As a refresher, The Star operates The Star in Sydney, Jupiter’s Hotel & Casino on the Gold Coast and Treasury Casino & Hotel in Brisbane. They also manage the Gold Coast Convention and Exhibition Centre. Furthermore, they’re progressing with the development of a new Integrate Resort as part of the Queen's Wharf Brisbane project due for completion in 2022.

This obviously means that expenditure will be reasonable high as this project completes, however the development will drive long term earnings. It seems recent weakness is driven by a couple of things. Soft consumer sentiment and reluctance to spend in Australia is a well-known theme, however it’s one that impacts Star. The other is around valuation and near term earnings. 2017 is expected to see a decline in earnings relative to 2016 which puts it on a forward PE around 19 x, which is rich for a company that has seen top line (revenue) decline over the 12 months (-2%). However, from F18, given the composition of their assets earnings will once again start to grow putting it on a PE nearer 16 times on FY18 and a yield of 3% FF. Strong balance sheet, good future growth, Chinese Tourism, and the stock has come back to attractive levels.

There has also been some talk (largely being pushed by Citi) suggesting that if Crown were to buy the Star, this would lift Crown earnings by up to 22% assuming they made an all-cash deal at a 30% premium to its last close – equates to around $6.45 when the note was penned. Corporate appeal always tends to help a share price however is not the reason to buy a stock.

The Star Entertainment Group (SGR) Daily Chart

Have a great weekend and keep an eye out for the report on Sunday.

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/07/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here