Bitcoin was sweet today but RFG was rubbish (TOX, RFG, AWE, MIN)

WHAT MATTERED TODAY

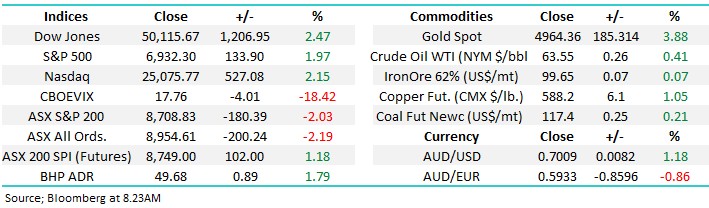

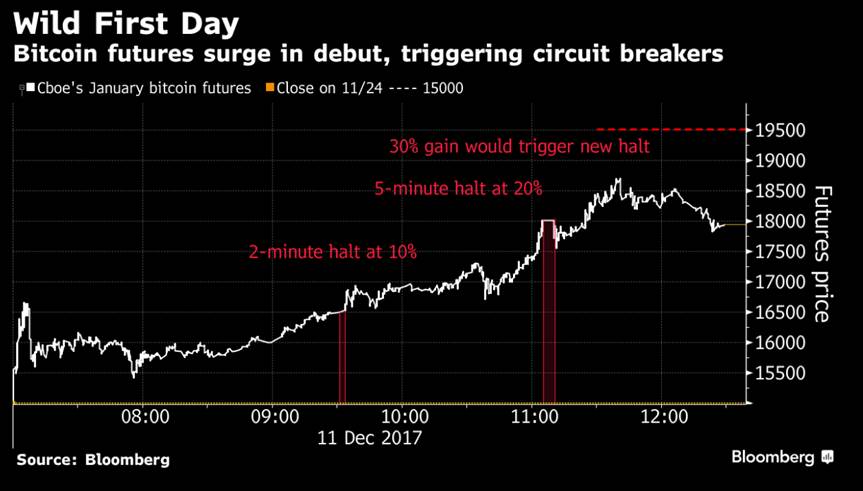

A positive start to the new trading week although gains were only small relative to the leads from overseas markets on Friday – perhaps traders were focussed on Bitcoin Futures which started trading today and had another massive intra-day range with a low around $15000 and a high of $18,500 – they triggered the Circuit-Breaker (twice), which halts trading for 2mins on an intra-day swing greater than 10% while they halt trading for 5mins when the swing exceeds 20%. It took Bitcoin just 2.5hours for the first circuit breaker to be applied! This is some extreme volatility however now being available in the futures market is certainly another factor in legitimising the casino...For those on Bloomberg, Jan Futures XBTF8 – volume was low but better than I thought it would be with around 2300 trades representing a notional value of about $US40m.

Back to more mundane events (which is pretty much everything if we use Bitcoin as a reference point) we did see some corporate activity back on the radar with Cleanaway Waste (CWY) making a $671m tilt for Tox Free Solutions (TOX) at a 30% premium, they have full board support and the bid is clearly a strong one, while on the flipside, Retail Food Group (RFG) ended up down the grease trap off by more than 26% on a Fairfax report detailing franchisee friction. More on both later.

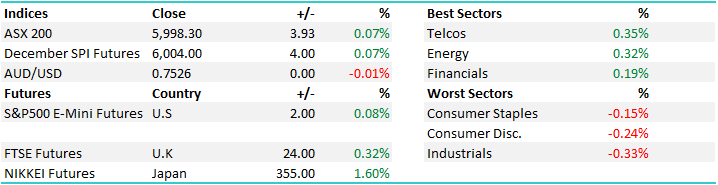

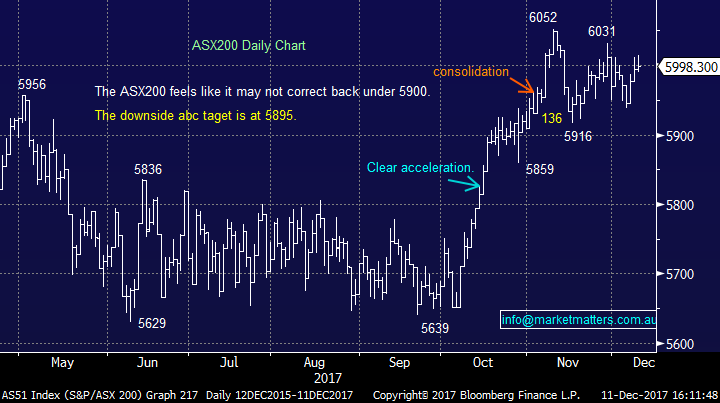

On the mkt today, the Telcos were again the area that saw most buying while the Industrials trickled lower, but nothing big on either side of the ledger. It seems traders remain happy to sell into strength above 6000 – which has been the case since early November. That region does look like it will break into the seasonal Christmas strength, however we haven’t really seen a coordinated effort from both the banks and miners, which is clearly needed.

An overall range today of +/- 25 points, a high of 6015, a low of 5590 and a close of 5998, up +4pts or +0.07%

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

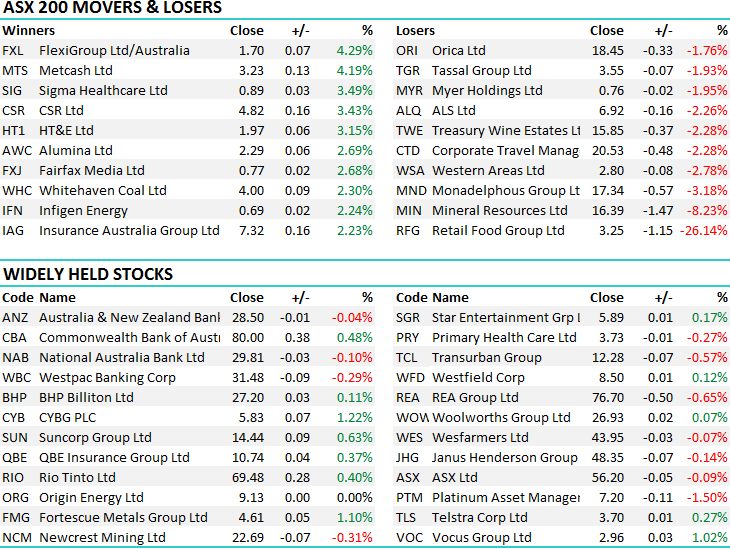

TOP MOVERS

1. BANG – Tox Free Solutions (TOX) copped a strong takeover approach from Cleanaway (CWY) and the stock rallied +19.72% to trade at $3.40. Cleanaway (CWY; mkt cap $2.3b) to acquire 100% of Toxfree’s (TOX,; mkt cap $552m) shares for $3.425 cash per share (current TOX share price = $2.84) less a special dividend payment from TOX. This is clearly a very BIG price and represent an EBITDA multiple of 10x, which if you think about it, TOX (and BIN more recently) have been buying smaller things for 3-6x now CWY is paying 10x for scale. While we can see the rationale for such a deal and it is expected to be strongly earnings accretive, it is still a very big price. BIN is the other (newly listed player) that’s worth a look however it’s a very competitive mkt for quality assets with the likes of SITA/ Suez, Veolia, Remondis. JJ Richards, URM, etc. all striving for market share.

TOX Daily Chart

2. Mineral Resources (MIN) / AWE – More corporate news with MIN bidding for AWE in what’s shaping up to be a bidding war for the gas producer, after China’s state-owned China Energy Reserve and Chemicals Group made a bid which was rejected and later pulled. MIN have launched a scrip-based offer of 80¢ a share which is 7¢ a share higher than a $463 million cash offer by the Chinese. AWE shares obviously very strong on the back of this closing up +16.44% to 85c (implying traders are positioned for another Chinese bid) however MIN shares took it on the chin closing down -8.23% to $16.39. AWE shareholders would own 13% of the combined entity.

AWE Daily Chart

Mineral Resources Daily Chart

3. Retail Foods Group (RFG) – fell 26.14% to $3.25, on the back of Fairfax Media reports which suggest some friction between Franchisees and the Franchisor. Of course, RFG has a portfolio of brands including my favourite Donut King, Brumby’s, Michaels Patisserie, Crust, Gloria Jeans etc. In essence, Fairfax Media has published coverage alleging that RFG is charging crippling franchise fees and other costs to boost profits forcing some franchisees to bankruptcy - destroying marriages and leading to systemic staff underpayment – RFG obviously refutes the claims however they’ve taken a further step (which is clearly not going to help the brittle relationship) writing to Franchisees reminding them that any external discussion of internal business could be a breach of contract! Doesn’t sound like a happy place and perhaps the image on the Donut King website typifies how the Franchisee’s might feel at the moment!

We actually had a question about the stock last Monday concluding at the time; RFG is indeed a heavily shorted stock coming number 6 with ~12% of its stock sold short. A company that manages donut stores and cafes does not excite us as we see the worlds move away from sugar gaining momentum. We see no reason to buy RFG at current levels even though its testing its multi-month $4 low, and think there is a high chance the stock will trade below the previous $3.98 low – another 10% drop.

Retail Food Group (RFG) Daily Chart

OUR CALLS

Commonwealth Bank (CBA) – we added to our existing position in CBA today, buying an additional 3% around $80.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/12/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here