Strong employment numbers put the kibosh on the market (MYR, IGO, CTX)

WHAT MATTERED TODAY

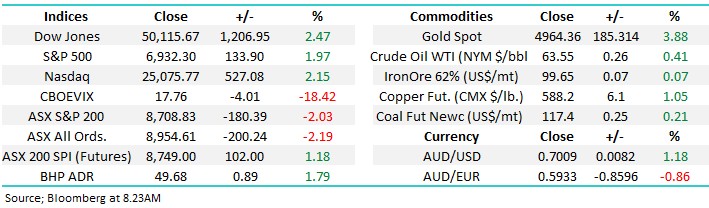

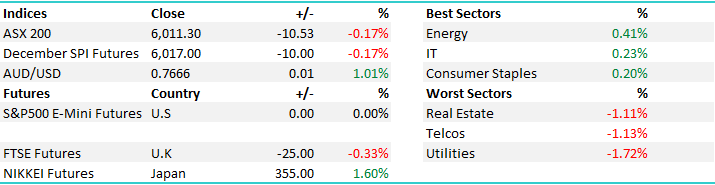

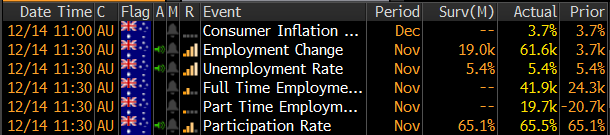

A very negative day really in terms of price action (not so much aggregate move) with the index up strongly early to make a new 5 year high before sellers dominated from 11.30am onwards following stronger than expected employment numbers. The unemployment rate was inline (5.4%) however participation was very strong at 65.5%....shows some strength in the underlying labour mkt and that saw the market sold off while money flowed into the Aussie Dollar which was up from 76.13c to 76.76c on the news. We also saw some tightening in short term interest rates in China however the labour stats the main game in town today.

Source; Bloomberg

Aussie Dollar Daily Chart

The Energy sector was again the standout courtesy of buying in the Coal space while again, we’re writing about the underperformance of the interest rate sensitive utilities. An overall range today of +/- 32 points, a high of 6043, a low of 6011 and a close of 6011, off -10pts or -0.17%

ASX 200 Intra-Day Chart – The mkt clearly didn’t like the thought of higher interest rates!

ASX 200 Daily Chart

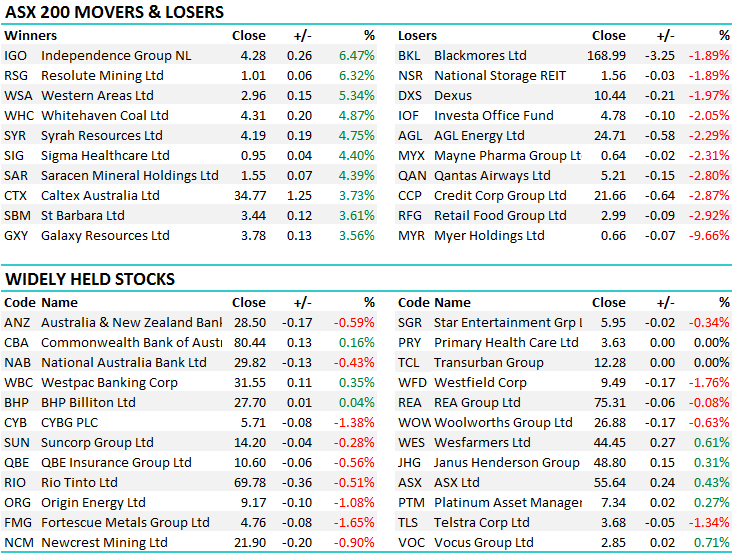

TOP MOVERS

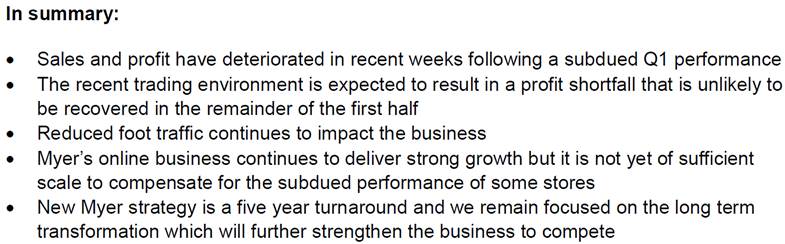

1.Myer (MYR) 65.5c / -9.66% - Poor old Myer, and poor old Sol for that matter with another downgrade today and the stock hit by another 9.66% to close on a new low of 65.5cps. Hard to be anything but negative on this name however clearly the risk being short here is whether or not SL will step up and have a crack.

The key line for me was…

Myer Daily Chart

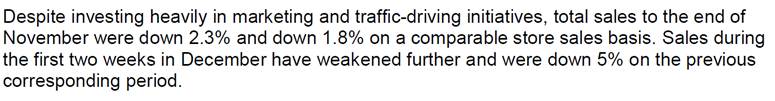

2 .Caltex (CTX) $34.77 / 3.73% - rallied as high as $35.26, however drifted into the afternoon following ACCC’s rejection of BP’s $1.8b bid for Woolworth’s petrol business. Back in August 2017, the ACCC flagged preliminary concerns so this news should not be that surprising! The concern was that BP already has <1400 sites across Australia and an additional 530 sites (with 12 in development) would increase BP’s share of the wholesale fuel market from 18% to >30% (roughly where Caltex’s share is) and would therefore substantially lessen competition (i.e. motorists would pay more for petrol). For similar reasons Caltex also failed in its $300m bid for 300 of Mobil’s fuel sites back in 2009.

Caltex Monthly Chart

3. Independence Group (IGO) $4.28 / 6.47% – we own IGO, and their move today was a strong one adding more than 6%. We like this Nickel / Gold play and are targeting a re-test of recent highs above $4.50.

Independence Group (IGO) Daily Chart

OUR CALLS

No changes to the portfolio’s today…

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/12/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here