Woolies Creams Coles (WOW, BEN, CYB)

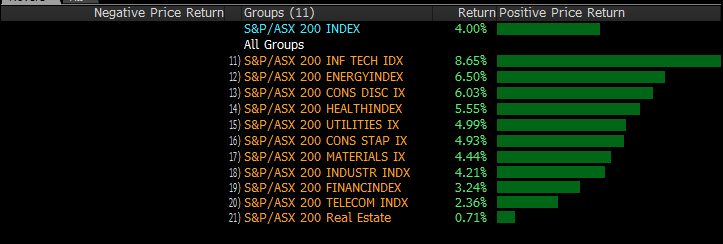

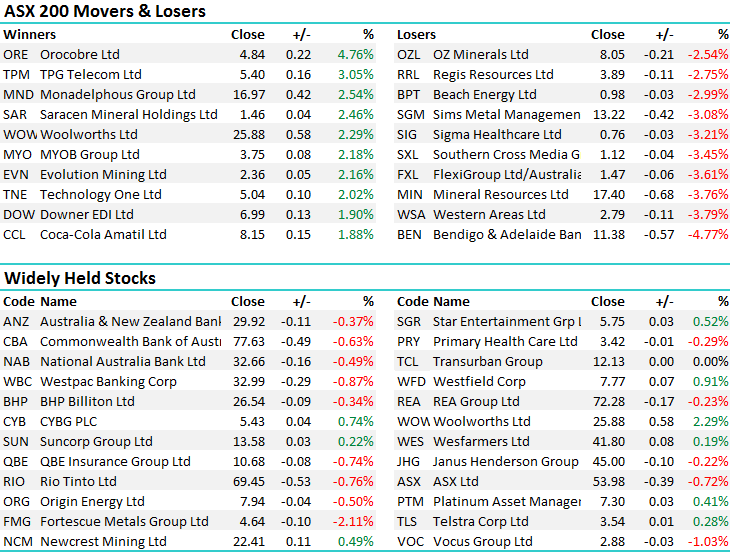

A positive open to trade this morning however that early optimism proved too much to handle and the mkt slid into the close to cap off what’s been a pretty bullish month for stocks. October proved to be the month that the 21+ week trading range for the ASX 200 was broken and the upside simply proved to be too enticing for stocks with the index up +4% – the biggest beneficiary being the IT coys – the likes of SEK and REA while the energy sector also did well following the price of Crude higher. Interestingly, the sector that everyone loves to hate, the retailers had a pretty good month adding +6% - Nick Scali (NCK) the best of the ones we have in the MM Income Portfolio after upgrading guidance and rallying on the back of it. These guys are good retailers and their market communication is always on point. That showed this month.

The laggards where the ‘bond like’ equities, the Real Estate names and the Telecoms – things that are sensitive to higher interest rates. That said, they were still dragged higher with the prevailing bullish sentiment.

Source; Bloomberg

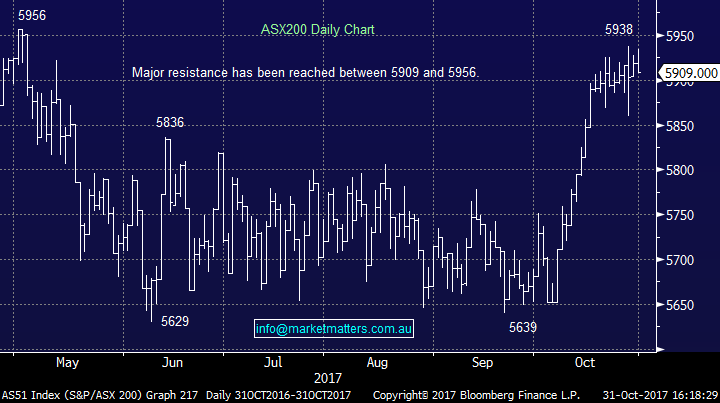

On the mkt today, Woolies reported good sales numbers (more on that below) and that dragged up the staples while the Healthcare stocks lagged. An unpopular call and we did sell this too early however CSL is showing signs of weakness here trading at $138.93. The grind up from sub $120 has been a struggle over the past 4 months and buyers here are looking exhausted. Another tight range today of +/- 26 points, a high of 5934, a low of 5908 and a close of 5909, down -10pts or -0.17%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

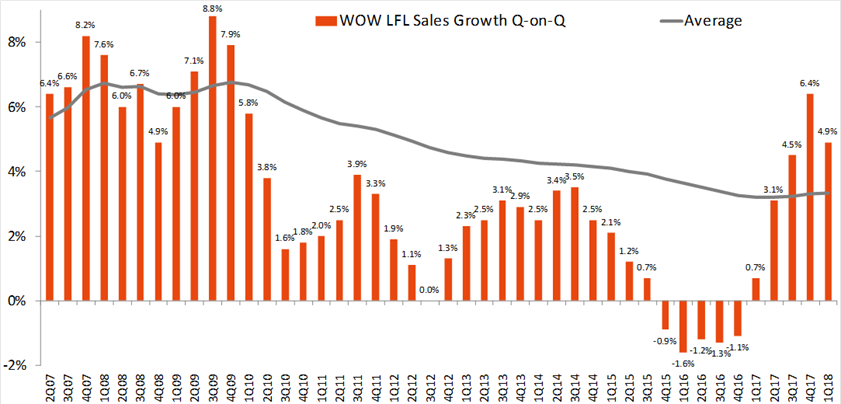

Woolies (WOW) – Reported a good set of quarterly sales numbers today and they’ve clearly got the upper hand (for now) on Coles. Key takeaways: Food did well with Like-for-Like (LFL) sales of +4.9%, within markets range of 4-5% after a peak 4Q17 LFL print of +6.4%; Liquor solid; BIG W remains under pressure and Hotels okay.

The food business is clearly key given it accounts for ~70% of earnings and they ‘Creamed Coles’ again. To put this in perspective, Coles 1Q18 Food only LFL sales growth was a paltry +0.3% (0.4% if you include Liquor) versus WOW @ 4.9%. Still, price deflation remains an issue with Woolies printing -2.4% vs. Coles’ -2.3%, main causes being in fruit and vegetable categories, especially tomatoes, lettuce and berries. My 3 year old loves blue berries so I hope that trend in berry prices continues. If only we were seeing the same deflation in their liquor business!

Source; Shaw and Partners

Despite the positive trends here + the clear fact they are beating Coles in terms of sales momentum, we think rising competition will keep pressure on margins and it only gets harder from here. In terms of outlook , they offered very little saying; (1) Food sales growth in line with 2H17; and (2) BIG W no improvement. We have no interest in WOW or WES for either portfolio. WOW closed up +2.29% today at $25.88, however the volume was not massive, about 1.3x the 20 day average so conviction not huge here…

Woolworths (WOW) Daily Chart

Bendigo Bank (BEN) – Had a shocker today down -4.77% versus a sector which was off -0.5% with comments from their AGM sparking a sell off. Not a lot to like here with rising costs and flat loan growth. They outlined 1H18 net interest margin of 2.34% which is okay, however cost growth of +2.0% & volume growth of zero is enough to get broker downgrades happening. Management are saying that APRA regulation has “slammed the breaks on investor and interest only loan growth” resulting in “intense price competition in owner occupied and business lending” and volumes hitting a wall. We have BOQ in the Growth Portfolio and some unsettling read throughs here, however it goes ex-divi in 2 days so we’re a little reluctant to sell just yet.

Bendigo Bank (BEN) Daily Chart

UK Interest Rates – this is something we’ll look to explore at some stage this week, however it seems The Bank of England is set to raise interest rates for the first time since 2007. Inflation is running too hot (3%) which is 1% above their target mainly because of weakness in the Pound courtesy of BREXIT. The theme of rising rates is something we’ll need to get used to and it’s important to have a handle on what stocks should benefit and those that won’t. We did have 10% of the MM Growth Portfolio in CYBG until recently – we sold out for a good profit at $5.30 however in hindsight, I think we pulled the trigger too early.

A 0.25% rise in UK interest rates should lead to a ~10% benefit to CYB earnings given they have a high amount of deposit funding locked on fixed rates + obviously the Pound could strengthen on higher rates and that would be another supporting factor for the bank….that said, we remain open minded here and may re-enter in the future, and god-for-bid, we might even pay a higher price for it...They were up +0.74% today at $5.43

CYBG (CYB) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/10/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here