Domino’s result hard to swallow!

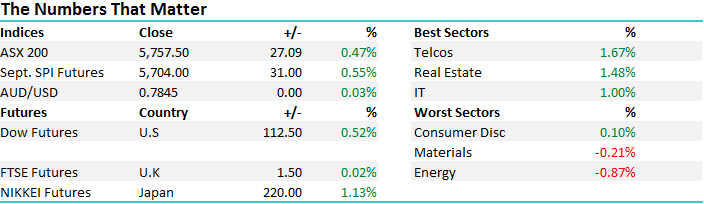

Another day of some hits and a few misses in terms of reporting, however interestingly, those stocks that have reported well in the last few days have continued to see strong buying on the back of it. The broader market was strong on open, bid up strongly in the first hour of trade before some selling kicked in from early afternoon. On the broader market today, the Telco stocks did well with Telstra seeing some love adding +1.68% to close at $4.24, while the biggest drag was seen amongst the Energy names - an overall range of +/- 36 points, a high of 5777, a low of 5741 and a close of 5757, up +27pts or +0.47%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

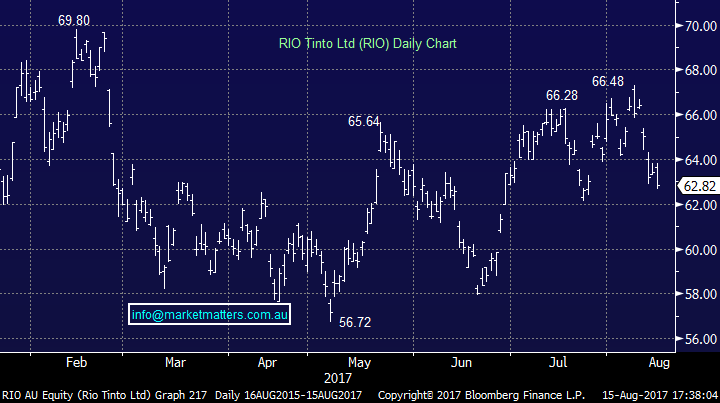

RIO – we sent an alert to SELL our 5% position in RIO today with a $63.50 limit. Markets are fluid and clearly the alert put some pressure on the stock which dropped very sharply as the alert was being received. Some may have been able to get out around $63.50, others may not, however this clearly illustrates the reality of the MM service. Real alerts, trading on a real portfolio and clearly mkt liquidity and speed of execution becomes a factor. To be clear, Market Matters is a service that writes daily notes about the markets, and trades a portfolio of stocks on the back of that. Whenever we trade, we send an alert to our subscribers notifying them of the actions we have taken on our portfolio. In our mind, this is the most transparent, clear and concise way to operate. In the instance, as the intra-day chart below shows, the stock pulled back sharply in a very short amount of time.

James will cover the stock in the next day or so, as part of a Direct From The Desk update to subscribers.

Rio Tinto Intra-Day Chart

Taking a step back, the basis of the SELL recommendation is around our more sanguine view for the material sector in the shorter term. We wrote….We are in the market now selling our position in Rio Tinto above $63.60 taking an 8.5% profit inclusive of the recent dividend. As per recent comments in the reports, we expect that RIO and resources generally will go through a period of underperformance, and therefore we’d like to increase our weighting towards the banks, reducing our exposure to resources in the short term. The threat of a sharp bounce in the $US we think could play into near term weakness in the sector, and given our large exposure there, we thought it prudent to cut RIO in this instance – locking in a nice profit, allocating the funds to other areas of the mkt.

Rio Tinto Daily Chart

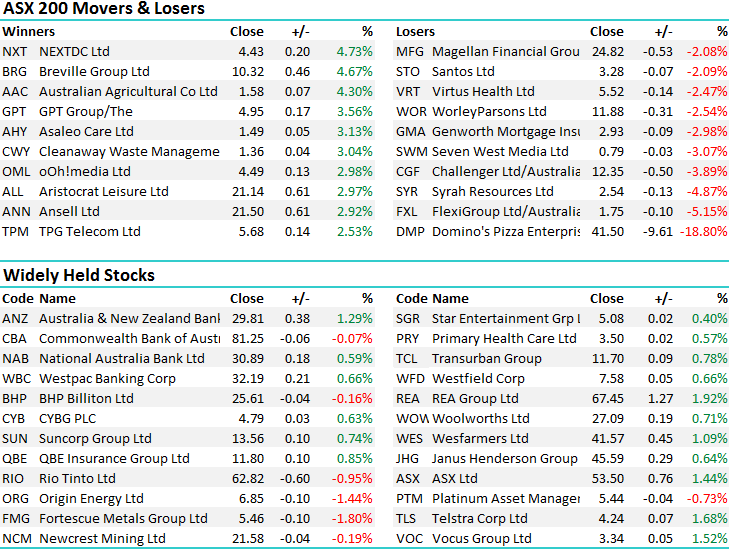

Elsewhere, Domino’s (DMP) was hit hard – falling more than 20% at one stage after missing prior guidance, and downgrading their FY18 numbers. In terms of the result for FY17, it was a slight miss however they’d angered the mkt by upgrading a few months prior. They then put further kindling on the fire by guiding to +20% profit growth for FY18 versus the market expectations of more than 30%. Consensus earnings for FY18 sat around ~$160m and guidance implies something closer to ~$140m. The drop in terms of expected earnings plus a rerate in terms of PE saw DMP whacked – and rightly so. The stock closed down -18.8% to $41.50 after trading as high as $80.69 this time last year. BIG downgrades to flow through tomorrow and the stock still trades on around 30x. This is not one to BUY in the short term in our view, however another leg lower might just get us interested!

Domino’s Pizza Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/08/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here