Banks leave the station – all aboard!

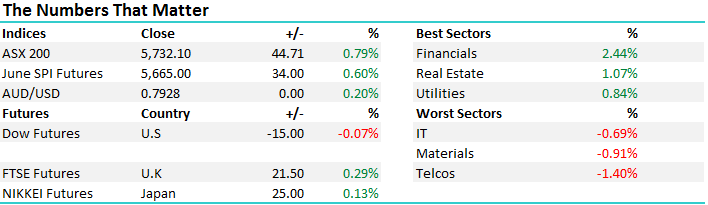

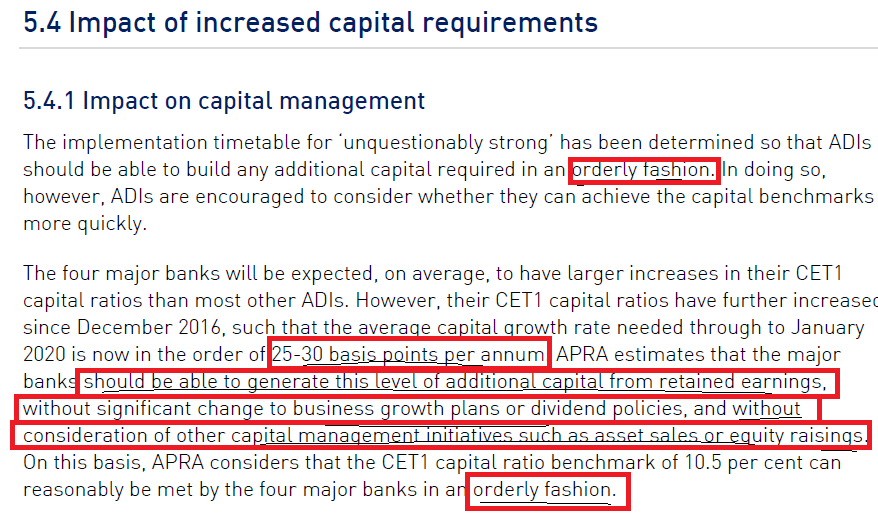

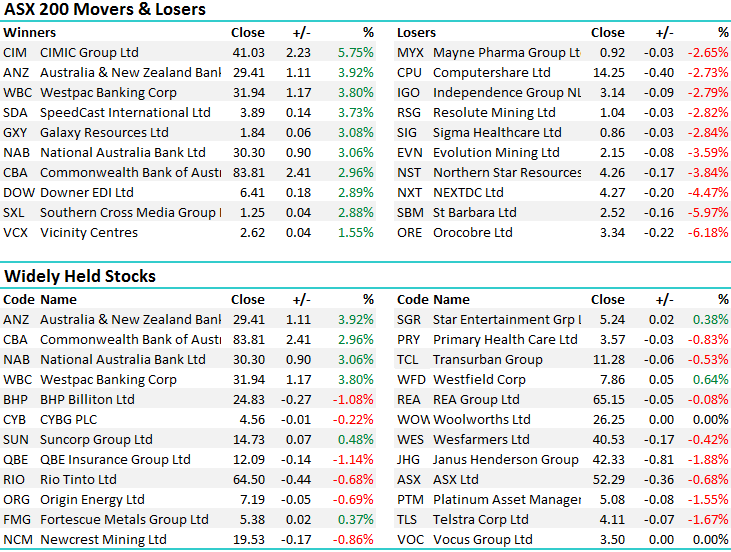

A very buoyant market today however it was courtesy of strong buying in the banks, and not much else, with the BIG 4 accounting for all of the gains for the ASX 200 / +45.29 points in fact versus a market that was up 44.7pts! Clearly the banks are dominant on the Aussie mkt and the relief around new capital requirements was clearly at play today. It now seems probable that the banks will generate capital organically to meet the new thresholds set out by the regulator – and they’ll have long enough to do it.

Each bank is a little different with ANZ having the strongest capital position, mainly because they’ve been selling capital hungry Asian businesses (which will impact growth – but hey, the mkts are more focussed on Capital this week). Commonwealth Bank has the biggest task to complete – something in the range of $3.5bn in new capital required however they too should get this done organically over time.

All up, the news means banks are not cum-cap raise and that overhang is now gone – a big positive. From bank levy’s, increased capital requirements & RBA interest rate hikes, banks have clearly copped it on the chin for some time, however the clarity that has now been provided should bode well for bank share prices from here.

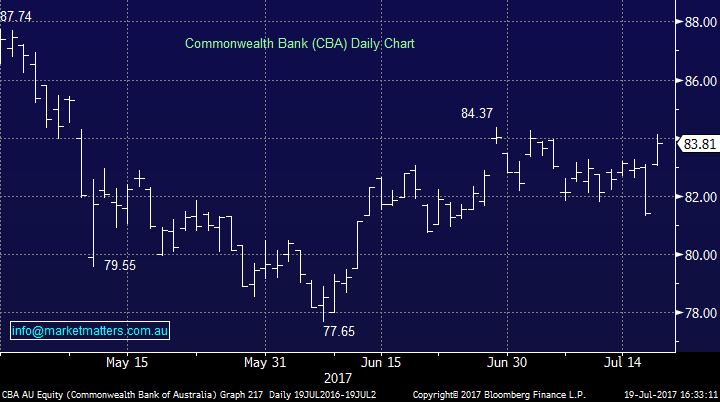

Today, ANZ was best on ground adding +3.92% to close at $29.41 while CBA was the weakest adding +2.96% to close at $83.81. We own WBC, CBA & NAB in the MM Portfolio, all from lower levels.

Commonwealth Bank (CBA) Daily Chart

On the broader market today, the banks the standout while Telstra dragged the Telco’s lower – down by -1.40% - an overall range of +/- 45 points, a high of 5743, a low of 5698 and a close of 5732, up 44pts or +0.79%.

The ASX 200 is still trading in a neutral pattern on the daily chart, however as discussed this morning only 8-trading days remaining this July, the statistical fact remains a break of the current 5629-5836 trading range should occur shortly and follow through for at least 50-points. Our “gut feel” remains we will get a relief rally in the dominant banking sector which should see the market higher into month end.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

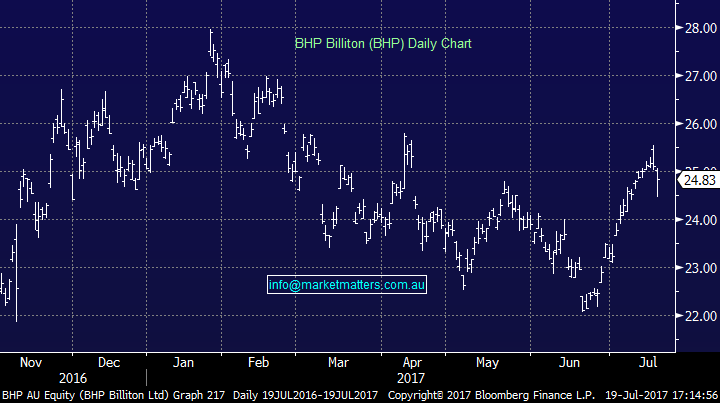

BHP Production Numbers; out this morning and some good parts and not so good parts + some decent variance in terms of production guidance for FY18. All up, theybeat iron ore and petroleum guidance in FY17 whilst coal and copper were softer (weather/strike) as expected. In terms of guidance, they downgraded US onshore production in FY18, however that’s actually a marginal positive to earnings (given it was loss making). All up, an OK report and we are still keen on BHP. Interestingly, if we plug in spot prices we get an earnings increase of +20% for BHP! We own BHP from lower levels.

BHP Daily Chart

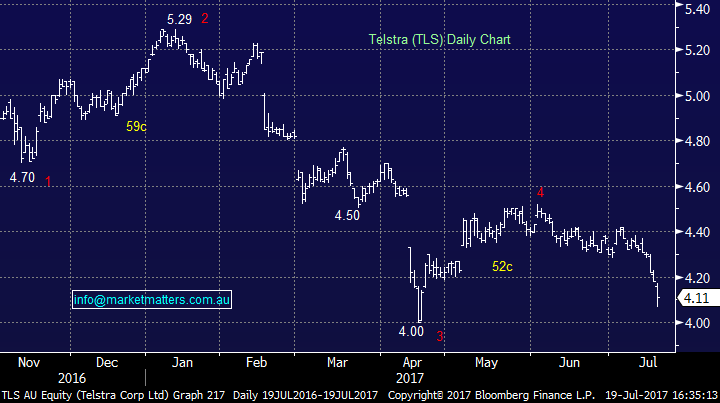

Telstra on the other hand looks weak and going lower in our opinion ($3.70 target). We think they’ll cut the dividend and this argument gained some traction this morning (in the Australian) following an interview on Sky Biz, with the Chairman commenting. “Boards review dividend policies all the time and we live in an extremely changeable world at the moment,” he said. “It’s fascinating that the potential competitors of the future, not the traditional Optus or Vodafone but more likely the Amazons of the world, don’t pay a dividend.” According to Mr Mullen, this evolution of established business and investor models has been critical in driving the success of the tech giants, giving them an advantage over the incumbents.

“They reinvest their ever-growing cash flow into cheaper and better products to gain market share,” he said. “I think there’s going to be a growing divide between some of the older established companies and the newer companies, not just because of technology but also because of the new investor models. “If Telstra didn’t pay dividends for 10 years we would have a $50 billion war chest to take on the new competitors,” he added (Source; The Australian)

Telstra Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/07/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here