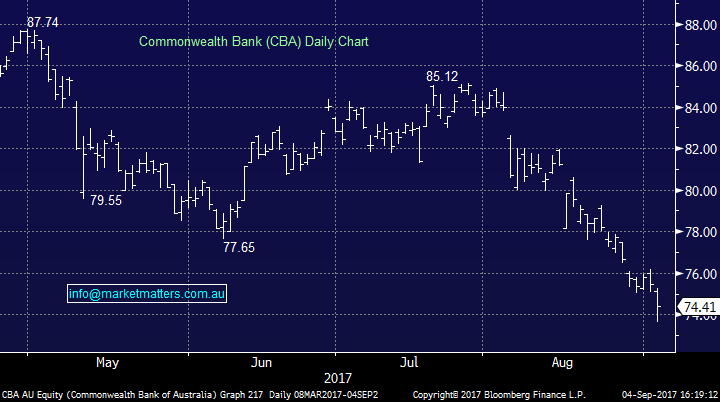

CBA in focus (CBA, MCP)

The banks continued to weigh on the broader market today led by CBA which traded down to a low of $73.63 before closing at $74.41, off by -1.42%, detracting 6.06 index points from the ASX 200.

AUSTRAC have now started legal proceedings and the Federal Court today gave CBA until mid-December to file its defense while AUSTRAC will have until March 16 to respond. Interestingly, CBA has retained Herbert Smith Freehills, the Lawyers that defended Tabcorp in the only other Federal Court case on anti money laundering obligations. In that case, Tabcorp was found to have contravened the law - which culminated in a fine of more than $45 million.

In that case, Tabcorp was found guilty of 108 contraventions of the act, while CBA is being scrutinized for 174 contraventions. I’ve read a lot of potential interpretations of the possible fine, ranging from $18m to telephone numbers of many billions and that seems to be the issue. A lack of clarity and inability to pinpoint the likely outcome, particularly given that any contravention in Australia where funds were sent overseas, may constitute a contravention in another jurisdiction.

While Australian regulators have historically been more lenient, international regulators have been less so. Examples here include an $US8.9 billion fine paid by BNP Paribas in 2014, a $US2 billion fine paid by JP Morgan Chase and a $US1.9 billion fine paid by HSBC in 2012. By CBA taking Freehills on board, it seems they are banking on a similar sort of outcome. At the end of the day, this is likely to be a negotiated settlement, and reflecting on Tabcorp’s $45m hit – which is the biggest fine in civil history, that represented about 18% of 1 years earnings for that year. If the same formula is applied to CBA, this would result in a fine of around $2.5bn, making it by far the biggest potential penalty ever imposed.

The outcome won’t be known for a number of years, and will be settled well after Ian Narev has left the building (and is hopefully running the ARU as per some rumours I’ve heard!). Clearly it has been a turbulent time for CBA - with the stock dropping more than $10 a share, or in mkt cap terms - down $17bn. We own CBA in both the MM Growth Portfolio and the MM Income Portfolio, and today we added to our holding in the Income Portfolio by 2.5% around $74.00 per share.

Commonwealth Bank (CBA) Daily Chart

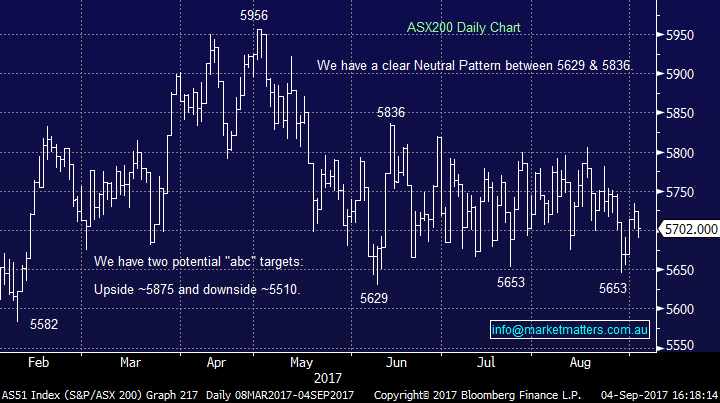

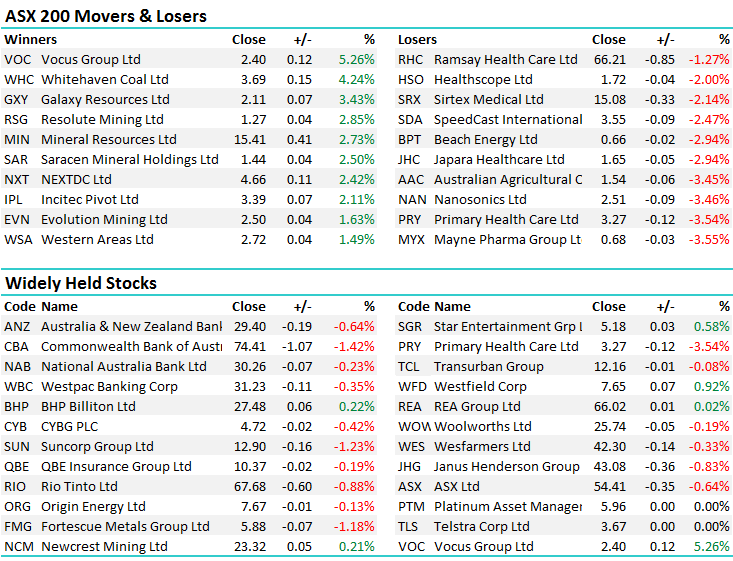

On the broader market today, the Utilities sector saw most pain partially offset by strength in the Real Estate stocks that did report well in aggregate over the past few weeks - an overall range of +/- 34 points, a high of 5724, a low of 5690 and a close of 5754, off -22pts or -0.39%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

A reminder for those with interest in the MCP Master Income Trust with the priority offer closing by the end of this week. Should you still have interest after viewing the prospectus, there are two ways to apply for units. The first is through the Broker Firm Offer where a priority allocation may be received if your broker is listed in the prospectus. If this is not the case, James and his team through Shaw and Partners can work with you to establish an account at Shaw, allowing them to make a bid on your behalf for this offer, and other regular offers that they have access to in the future.

Alternatively, access to the General Offer is available through the link below. https://sharebpo.7g.com.au/OnlineApplication.aspx?ID=C65E7E4637248431D8597C6954881FC041594812

….and more information including our views are available on the MM website

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/09/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here