The High Court causes a stir (IGO, IFL, MQG)

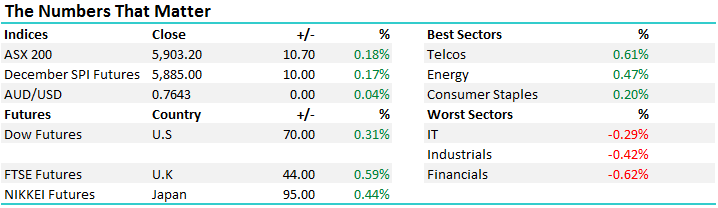

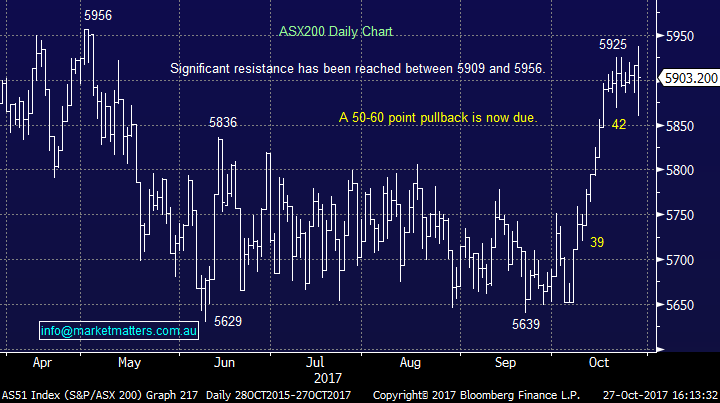

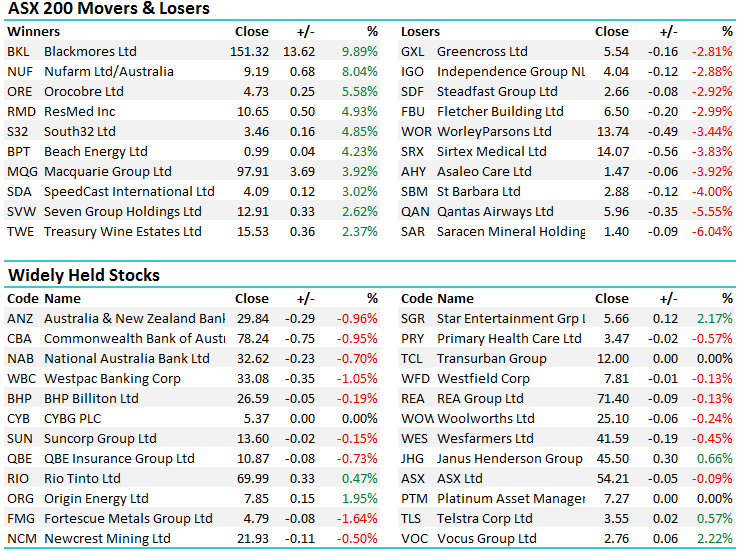

It was a day of two halves today as the early strength turned into volatility at 2.15PM when the High Court ruled 5 of the 7 Australian MP’s, including Barnaby Joyce, to be ineligible for Parliament causing the Turnbull Government to lose its majority. The uncertainty clearly sent markets into a spin, falling 65pts in around 20 minutes of trading before recovering and settling around where it eventually closed. All in all, we believe this result has a subdued impact on markets as it is expected that the one seat majority will be restored after the New England by-election planned for early December – now just 5-weeks away. In other news, MM stepped up to buy IFL today, MQG has started the year strong and IGO struggled again today after broker downgrades – but more on those later. Overall, telcos outperformed, and financials lagged, the range today was +/- 79 points, a high of 5938, low of 5859 and a close of 5903, down 13pts or -0.22%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Macquarie Bank (MQG) provided a first quarter trading update that was 7% above consensus, lifting guidance by 9% and announcing a $1b buy back – does it get any better! The share price reacted accordingly, jumping nearly 4% to close at $97.91, $3.69 higher than yesterday's close. MQG is a stock we have had on our radar for some time, but were clearly too picky on the price and have missed the boat here. We still like MQG, but maintain vigilant with our entry price, preferring to buy weakness than strength. Hear more about our thoughts on MQG in today’s Direct From the Desk - LINK HERE.

Macquarie Group (MQG) Daily Chart

We own Independence Group (IGO) from $4.27 and after enjoying a ‘quick pop’ up to $4.47 we are now down 5.4% with the stocks trading at $4.04. We covered the initial production report during the week, however since then, a number of brokers have downgraded the stock – the consensus price target now sitting at $3.76. We actually think the production numbers were fine, and the weakness over the last few days presents another opportunity to buy the stock, after coming back and testing technical support . We remain comfortable holders for now.

Independence Group (IGO) Daily Chart

Another broker downgrade help us pick up a stock today, this time in IOOF Holdings (IFL). Both Credit Suisse and Bell Potter reduced their price targets on IFL and the stock fell into our buy zone this morning as it briefly dropped below $10.80. We increased the buy price as the stock rebounded slightly, eventually getting filled at $10.91. IOOF has recently purchased ANZ’s wealth management business for just under $1bn, funding part of the acquisition with an institutional share placement at $10.60 to raise $461m. We like the deal for IFL and see recent weakness as an opportunity.

IOOF Holdings (IFL) Daily Chart

Have a great Weekend all, look out for the weekend report on Sunday

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/10/2017. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here