Trump Bump then Dump…

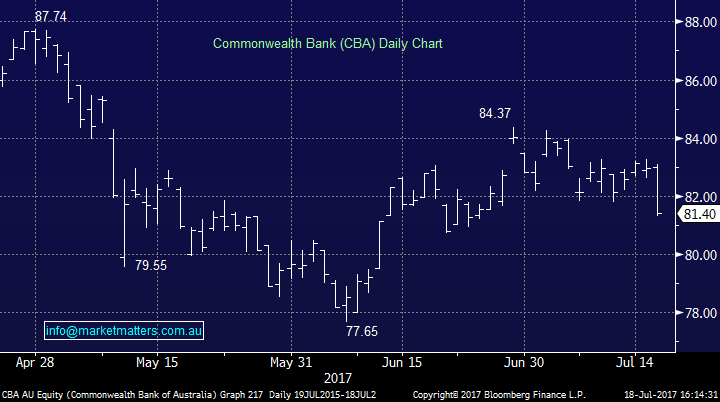

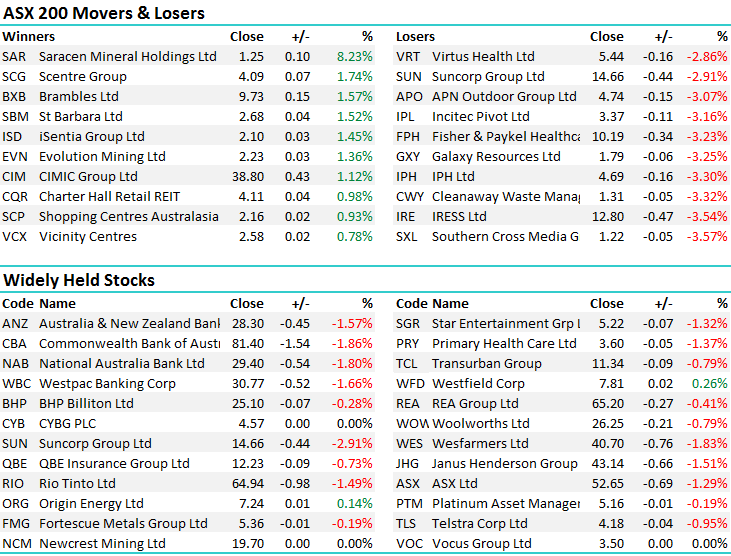

A confluence of factors combined to send stocks deeply in the red today ahead of the much anticipated APRA ruling on bank capital requirements. What is ‘unquestionably strong’ and how long will the banks be given to achieve it? The banks dropped by 1.5-2% today taking a massive 24pts points off the broader index. ANZ the best (relatively) given they have highest tier 1 while CBA was the weakest link down by -1.86%.

Commonwealth Bank (CBA) Daily Chart

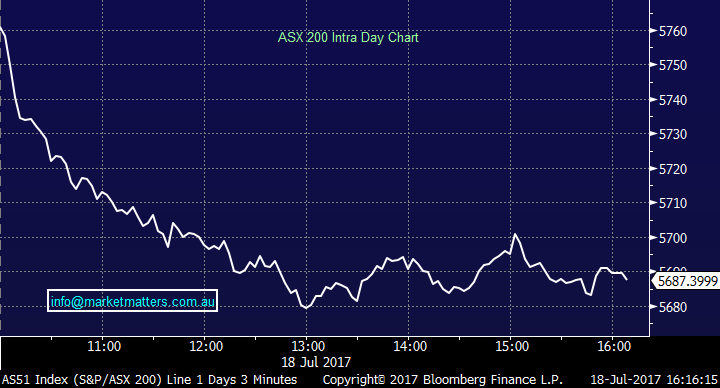

On the broader market today we had an overall range of +/- 83 points, a high of 5761, a low of 5678 and a close of 5687, off -68pts or -1.18%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Trumped Again; DT is struggling to repeal and immediately replace the ‘failure of Obamacare’ as they phrase it, and today had another set- back with a number of key Senators failing to support the revised deal. That in itself is probably not market moving however the implication that Trump will have difficulties getting through the BIG stimulatory measures that have underpinned the strong market advance since his surprise victory has clearly got some traders in sell mode.

The weakness though is very much focussed on Australia so that excuse only holds so much weight. The Banks in the firing line could be it – The ASIC Chair on the front page of FIN this morning talking about Hybrids (we’ll address this tomorrow in the Income Report) could be another, or maybe a soft production report from RIO…or as we wrote yesterday, someone simply ‘selling Australia’ and using the FUTURES market to do it.

Rio Tinto (RIO) Production Numbers; They were weak but that was expected given weather / cyclones – railway maintenance – strikes + generally this is a weaker period of shipments. All up, a weaker score card for RIO. They revised down their full year Iron Ore guidance by 10mpta and this saw Iron Ore prices supported in Asian trade – Futures added +5.19% during our session. The soft numbers should see earnings downgrades, but not big – around the 2% mark.

The stock closed down -1.49% to $64.94 – we own RIO sub $60 – however clearly resistance around $66 short term

Rio Tinto Daily Chart

Oil Search (OSH) Production Numbers; A decent set of numbers today, the clear standout was the prices achieved relative to the prior period – average selling price was $47.84. In a low oil price environment, strong prices become more important than ever – and OSH is clearly delivering on it. Production YTD was 14.8 mboe and full year guidance is unchanged in the range 28.5-30.5 mboe. No doubt the best play in the energy sector however we’re still 50/50 on Oil at this point.

The stock lost -0.74% to close at $6.73

Oil Search Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/07/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here