Shorts should be pursued to the end of the earth says Gerry! (HVN, RHC, OSH, A2M)

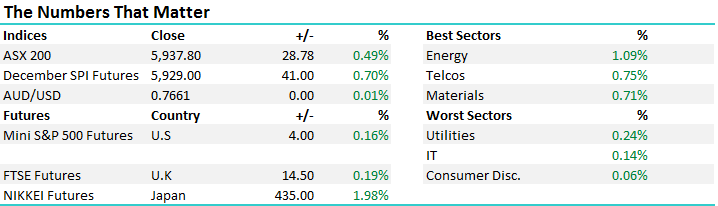

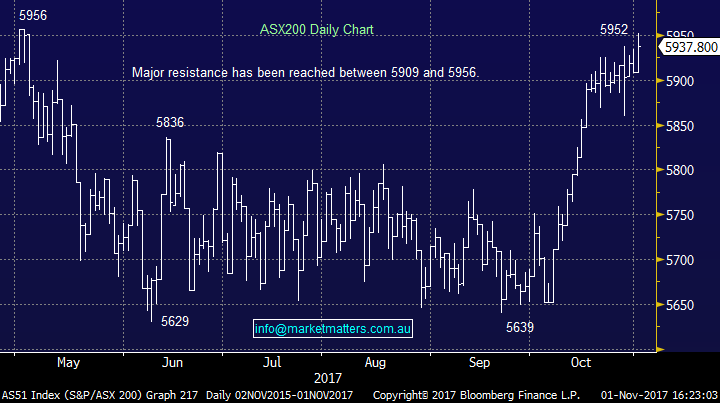

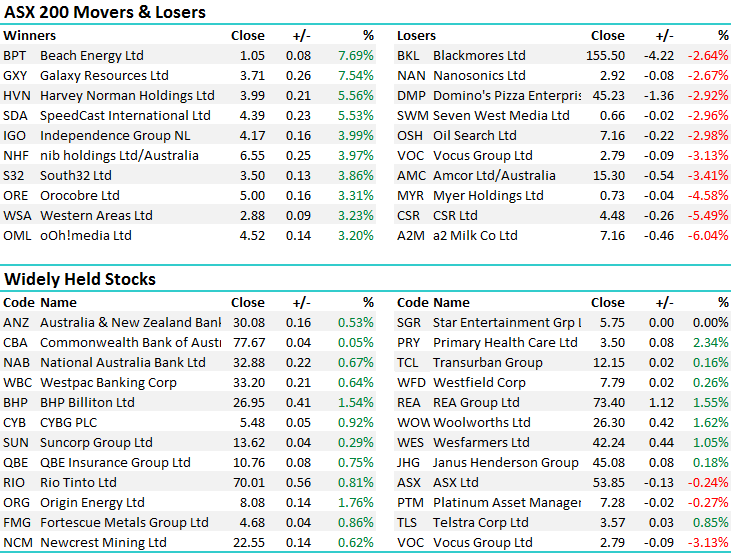

A bullish start to trade, some softness over lunch while the tail wagged into the close to see the index higher again. The energy stocks saw the best of it (excluding Oil Search) while Harvey Norman & Nick Scali tried to ignite the retailers however the bigger index weights lagged which kept a lid on the sector. A range today of +/- 43 points, a high of 5952, a low of 5909 and a close of 5937, up 28pts or +0.49%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Harvey Norman (HVN) – the stock was strong today as we mentioned in the Income Report out mid afternoon, however to reiterate, ASIC has cleared HVN of any wrong doing in terms of financial reporting and in particular whether franchise stores should be consolidated by HVN. ASIC said in its letter to Harvey Norman that it did not intend to make further inquiries with the retailer in relation to the matters raised, in effect clearing its treatment of franchise loans and operations within Harvey Norman’s accounts.

The investigation has gone on for the last 18 months and has been a decent overhang on the stock. Gerry in typical fashion used the platform to hammer short sellers saying they should be pursued to the end of the earth…not sure that helps the stock price however shorts have been building and now represent 10% of available shares – or about 110m shares sold short. To give some context here, the stock did 16m shares today which was about 4x the daily average. HVN closed up + 5.56% to $3.99. This stock could really get going given it trades on just 10x. We own HVN in the Income Portfolio

Harvey Norman (HVN) Daily Chart

A2 Milk (A2M) - Colonial are the biggest holders of A2 Milk and yesterday they announced a reduction in their holding by around 7m shares which has obviously spooked the mkt and the stock has dropped as a result. Clearly a company that has done exceptionally well, and in hindsight we wish we were there, however the recent move highlights how susceptible the stock has become for some decent set-backs along the way. The trend remains exceptionally strong and weakness today was bought with the stock down to a low of $6.70 (~14%) only to finish down -6.04% at $7.16.

A2 Milk (A2M) Daily Chart

Ramsay Healthcare (RHC) – I was asked about RHC today on Sky Business when I did a quick cross at 1pm from the office. In the studio was Henry from Marcus Today and Chris from RBS – both were keen on RHC however to us, the chart looks horrible, it’s an over owned stock which is understandable given its impressive track record but unfortunately we can’t invest now and get the returns generated in the past! Growth is becoming harder, regulatory risk overseas around pricing has risen and so to has the sovereign risk in their Australian operations as the Government looks to balance its books. Simply, it’s priced because of its strong track record however for us, it gets harder from here and a pullback below $60 (~10%) is our preferred scenario.

Ramsay Healthcare (RHC) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday or when activity occurs. .

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 1/11/17. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here