All eyes on the Platform Managers (NWL, MGP, HUB, AMP, BBN)

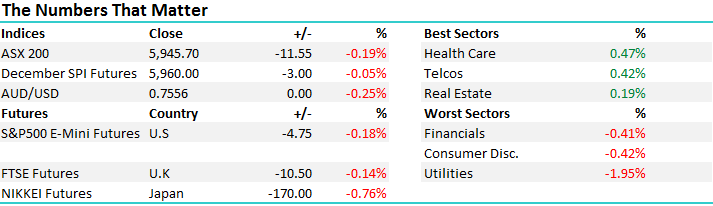

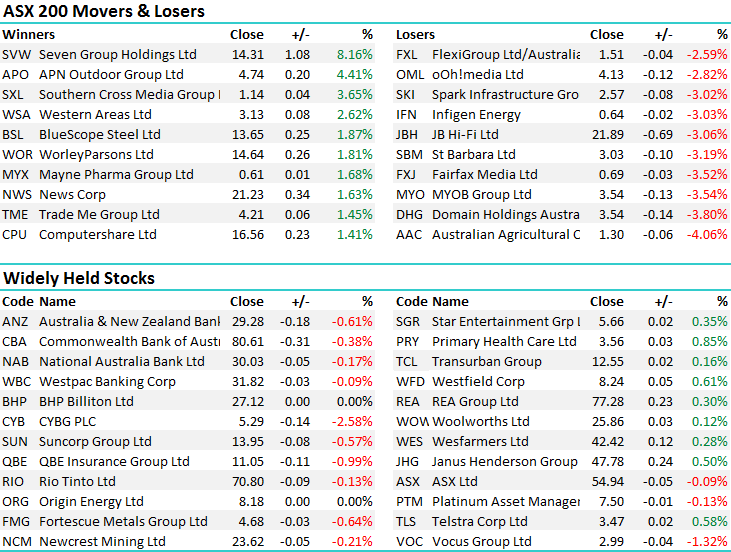

35 points were taken off the index early before buyers stepped up to support a weak open, grinding back towards parity. We fell just short of Friday’s close in the end, as weakness particularly in utilities and financials more than offset the strength shown by the rebounding energy sector. Overall, a range today of +/-34 points, a high of 5957, a low of 5922 and a close of 5945, off 11pts or -0.19%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

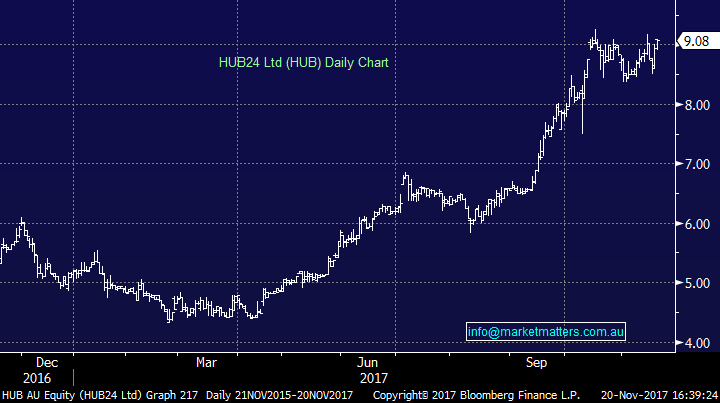

Most of the market was watching the new listing of Netwealth (NWL) which commenced trading at midday today. It was a highly sought after listing in a space that has had a lot of traction recently. Another platform provider, Managed Accounts (MGP), raised $34m just a few weeks ago to acquire competitor Linear, while Hub24 (HUB) more than doubled since it’s Feb lows. Hub tried it’s best to rain on the Netwealth parade today, announcing “market leading integration” and platform enhancements at the AGM today. It did little to take away from NWL, which closed over 40% higher than its listing price, up $1.62 to $5.32 after the deal was priced at $3.70. The word is investors were significantly scaled back in the offer as demand was high, and have now used the opening day as an opportunity to top up their holdings.

Netwealth (NWL) Intra-day Chart

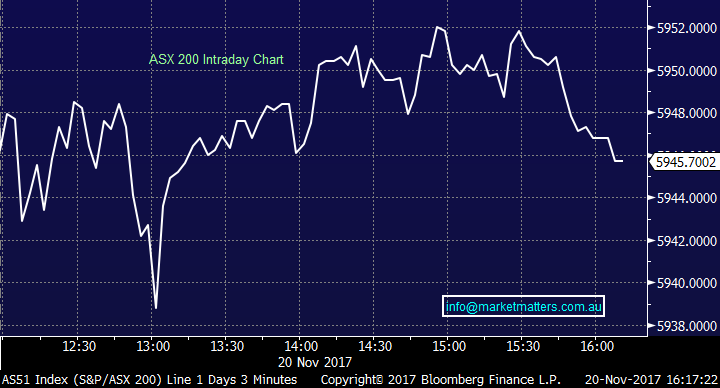

Scalability for platform managers is undeniably important as fixed costs and capital expenditure outweigh the variable costs. As competition grows, retaining and growing FUA (Funds Under Administration) & FUM (Funds Under Management) will drive margins and profitability for platforms. Historical FUA/FUM growth has been significant accross the platform space, leading to the two players above trading on lofty PE ratios – Hub24 on 54x, while Netwealth is on a huge 67x 2018 PE. As we stated in this morning’s report, “you definitely need to look at the company’s growth potential in the years ahead as opposed to today’s P/E otherwise you are likely to miss some of the best performing stocks out there. This risk obviously comes when a company becomes ex-growth.” The question remains, when do platform managers go ex-growth.

Hub24 (HUB) Daily Chart

Other notables in the Financials spaces was the rumours that AMP is planning to sell its bank assets. Rumours around corporate activity at AMP are nothing new with investors pushing to have non-core businesses split from AMP’s core wealth management arm for over 12 months. Although the rumoured $5bil seems excessive for this business, which is probably why it was disregarded by the market with AMP falling 0.8% today, it is likely that there would be some demand if it was to be sold with many Asian banks looking for an inroad to the Australian market.

AMP Daily Chart

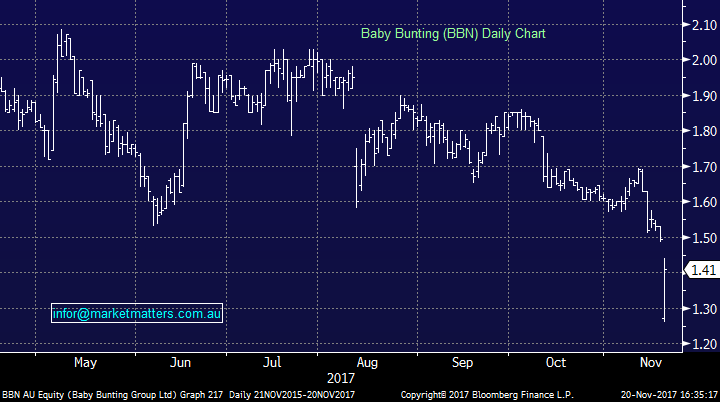

Baby Bunting (BBN) was hit hard today after downgrading guidance stemming from “aggressive discounting continuing” and “supply issues with a leading car seat supplier.” Now guiding to no growth in FY18, BBN initially fell 15% before recovering some of the losses, closing 5.7% down at $1.41. The 11% downgrade only extended downtrend that began late last year when BBN peaked around $3.20.

Baby Bunting (BBN) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/11/17. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here