Banks lead the charge as market tickles its December mojo…(ASX, TGR, CYB)

WHAT MATTERED TODAY

The banks lead the buying today , as the market opened strong and was bid up throughout the session, some relief after three days of selling. One of the better performers in the market was, ironically, the exchange itself after they announced plans to move its settlement system to a Blockchain system – the same tech that underpins Bitcoin (I think) – however we’ll cover that more in the AM report tomorrow, authored by Denis, who is a lot more tech savvy than I. From my perspective, and for someone that has operated in the market for many years, the archaic system of settlement that we currently operate under needs a lick of paint, or more accurately a complete new framework.

Financials all performed strongly today, and the big four were the catalyst for much of the markets gains – accounting for a third of the advance on the ASX 200. Overseas earners also got a boost from a lower Aussie dollar, notably CYB which jumped +1.841% to close at $5.64. We own it in the Growth Portfolio

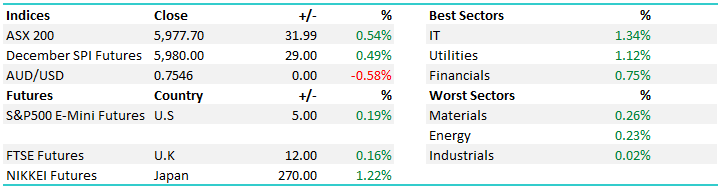

On the broader mkt today, buying was strong on the open and continued higher throughout the session. The IT stocks did best adding +1.34% while Industrials dragged, but still finished in the green. An overall range today of +/- 43 points, a high of 5987, a low of 5944 and a close of 5977, up +32pts or +0.54%.

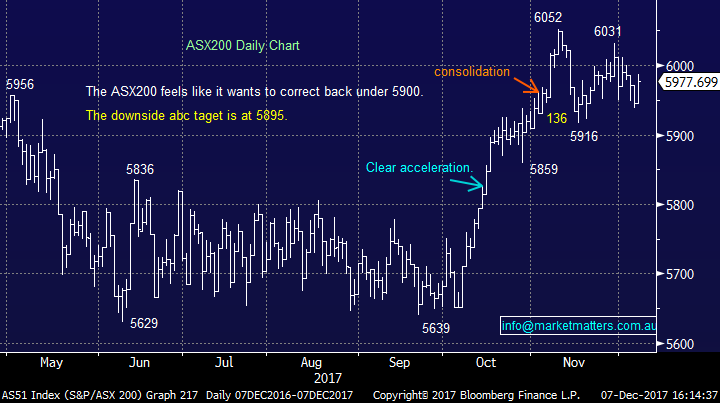

Looking more broadly, the local ASX200 has now been trading in a tight 2.2% range around the psychological 6000 area for the last month as investors question whether we will get a Christmas / window dressing rally again in 2017. Remember on average the market advances +2.5% in December but the gains usually don’t kick in until the middle of the month i.e. next week.

Our overall the view at MM on the ASX200 has not waivered:

- We remain bullish the ASX200 into 2018, targeting an eventual solid break over 6000.

- Short-term a pullback under 5900 would not surprise but we would be buyers here looking for a Christmas / window dressing rally.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

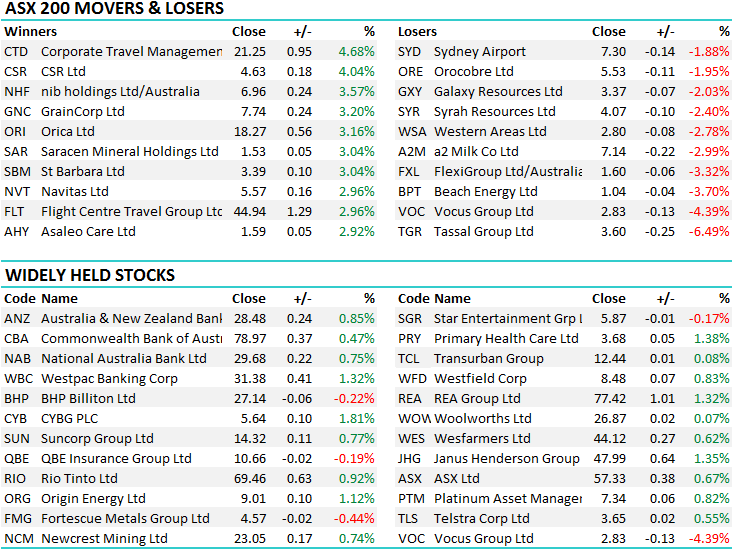

TOP MOVERS

1. ASX Limited (ASX) – – jumped +0.70% after announcing that the dated CHESS system used for clearing and settlements would be replaced by a distributed ledger system, known as blockchain. ASX is the first major global exchange to make the jump and, while there may be some hassle in the conversion, it will enable more players into the market at a lower cost and lower settlement risk, and likely to increase volume through the exchange to the benefit of ASX. We like it!

ASX Daily Chart

2. Tassel Group (TGR) – The stock was downgraded to ‘underweight’ (sell) by JP Morgan, and that’s all it took to send the Salmon producer and seller down 9% today. A left field company in the top 200, TGR has struggled this year as bulk Salmon prices fell.

Tassel Daily Chart

OUR CALLS

Telstra (TLS) - we reduced our holding in Telstra today by 5% in the Growth Portfolio. We did not get filled in JHG in the Growth Portfolio given the stock traded up strongly today.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Wednesday orFriday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 7/12/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here