2 clear observations from July

It was all about the resource stocks today with Iron Ore limit up in Asian trade (+7.95%) which put a rocket under the Iron Ore coys in particular, Fortescue the standout adding +5.9% to close on its highs at $5.74, while both BHP and RIO chimed in for some solid gains – BHP adding +2.05% flirting with $26 while RIO added +2.41% to close just shy of $66. To reiterate, our target for BHP sits at $28 while we’re targeting $70 for RIO, which seemed a far flung expectation a few weeks ago.

BHP Daily Chart

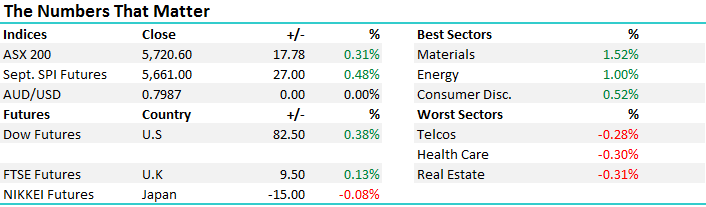

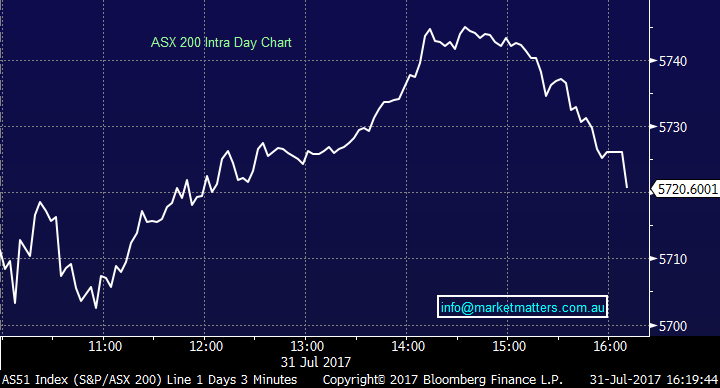

Obviously the Material sector led the charge adding +1.52% and interestingly, the 3 stocks mentioned above accounted for ~11 index points or +64% of today’s gains, while most pain was felt amongst the Real Estate names followed closely by Healthcare and the Telcos – all sectors Market Matters are giving a wide berth at the moment. Overall we had a range of +/- 44 points, a high of 5745, a low of 5701 and a close of 5720, up +17pts or +0.31%.

ASX 200 Intra-Day Chart

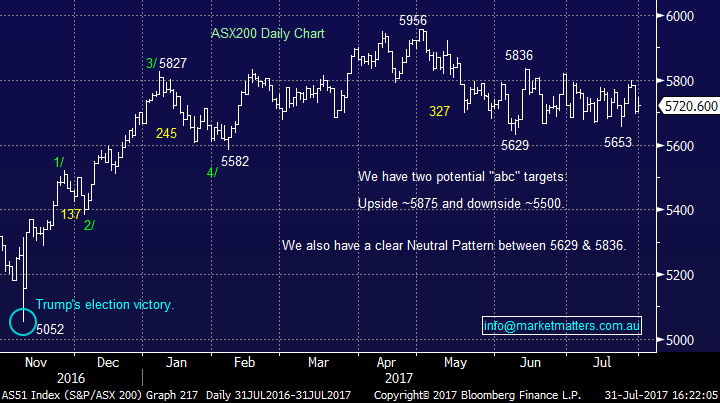

ASX 200 Daily Chart

Looking at the monthly performance for the index, and the sectors within it, a couple of things stand out.

1. The typical July Strength did not play out with the index down -0.02%, versus an average post GFC gain (not including 2017) of +4.04%. The weak performance we saw this July brings down the monthly average (now +3.59%) however clearly, it’s still a bullish month for equities. We were calling for a July mkt rally which didn’t play out for the mkt generally, however some sectors did particularly well. Our stance now is more cautionary across the board given weaker seasonals in August/Sep

2. Secondly, the reflation trade did best and this is an area we are exposed to. Our biggest bullish bets are in Resources and Financials for the MM Growth portfolio while we have a skew towards the beaten down Consumer Discretionary stocks in the MM Income Portfolio. In a weak, choppy market, the worst performers were the typically safe, defensive areas – Healthcare for instance was clobbered -7.47% followed by the interest rate sensitive Utilities sector. Clearly, being exposed to the right sector in the first instance, or at least avoiding the areas that have major headwinds, and then drilling down into specific stocks to buy / or avoid is getting more crucial as this mature bull market works towards completion, and central banks globally turn the dial on current policies.

Source; Bloomberg

As it stands, we’re holding high cash levels (23.5%) looking for opportunities if they present themselves in the right sectors. For now, 5500 on the ASX 200 looks to be good risk/reward buying.

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/07/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here