ASX 200 breaks out of the 21 week range…Finally! (CGF, BEN, HFA, RRL)

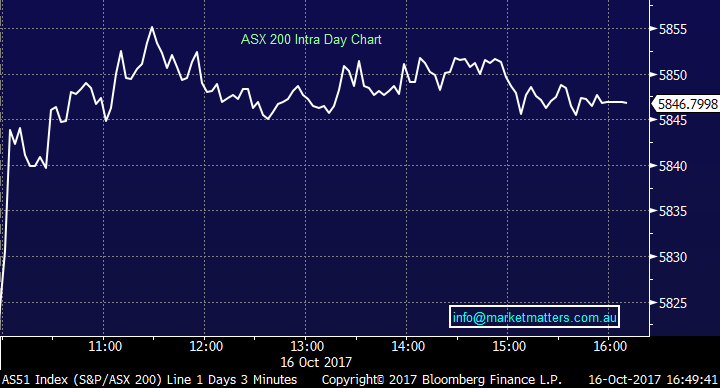

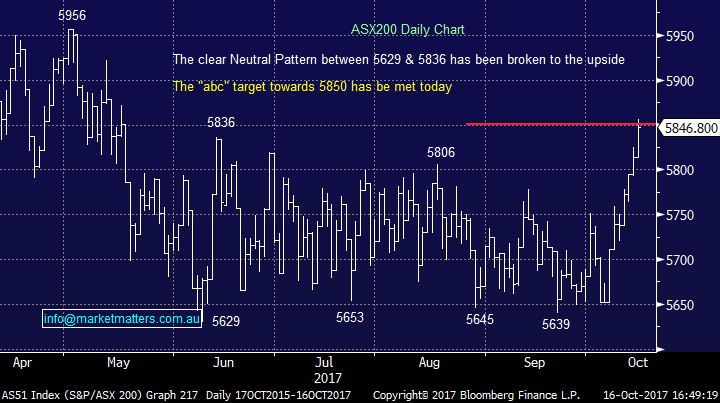

Another positive session for Aussie stocks saw the market break out of its 21 week trading range of 5629 and 5836 channel with the index finally gaining enough momentum to push up into some blue sky - whether it has the strength to push beyond 5850 remains the big question after breaking up to a high today of 5856 and closing back below at 5846. Still, we’ve got to acknowledge the more bullish stance taken by domestic investors in the last week which does demonstrate that the local market can – sometimes at least - run its own race as we enter what’s typically a bullish period for local stocks.

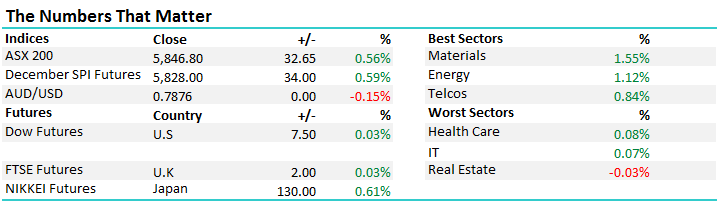

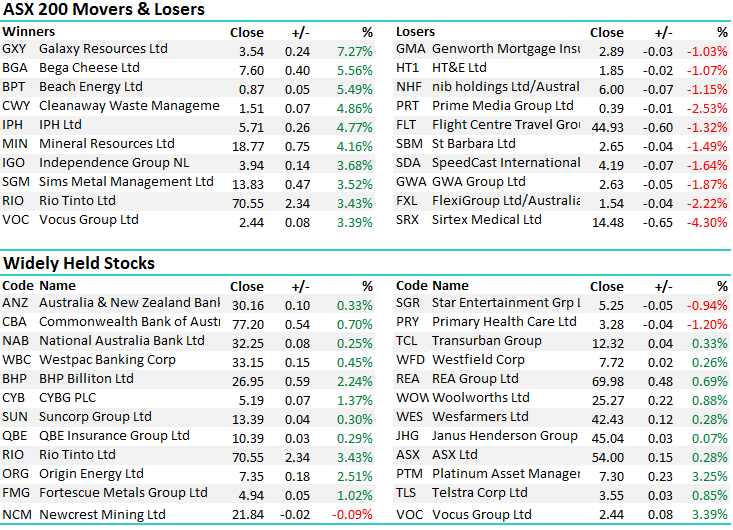

Overall today, the Material sector did best adding 1.55% after underperforming last week while we even saw the much disliked Telstra ticking up on the session – closing at $3.55. On the weaker side, the Real Estate stocks finished down marginally, losing 0.03% - a range today of +/- 33 points, a high of 5856, a low of 5823 and a close of 5846, up 32pts or 0.56%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

In terms of the MM Portfolios, we’re looking to take profits on Regis Resources (RRL) above $4.00 with the stock hitting a high today at $3.95 – so getting close. If done, this will book a profit of ~9% after holding for a couple of weeks. We did envisage to hold for the medium term however the rally in the last week has been strong, while we think the $US may provide a headwind for Gold leading into Christmas. In all likelihood, we’ll be able to buy back in at lower levels at some point.

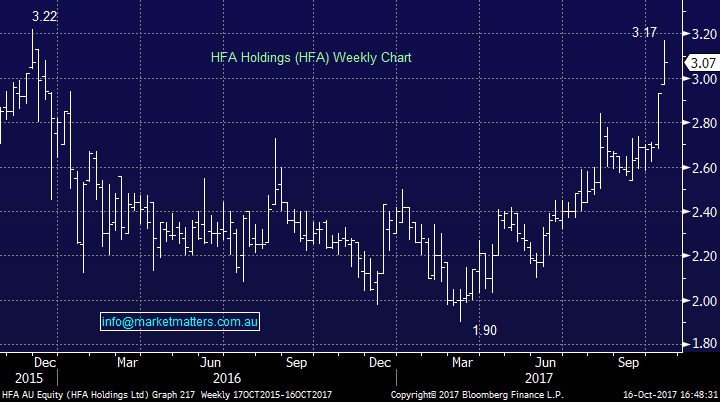

Elsewhere, we sold HFA Holdings (HFA) from the Income Portfolio taking a decent 35% profit in around ~3 months which is obviously a good result. As we suggested in the Alert, the stock has performed strongly with a number of recent broker upgrades (Ords & Macquarie) prompting some decent buying in the stock. We originally bought due to valuation and high yield and the market has now caught on – bidding the stock up strongly. This has prompted us to go the other way, and sell into strength given reasonably low liquidity in the stock – hence use momentum to get filled.

HFA Holdings Weekly Chart

Challenger Group Financial (CGF) – a stock we bought recently at $11.95 will announce their first quarter annuity sales number tomorrow, with expectations for around $850m. This is down a long way (~17%) on this time last year however CGF have made a conscious decision to reduce sales of shorter dated products with lower margins which helps their capital. I’ll do a Direct From The Desk tomorrow on this topic. CGF closed at $12.52 today.

Bendigo Hybrid – as flagged in the MM Income Report last week, Bendigo today announced a new Hybrid with BEN’s Group Treasurer in today to run through the offer. It’s a small offer, with BEN intending to raise $300 million (more or less can be done), however the offer does include a Reinvestment Offer for an existing security with ~$270m outstanding. Normally these have around 50% roll over rate so the excess will be reasonably small, and with a decent margin and very limited new supply, the security should do well.

In short, the margin of 3.75%-3.95% compares well to existing securities on issue which are trading at a margin nearer to 3%. We’ll put a note out tomorrow given we’re likely to add to the MM Income Portfolio.

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/10/17. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here