Not a lot to hang ones hat on today! (OZL, ALL, JHC)

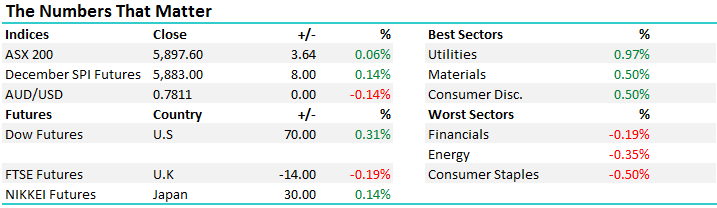

The market chopped around par today eventually closing marginally higher as buyers got on top of the early sellers…the Utes did best, while the banks were weaker earlier however recovered into the afternoon session – the financials closing down –0.19%. A range of +/- 23 points, a high of 5908, a low of 5885 and a close of 5897, up +3pts or 0.06%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

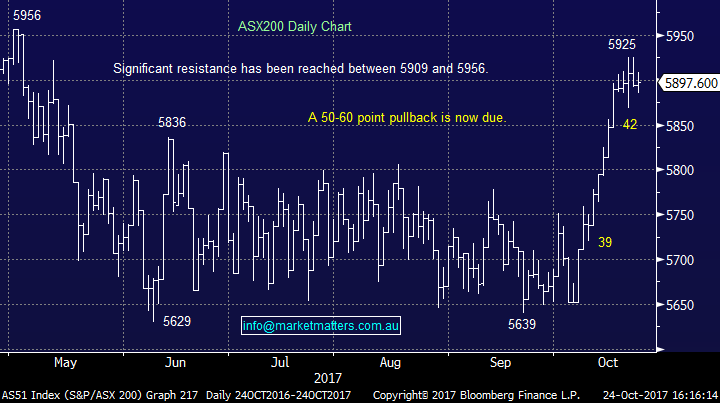

Oz Minerals (OZL) – came very close to our BUY price today hitting a low $8.26 before bouncing back up to close at $8.34. We’re looking to buy anywhere below $8.25 and todays move was slightly frustrating, however given our views on the short term direction of the mkt – likely to consolidate / soften near term, then worth holding fire. I had a conversation today with a client around cash levels being high – we’re at 20% in the Growth Portfolio and 18% in the Income Portfolio, however that will reduce after we take up the Bendigo Hybrid as discussed last week. It’s always tempting to pay up if the mkt moves higher, and we’re not getting the full benefit of it, however cash = flexibility and given the mature stages of the current bull market, I think flexibility will remain extremely important. As we wrote in the AM report this morning, we now believe there is a very strong possibility that US stocks are commencing a ~5% correction to provide an excellent buying opportunity for yet another exciting Christmas rally. Our feeling is that local stocks will outperform most of their global counterparts if this correction does unfold and the below levels should become important over coming days / weeks:

1. We should see a test of last Friday’s 5870 low in the next 24 hours which is likely to offer some initial support.

2. We see a worst case scenario of a pullback to the 5825 area which we would regard as an optimum buying area.

3. A break back under the psychological 5800 area would negate our current bullish outlook for stocks into 2018.

OZ Minerals (OZL) Daily Chart

Aristocrat Leisure (ALL)– had a good session today on the back of a few positive broker notes following their first Capital Markets day yesterday. Taking a step back for a moment, the mkt has traditionally been sceptical of ALL and therefore priced it on a discount to the broader mkt, partly because they have a poor track record in terms of acquisitions and secondly because it seems like they’re always in some form of ‘transformation’ process, which doesn’t really warm the heart. In short, their tone yesterday was a good balance between being conciliatory and constructive, confronting what they did wrong in the past and presenting a decent plan for the future. We own ALL, we’re up ~14% and the stock looks strong here…

Aristocrat Leisure (ALL) Daily Chart

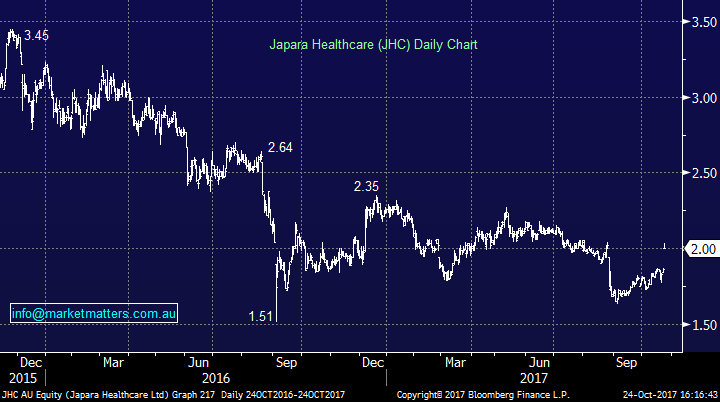

Japara (JHC) – The aged care space is one we’ve watched for a while now, and the move by Moelis this week to buy nearly 10% of JHC caught our eye with the investment manager saying….Moelis Australia believes that Aged Care is an attractive sector in which to invest and that Japara has quality assets combined with an outstanding record of management, governance and provision of resident care.

Clearly it’s been a sector under pressure however recent trends seem to be improving.

Japara Health (JHC) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/10/17. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here