Takeovers ignite the ASX today (MTR, SHV, FMG, BHP)

A more bullish session today than overseas leads + local futures were suggesting this morning, with some combined buying amongst the banks and miners early on, although the miners were sold pretty aggressively from their earlier highs – more on that below. I love seeing headlines of corporate activity on the ASX – takeovers and the like – it tends to give a shot in the arm to an otherwise dull market + improves confidence and speculation of more to come with 2 such headlines coming across the ticker this morning – Mantra and Select Harvest both copping bids. We actually should see more of this in coming months given the end of super low interest rates is clearly approaching – and corporates can lock in cheap borrowing ahead of any rate hikes + organic growth is hard to generate and cost cutting to support earnings growth can only last so long!

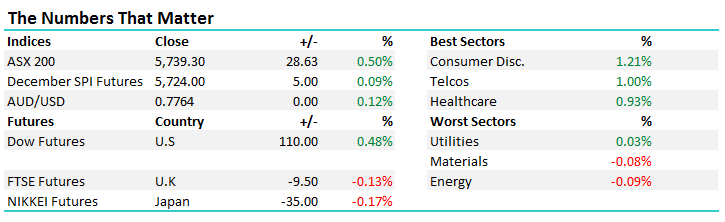

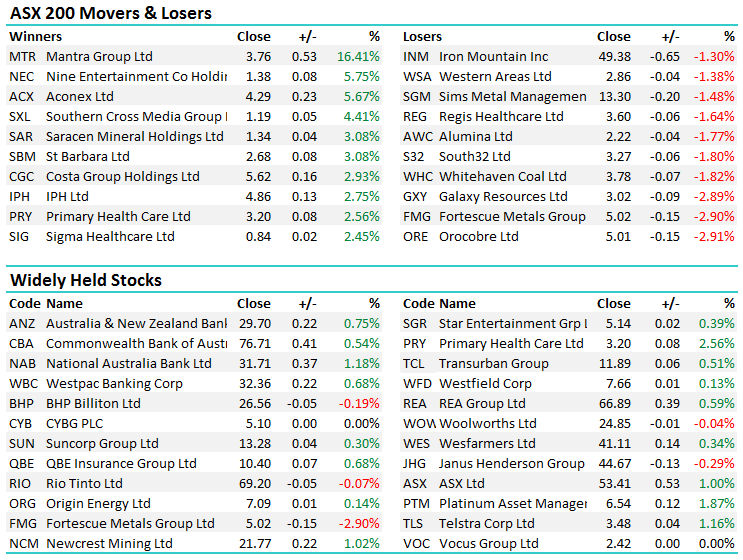

Overall, it was the beaten up retailers that did best on market today – Harvey Norman one of the better ones adding +1.8% to close at $3.93 after a fairly torrid run in recent times – the consumer discretionary sector adding +1.21% overall while the Energy stocks were weak, down by 0.09% following weakness in Crude prices last week, although some rig shutdowns in the US over the weekend cushioned the blow from the ~3% decline in Oil on Friday. Choppiness continues in that sector and that’s likely to be the theme for some time – taking a more active approach to energy stocks makes sense to us. Currently we have a small exposure to Santos in the Growth Portfolio.

A range today of +/- 48 points, a high of 5759, a low of 5711 and a close of 5739, up 28pts or +0.50%.

ASX 200 Intra-Day Chart

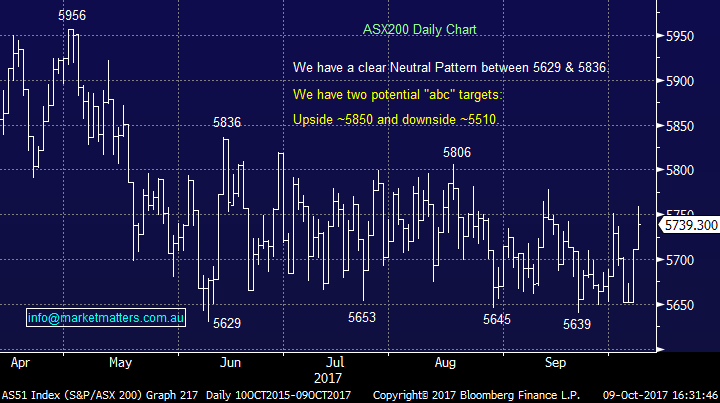

ASX 200 Daily Chart

Takeovers – Mantra (MTR) & Select Harvest (SHV)

MTR is a stock we’ve been in an out of in the past, liked the story, saw upside in terms of their exposures to Asian tourism and was keen from a valuation perspective, however the stock often looked poor technically and we finally cut and run from the holding. Somewhat frustratingly, today Paris-based hotel giant Accor has made a $1.2 billion all cash offer to buy Mantra at $3.96 a share, or $4.02 when you include the 6¢ final dividend paid in 2017 – the offer is all cash and represents a 23% premium to Fridays closing price of $3.23. We’d spoken of this stock as a potential takeover target in prior notes however we were not on the horse when it came though! The stock obviously rallied today closing up 16.41% at $3.76. Mantra operates 125 properties under the brands of Mantra, Peppers and Breakfree. At this stage, Accor has been granted access to DD which seems promising.

Mantra (MTR) Daily Chart

SHV was probably more interesting given they received a takeover bid – knocked it back – then launched an equity raising to pay down debt. SHV traded last Wednesday at $4.20 (before entering a trading halt) and received an indicative offer (with conditions) from Mubadala at $5.85 - which is a big premium. SHV saying it undervalues the company and now they have launched this equity raising ($65 million) via a non-underwritten institutional placement at $4.20 + a share purchase plan for retail shareholders at the same price as a clear defence strategy. Obviously, there will be a big scramble for stock in that raise.

Select Harvest (SHV) Daily Chart

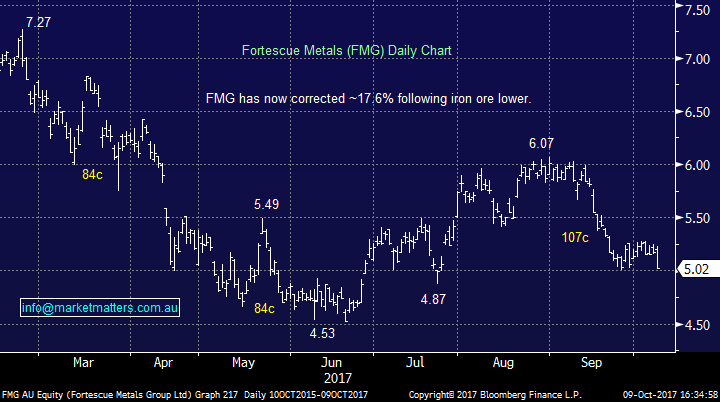

Resources – a BIG reversal from early highs this morning in the likes of BHP / Fortescue and others as we saw some weakness in Iron Ore Futures in Asia throughout the session – settling down around 3% at time of writing. FMG in particular looks primed for another leg lower and on that move, we’ll look to be buyers again – a similar story / pattern playing out in BHP & RIO. Watch for alerts.

Fortescue Metals (FMG) Daily Chart

BHP Billiton (BHP) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 9/10/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here