Banks in the firing line, New CEO for Fortescue , Aristocrat a volatile beast! (ALL, Banks, FMG, NAN)

WHAT MATTERED TODAY

The market opened with a flurry of selling this morning as news broke that the banks had collectively written to the PM somewhat surprisingly requesting an in-depth banking enquiry in a move designed to end speculation and reduce the ongoing rot of public and political opinion. The response, which I think is a very good one from the banks, reminds me of a quote I had written on my desk a few years ago – seems relevant here - You can’t control everything that happens to you, but you can control the way you respond - and in your response is your greatest power.

Banks have clearly gotten on the front foot here, sick of being up against the ropes and the response here is clearly a strong one. The emotional reaction on the market first up was to SELL, before cooler heads prevailed and the majority of the banks actually finished in the black after being down substantially early on. It seems to me, the banks have been preparing for this for some time and a Royal Commission has a couple of important aspects that work in their favour.

The points of reference are more concise and the process more structured versus the huge number of independent enquires that are underway, while the commission will be conducted under a tight time frame, which will bring closure to a situation that has continued to drag. As was stated in the media today, this is the least worst option from a list of bad outcomes for the banks. Important to say though, that banks have clearly had issues in the past, and given their size and complexity, will probably have issues in the future. We doubt a Govt enquiry will achieve a lot in a practical sense however, we’ve now sorted the same sex marriage debate, the dual citizenship saga continues but has an endpoint it would seem, and now we have a timeframe to get banks from headlining the political agenda – prompts the obvious question - what will the Politicians do once these issues are sorted? I have a few suggestions….

Elsewhere, some huge volatility in Aristocrat Leisure which reported full year results this morning + announced the purchase of an online gambling business for around $1bn – the stock the was up initially before falling off the proverbial cliff shortly after. We held ALL and had a $24 price target, and fortunately exited above $24 however, time was of the essence in that trade. More on this stock below + our views for those that may have missed the exit.

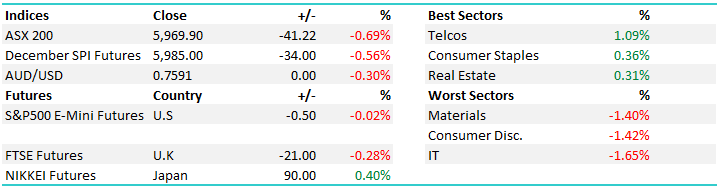

On the mkt today, sellers were dominate early and targeted the banks obviously, however the low was put in at 11am and the index grinded higher from there - a range today of +/- 54 points, a high of 6003, a low of 5949 and a close of 5969, off -41pts or -0.69%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

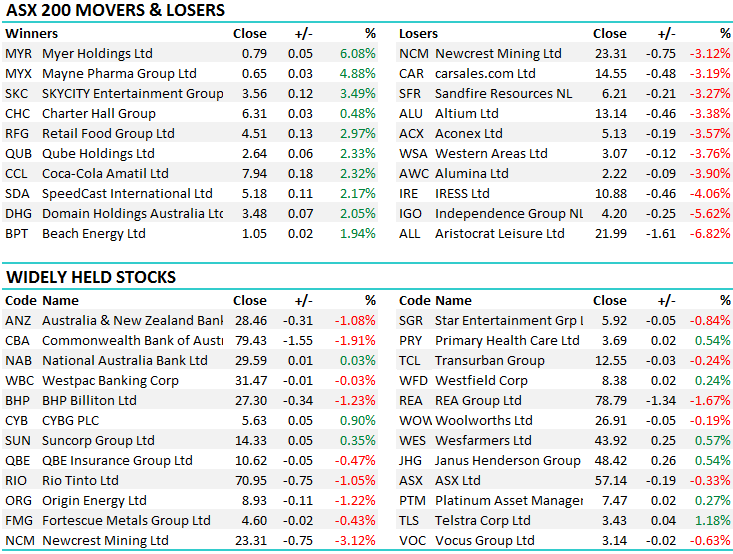

TOP MOVERS

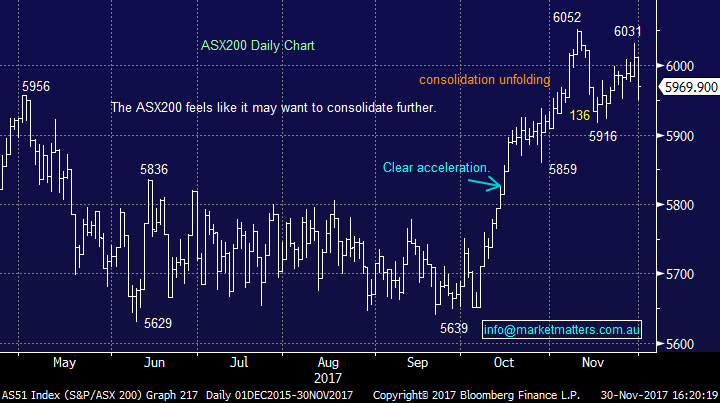

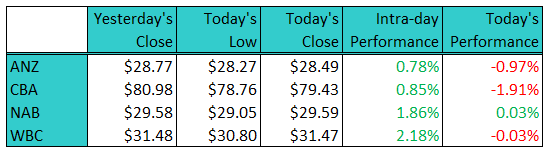

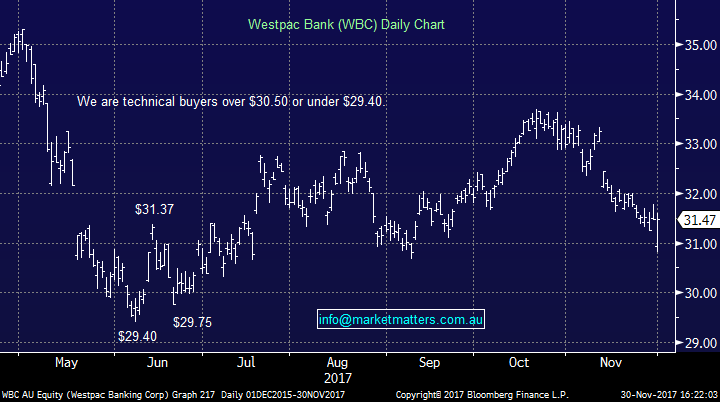

1.Banks - to give some context here around the performances today, the knee jerk reaction happened straight up on open after the enquiry was announced, but the majority traded to lows mid-morning before recovering, Westpac the biggest recovery adding +2.18% from the lows while ANZ bounced, but was more of a whimper. We used the weakness this morning to top up on CBA in the Growth Portfolio.

Westpac Daily Chart

2. Retailers – News today that OrotonGroup had collapsed after major shareholders the Lane family and high profile fund manager Will Vicars failed to step in and rescue the business. They had tipped in funds earlier in the year, and were not willing to do so again. This is a company that has been in a death spiral for some time as they struggled to extract sales from what was a very strong brand. Looking at their FY17 financial metrics, top line was OK but down on prior years, however when rent is 20% of sales and your operating on EBITDA margins are just 2%, something has to give. Today it did and administrators were appointed

Oroton Group Monthly Chart

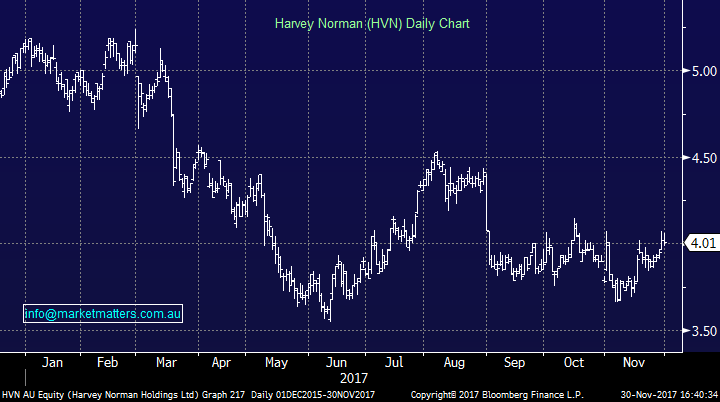

Elsewhere in retail land, there was actually some love back in the sector led by Myer which rallied +6.08% to finish at 78.5c – SL and MM will be waving the flag today, while strong buying was across the board – mainly early on in JB Hi Fi (JBH) and Harvey Norman (HV) which having been tracking higher of late despite the negative headlines…

Harvey Norman Daily Chart

4. Aristocrat Leisure (ALL) – I haven’t seen volatility like that in such a short window for a while with the stock reporting FY results around 9.00am and announcing an acquisition of Big Fish Games for around $1bn at that time. The open was strong on the mkt (+3%) before getting clobbered by around 12% as what looked like one big line of aggressive selling that simply whacked the stock. The result in my view was decent, the acquisition stacks up, but clearly the increased gearing has spooked a few – or simply we’ve seen some decent profit taking.

Aristocrat Intra-Day Chart

Aristocrat Daily Chart

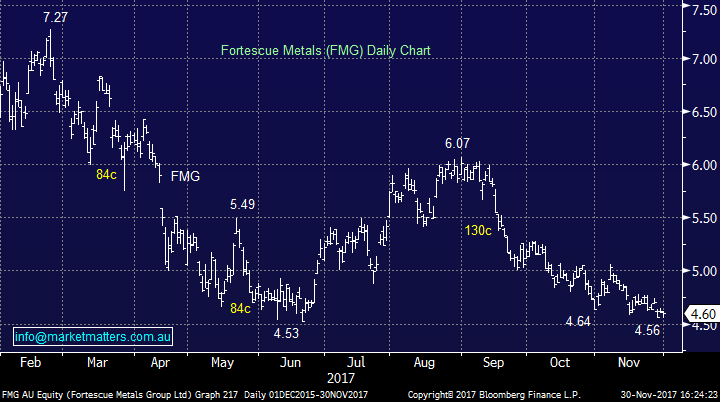

5. Fortescue Metals (FMG) – a big change in terms of leadership announced today and the stock reacted reasonably well, closing down just 2c to $4.60. I say reasonably well given there were a few obvious surprises in the re-shuffle. Firstly, we now see a female CEO leading an Iron Ore venture which is clearly not the norm, with Elizabeth Gaines stepping up from CFO into the CEO role. Probably not the mkts first choice however she’s very well respected and has a very good financial mind. Supporting here is the operational guru Greg Lilleyman, the current director of operations (ex RIO) who many thought would be the next CEO. A new CFO and Deputy CEO also announced, however the key takeout here, is that appointing a ‘finance type’ to the role shows how far FMG has come, and its likely path into the future. The heavy lifting in terms of operational efficiencies has been done, now to drive financial returns for shareholders - We bought FMG on Tuesday at $4.60

Fortescue Metals Daily Chart

OUR CALLS

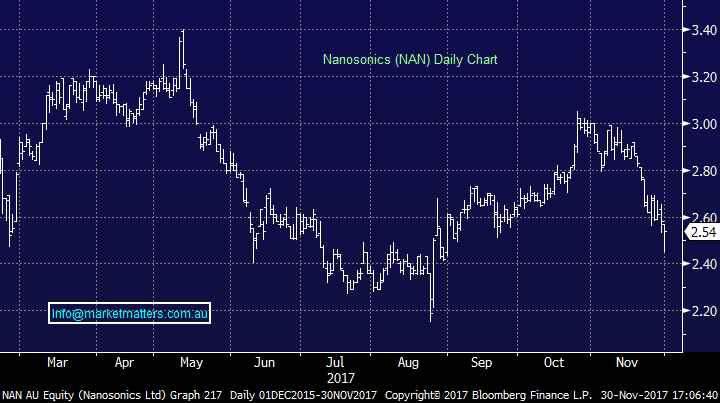

For the Growth Portfolio, we sent an alert to sell Aristocrat above $24, Nanosonics around $2.60 and top up CBA below $79.30. Clearly you had to be fast with ALL, and no doubt some subscribers missed the boat. If we still held the position, we would amend our sell limit to be $23. We did not sell NAN today, given it traded below our sell level. We will continue to monitor and update this alert, We were filled in CBA at $79.00

Nanosonics Daily Chart

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/11/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here