Sector rotation the main game in town

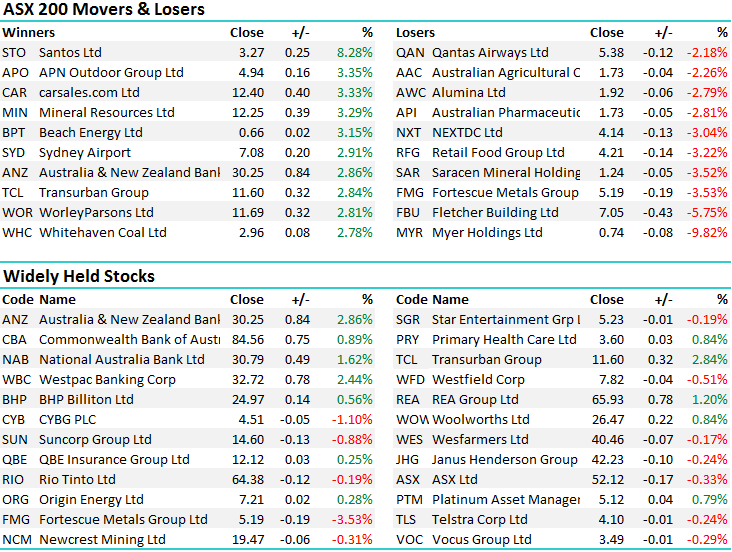

A less eventful session today with the Banks opening strongly but suffering some selling after early strength, while the resources were a mixed bag. The interesting aspect is more around sector rotation – not a lot of obvious new buying coming off the sidelines, just redirection of existing money. When the banks were strong yesterday, the resources copped some selling and the same was true today on some of the other sectors.

It seems to us that fund managers are sitting on the fence in aggregate terms, but just flicking between what’s hot and what’s not. You can see why this would be the case with overseas money, and the reluctance to bring new money into a market post a BIG rally in the currency, however the domestic fundies are a different story – it speaks more to the lack of any real conviction in views at the moment.

To recap our views, we think the mkt trades higher into month end however we’ll then be more aggressively increasing cash for a more mundane Aug / Sep. To date, the banks are up around +3.5% for the month with the average gain (post GFC) in the month of July of around +4.49% - some more upside however the last 2 days buying has been fairly decent.

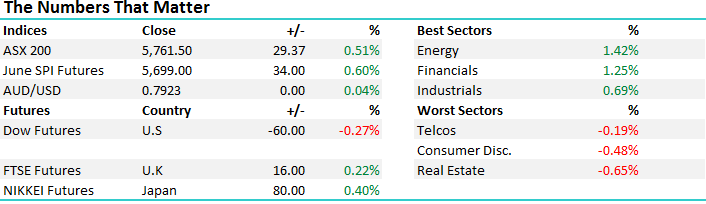

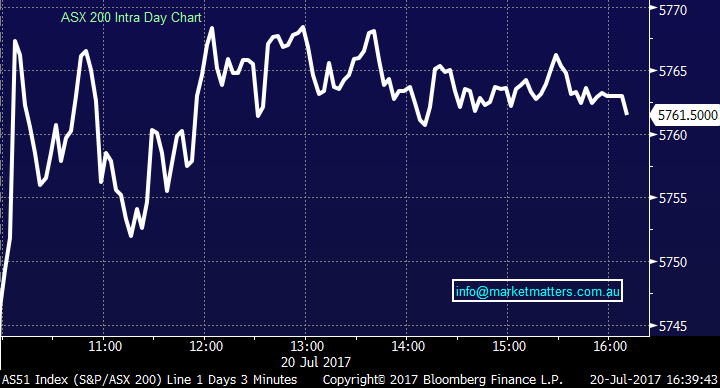

On the broader market today, we had an overall range of +/- 27 points, a high of 5770, a low of 5743 and a close of 5761, up +29pts or +0.51%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

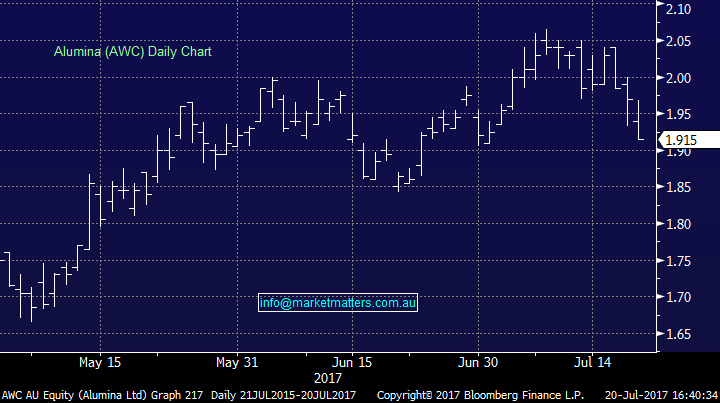

Alumina – Alcoa was out overnight with results and they delivered a miss in terms of earnings ( ~1.8%) but inline revenue. Importantly, the Alumina unit (of which AWC has a 40% interest) delivered US$227m worth of earnings which was a slight miss and that’s why we saw some selling in AWC stock today – shares finishing down by -2.79% to $1.915. We think AWC will probably tread water for a while now (given the miss) and recent strength in the share price.

Alumina (AWC) Daily Chart

Santos – out with production numbers this morning and the stock was strong on the back of it – largely because we saw a better result in terms of debt and costs, which are grinding down, as per the companies key focus for the next year or two. Free cash flow breakeven is now $US33 down from around US$36.50 in 2016 – which is a good result. The mkt hates Santos, has been burnt too many times so any less bad news attracts buying. If they can de-lever the balance sheet, gets costs down, they might actually do OK. The stock up by +8.28% to close at $3.27

Santos (STO) Daily Chart

Macquarie (MQG) – this has been under pressure lately and it seems to have a ‘smell’ about it – on up days it’s failed to participate – and on down days it’s underperformed. 63% of MQG’s earnings are offshore and the average AUDUSD rate was around 75 last year, if the currency stays around 80c, this could impact their earnings negatively by around 4%. Interestingly, the US banks have seen weakness in fixed income divisions mainly however that’s not a big parts of the MQG book. If the currency spikes through 80c and MQG gets hit, buying weakness looks a good play here. They have their AGM next Thursday (27th July).

Macquarie (MQG) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/07/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here