Sell the rumour buy the fact for Aussie retailers (JBH, HVN, TLS)

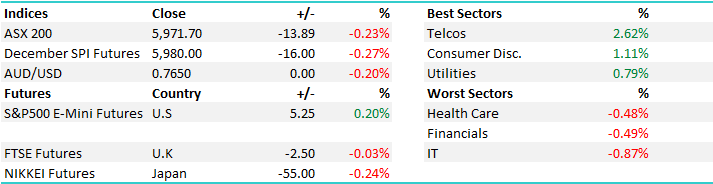

WHAT MATTERED TODAY

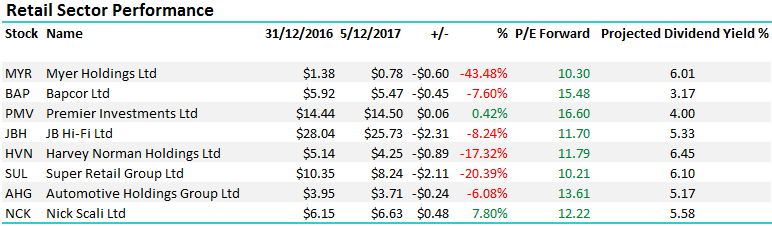

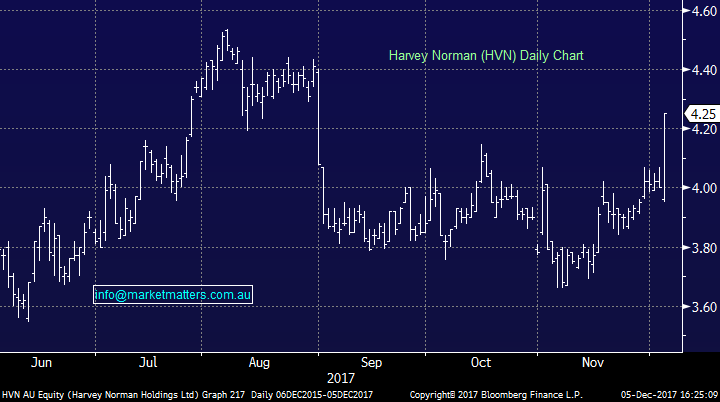

A very interesting day for some sectors on the Aussie bourse with the much anticipated launch of the Amazon retail platform in Australia met with very strong buying across the Aussie retail complex – JB Hi Fi (JBH) the best of them adding 6.76% to close at $25.73 while Harvey Norman (HVN), which we own with a 4% allocation in our Income Portfolio, clipped its heals adding +6.25% to $4.25. Clearly the pricing and the delivery terms not as aggressive as some thought + the product offering was not as broad. More on this later.

Other standouts included Telstra (TLS) which put on +3.14%, and Magellan (MFG) which is clearly enjoying the limelight of the Ashes series, a deal worth around ~$20m for 3 years, + they also got upgraded by UBS with the investment bank slapping a $30 PT on the stock, versus todays open of $25.25 - they closed up 6.24% to $26.72 – overcoming the big exit from US tech that we saw overnight. On the flipside, the high PE growth stocks took it on the chin, the things that have done exceptionally well in recent times however the trend we saw in the States overnight has started to flow down under – the likes of BWX Limited (BWX), a story we like but the stock is too rich and it fell 4.84% today, while A2 Milk (A2M) lost 2.94%, Xero (XRO) fell -3.55% and Hub24 (HUB) was off by -4.67%.

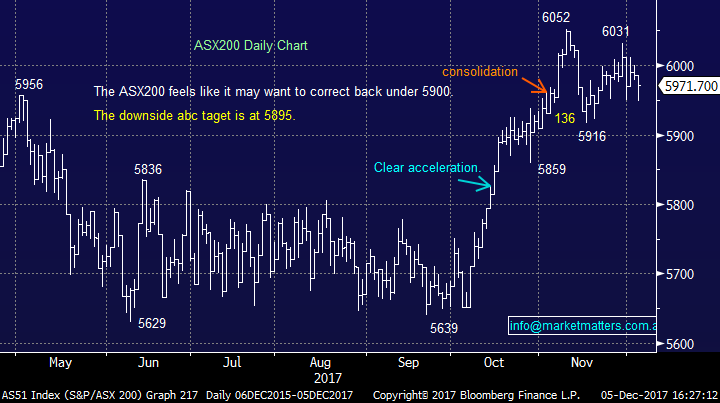

The mkt got bid up on open today, but sellers came out of the woodwork around midday – the 6000 level continues to provide a strong point of resistance. I think we need the mkt to unwind back down to the ~5900 region before having another good crack at 6000 or beyond. Overall, Telco’s the shining light for a change led by Telstra which closed on its highs - the IT stocks were the weakest link following the weak lead from the NASDAQ overnight. An overall range today of +/- 37 points, a high of 5985, a low of 5948 and a close of 5971, off -14pts or -0.23%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

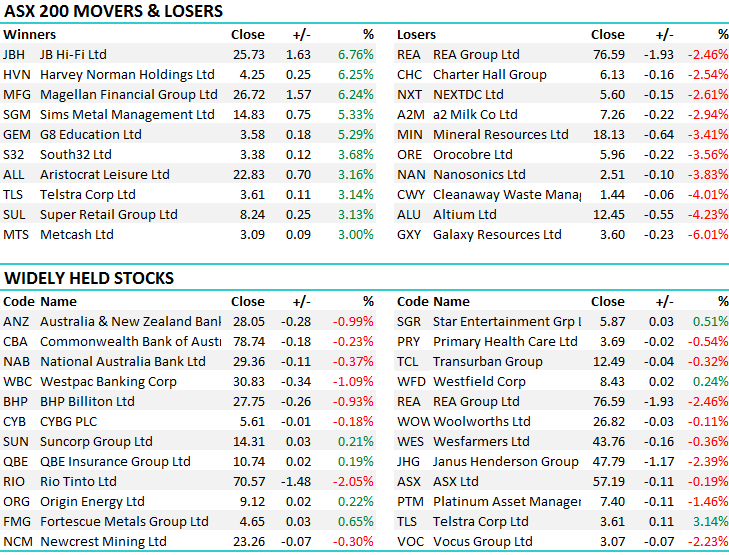

TOP MOVERS

1. Retailers - Pretty sick of talking about Amazon to be honest, and their launch today is a welcome development. I’ve often mused that the reality of the behemoth would prove to be a fraction of what the hype has been during the build-up and the reaction today was interesting, and more or less proved that point. A good note went around our desk today, written by one of the instos and it highlights a few interesting aspects, the bulk of which we had ‘thought’ but now know. Amazon is about convenience, variety and price.

Convenience; Normally would mean same day delivery but Amazon have started with 2 days standard delivery on all products which is NOT that convenient + it costs between $5.99 & $9.99. Priority delivery will cost $9.99 & $11.99 in major metropolitan areas

Variety; Here Amazon does well, but only in individual product categories. E.g search Headphones and you will get 24 pages of results with totalling 783 products in the category, however for now, they lack many key product categories, for example when you search fridge they don’t have your regular run of the mill products, its mostly parts or camping (portable) fridges. When you search TV, you get nothing, only cables. The categories they do have are rich in variety (for the most part), the issue at launch is that they are missing massive categories like TV, Whitegoods, Furniture

Price; A vast majority of stock is from amazon market place, (other retailers use amazon like ebay to sell their goods). Because of this there isn’t the margin for Amazon to be cheaper, so apart from a few headline grabbers in terms of price (some very cheap rice cookers! ) across the board it didn’t excite me.

To give some context here about the spate of Amophobia that has cast it’s shadow over the Aussie retail sector in the last 12 months, stocks have re-rated hard, particularly those that are most exposed to what Amazon offers. Bear in mind that the sector rallied strongly today so that sugar coats some of the moves, however Harvey Norman still down 17% in 12 months, Super Retail down 20% (although Decathlon is also coming here), while JB has done OK in a comparative sense, but still its underperformed the mkt by a big quantum with a massive PE re-rating from 18’s to 12’s on a forward basis. As I said, we own HVN in the Income Focussed portfolio and the move today was strong. This could easily see a re-rate +20% higher.

We also saw a better print in terms of retail sales today, +0.5% versus +0.3% expected and up from the weak print last month of +0.0%.

Harvey Norman Daily Chart

JB Hi Fi Daily Chart

2. Telstra (TLS) – Worth at least a mention this afternoon being up +3.15% on the day, being the 13th best stock in the 200 following broker upgrades yesterday! As we’ve written recently, BIG lines of stock like the one that crossed on the 28th Nov – we wrote about it here, often happen at the low point. In that instance, they crossed at $3.36 – about 100m shares, the daily low was $3.34 and the stock closed today $3.61. We hold TLS in both the income and growth portfolios, looking to trim into strength, but not yet.

Telstra Daily Chart

OUR CALLS

Nanosonics (NAN) – We sold today at an average price of $2.515. A hard stock to trade, clearly volume an issue.

Telstra (TLS) – closed today at $3.61, we’re looking to trim the Growth Portfolio holding into strength. Watch for alerts on this one.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/12/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here