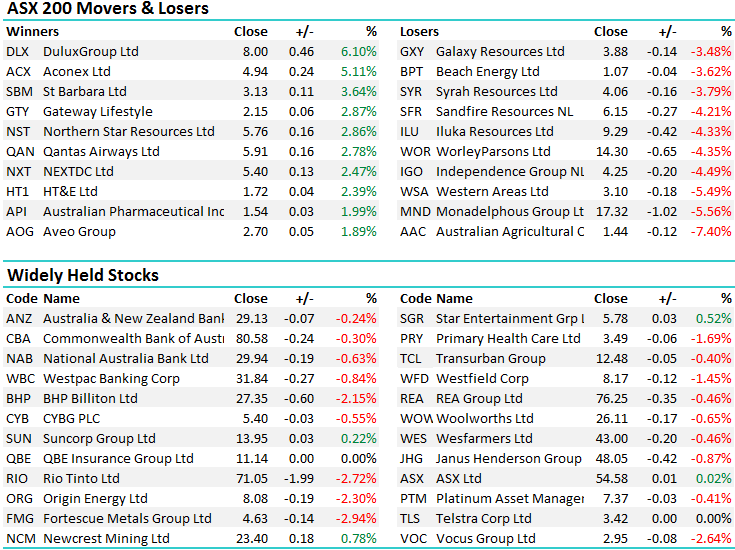

Energy& Materials drag ASX down for 2nd straight day (DLX, WPL, MTS)

Another weak session played out for local stocks today with weakness in Oil and other commodity prices overnight, particularly Nickel (-5%) dragging down those sectors today with the likes of Western Areas (WSA) and Independence Group (IGO) down between 4 & 6% a piece while BHP and RIO lost more than 2% each. Fortescue (FMG) extended its recent slide and is now threatening to break down below its 12 month low which sits around $4.50 – the miner closing today at $4.63. Elsewhere, it was interesting to see that the 2 hospital operators – Healthscope (HSO) and Ramsay (RHC) also copped it on the chin and we remain negative these names, seeing likely downside from current levels. Growth stocks that are finding it harder and harder to deliver on baked in growth assumptions become more susceptible to a sell off in a rising interest rate environment- which we’re clearly seeing.

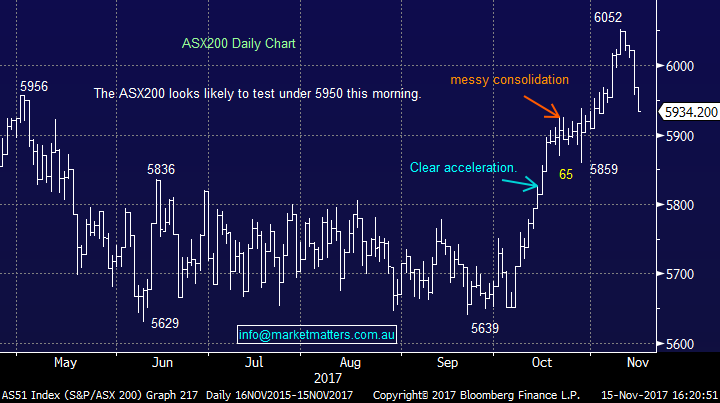

Anyway, a choppy day but a reasonably tight range of +/- 24 points, a high of 5958, a low of 5934 and a close of 5934, down -0.34pts or -0.58%. The index closing on its lows a fair sign of weakness.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Woodside (WPL) – down today by 43c/1.38% to close at $30.77 with the position we took yesterday around $31.25 now underwater – however we did see some reasonable buying from the lows today and a decent pop up into the close. We mentioned in the income report today however with a 3% allocation it clearly leaves room for adding to the position if further weakness prevails, however I doubt it will. The strong buying from the early lows a good sign that overhang is now gone + there was scale back in a lot of the insto bids for the $2.7bn Shell stock, which was done at $31.10, so not really that surprising to see strong buying appetite sub $31…

Woodside (WPL) Daily Chart

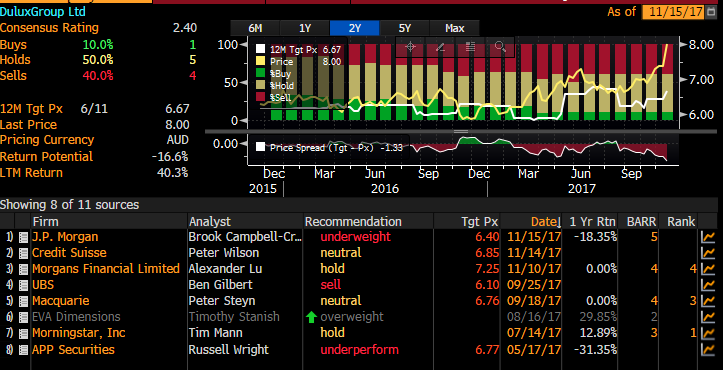

Dulux (DLX) - delivered a very good set of numbers today in their Full Year Result and the stock pupped +6% on the back of it – trading to an all-time high. This is a very good business – strong performance + the outlook was more upbeat than the mkt thought it would be and their +10% increase in the dividend was testament to that …the only issue with the stock at the moment is around valuation – on 20x for a growth stock is not that high however clearly the housing market is showing signs of a top + with interest rates tracking higher = less $$$ for renovation, however you could construct a plausible argument to think that a lick of paint is a good ‘cheap fix’ and therefore their earnings are potentially more defensive than the mkt gives them credit for. This has always been a stock I like, but have never owned for MM - been gun shy really however into weakness this is clearly one to look at. At 20x you need weakness to BUY rather than the prevailing strength today.

Dulux (DLX) Daily Chart

Brokers remain negative the stock however expect some begrudging upgrades to flow through overnight.

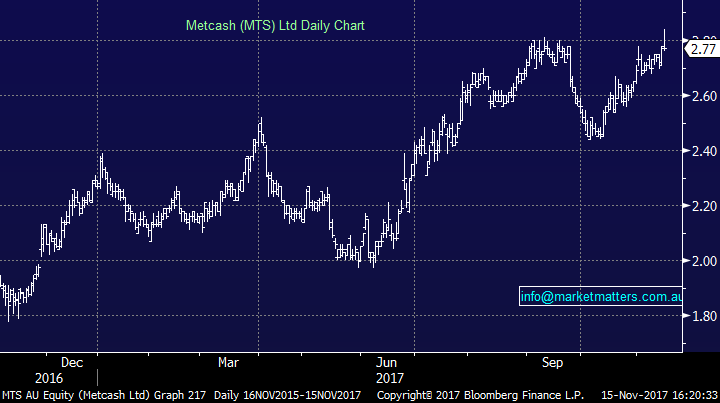

Metcash (MTS) - Came up on a scan today that highlighted a failed break out of the range which is typically a bearish sign, although it was only utilising short time periods so not as relevant – but worth keeping on the radar non-the-less. This is company gradually turning around and plugging away to improve their offering, you can see the improvement in their store roll out, the look and feel of stores, their actual retail offering. On 15x and a differentiated strategy why pay 22x for Woolies or 17x for WES? We’re not overall keen on Supermarkets at this juncture but MTS probably to pick of the bunch

Metcash (MTS) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/11/17. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here