The market hates retail – could there be fireworks this reporting season?

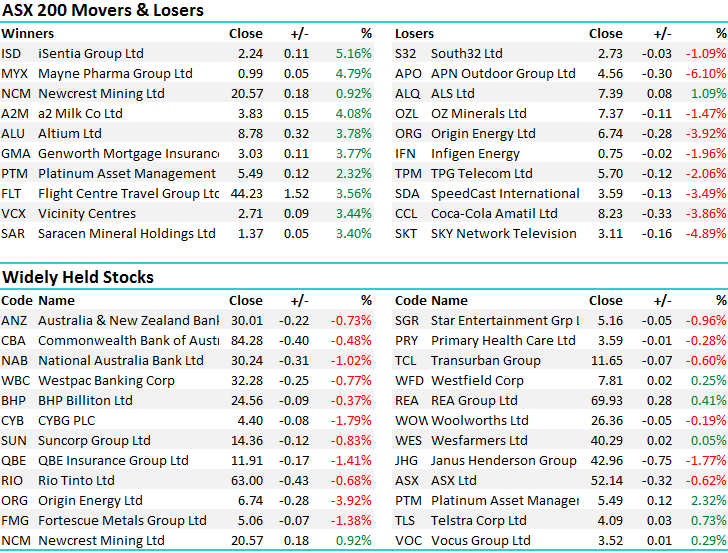

We were expecting some weakness to play out and that clearly wasn’t the case today with the mkt opening higher and pushing up throughout the session, only to see some decent lines of selling tick into the close…..the mkt selling off around -25pts from the 3.30pm high. Some dogs are clearly starting to wag their tales ahead of this reporting season and the areas of the mkt that have major headwinds – that are the ‘avoid’ type stocks / sectors are actually seeing most love.

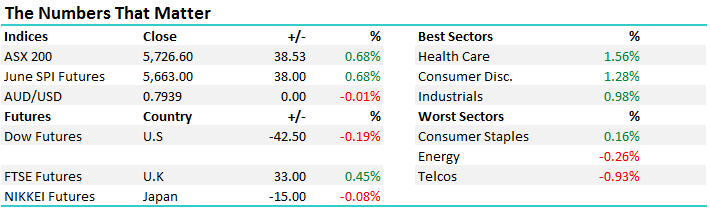

Those areas of the mkt did best today, with Healthcare and Consumer Disc leading the charge – up +1.56% & 1.28% respectively – Telcos were back in the dog house down by around -1% - an overall range of +/- 53 points, a high of 5743, a low of 5690 and a close of 5726, up +38pts or +0.68%.

ASX 200 Intra-Day Chart

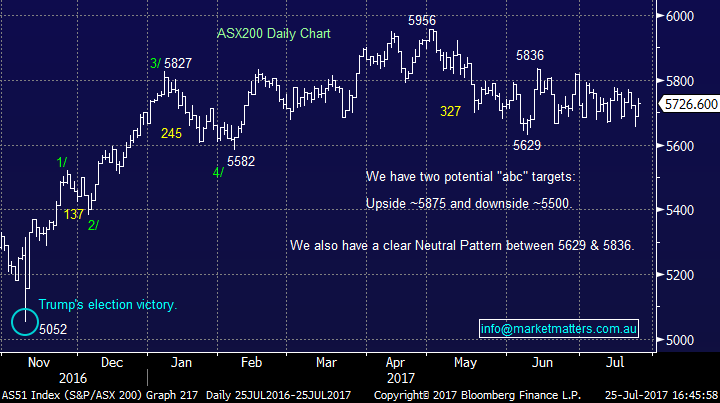

ASX 200 Daily Chart

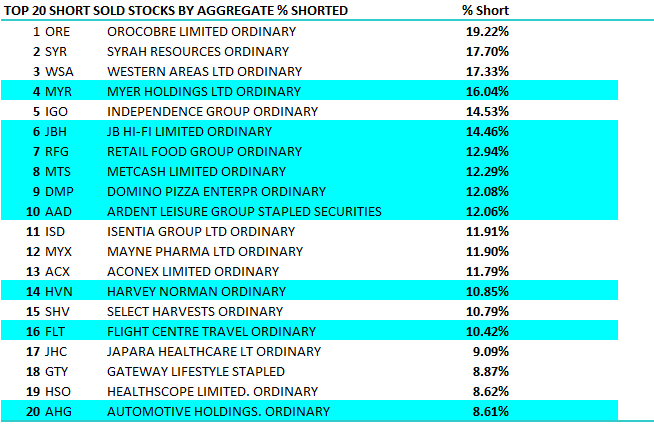

The AFR running a front page this afternoon courtesy of a research report from DB, saying that companies that have been targeted by the short-sellers end up being the stocks that perform best during reporting season. They give some well researched stats to support the argument and it makes sense. It also supports the normal MM thinking that mkts often get things wrong, over react one way or another, and it’s dangerous going with the crowd.

Amaphobia - or in laymen’s terms, the complete fear of Amazon to the extent that Taxi’s drivers, Uber operators and even the Coffee man is getting nervous about its impending launch in Australia. Imminent doom awaits for our retailers and we simply shouldn’t be there. Of the 20 top shorts on the Australian market almost 50% of them are retailers of some description. To be fair, the impending entrance of Amazon is not all to blame – retail sales have also been incredibly weak due to higher living expenses and a lack of any meaningful wage growth – topics we covered this morning, however the table below is pretty extreme.

JBH for instance was happily trading on a PE around 22 times for an extended period and with the recent derating the stock now finds it on 15 times, yet we haven’t seen an impact on earnings (as yet). Harvey Norman is now trading on 10x which is cheap, but not as cheap as Myer which is trading around 9x post the recent downgrade. These are now cheap stocks with a lot of Amaphobia built into them, and maybe, just maybe the mkt has overreacted – it wouldn’t be the first time! We looked at IVF stocks this morning which have been whacked in recent times. In coming morning notes we’ll have a look at the retailers.

% of stock short sold

JH Hi Fi (JBH) – Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/07/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here