MM has spent some money today as our patience appears justified

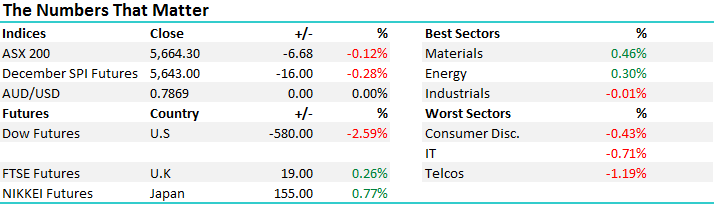

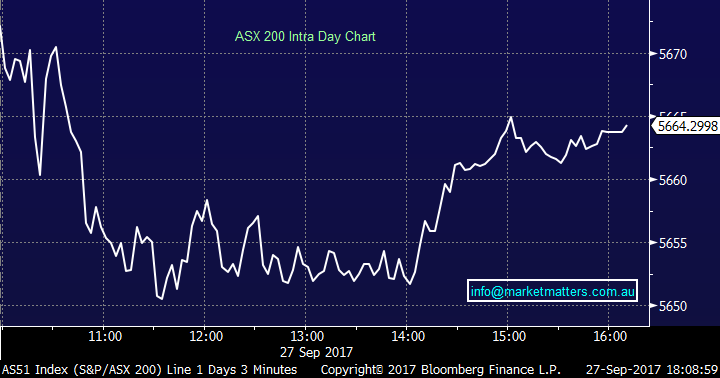

The local market yet again opened ok this morning only to encounter some selling but more noticeably a total lack of buying. Volume continues to be extremely low as local investors / fund managers and traders alike start looking forward to a long weekend, albeit with different days off! The ASX200 traded down as low as 5649, a mere 20-points above its 20-week low, a break down towards 5500 feels inevitable but we’ve thought that before! If we actually got a decent down night in the US it would really put the cat among the pigeons. Today the market had a range of +/- 23 points, a high of 5672, a low of 5649 and a close of 5664, down 6 points of -0.12%.

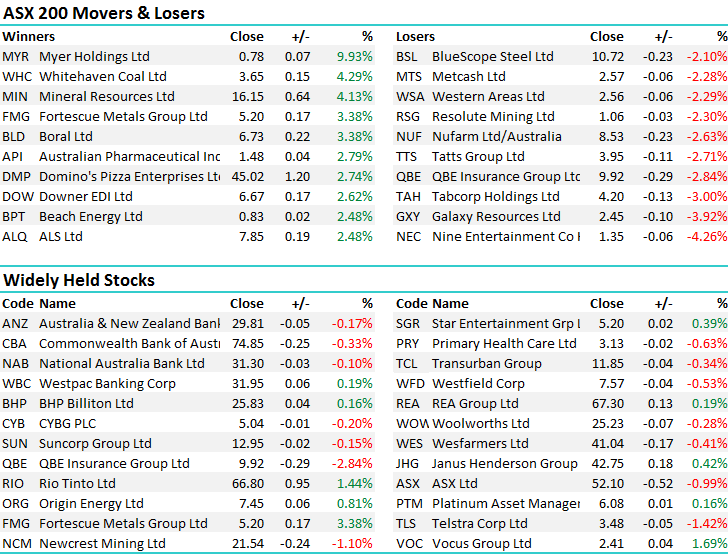

QBE was the standout on the downside falling 3.4% while Myer staged an impressive 12% turnaround after being sold off early – some renewed takeover interest perhaps?

Today we are going to focus on the 3 stocks mentioned in today’s alert plus a potential sell over coming days / weeks. It’s important to be very “hands on” during these periods of activity as they often come and go very quickly.

ASX 200 intraday Chart

ASX 200 Daily Chart

1 Aristocrat Leisure (ALL) $20.25 – We are targeting ALL around $11.95 and still believe there is a strong possibility we will buy our first tranche in the next 24-48 hours and may even go from 3% up to 5% if weakness does unfold.

*Watch for alerts.

Aristocrat Leisure (ALL) Weekly Chart

2 Telstra (TLS) $3.47 - We added 2.5% to our TLS at $3.48 today. We have no intention of increasing this position but ultimately see a rally back towards $3.75-80 with an attractive 11c fully franked dividend due in February.

Our selling back on the 26th of June at $4.34 looks pretty good now!

*Watch for alerts.

Telstra (TLS) Weekly Chart

3 Challenger (CGF) $12 - We allocated 3% into CGF today at $11.95 and remain keen to increase our exposure into any further weakness.

*Watch for alerts.

Challenger Financial (CGF) Monthly Chart

4 Healthscope (HSO) $1.68 - We are currently losing a few cents on our position in HSO and are contemplating selling out around the $1.70 area, especially if the market spikes down towards 5500 potentially yielding excellent switch opportunities.

Healthscope (HSO) Weekly Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/09/2017 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here