Sellers start to dominate on the local market (SYR, PTM, MFG)

WHAT MATTERED TODAY

More of the same today only on a bigger scale with early optimism met with some decent selling later in the session after the market traded to a 10 year high of 6150 on the ASX 200 during morning trade. As we cautioned yesterday a market that is trading in tight ranges and finishing well off its daily highs suggests that its exhausted & a pullback is probably imminent. One day certainly doesn’t make a summer, and we did temper our view slightly in the AM report today, however as Fund Managers come back online and with the lack of any near term catalysts for stocks (aside from US quarterly reporting), we think a degree of caution and an increase in cash levels is a prudent way to play it right now – we did just that in the MM Income Portfolio today going from 2.5% in cash to 7% by trimming NAB, while we sit at a very healthy 26.5% cash in the MM Growth Portfolio.

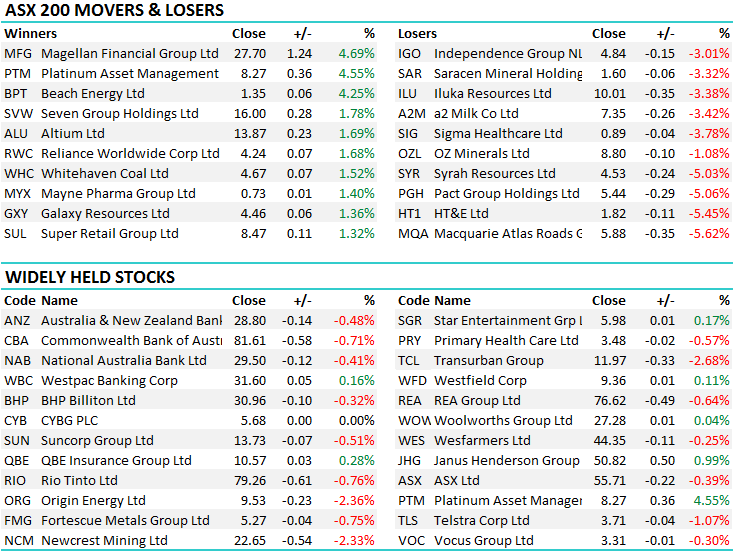

The other interesting trend that caught the eye today was around the Fund Managers and specifically Platinum (PTM). Inflows have really ticked up and the bearish broker calls are starting to capitulate – Morgan Stanley the latest today to begrudgingly upgrade the stock, simply because PTM is getting more inflow than most thought they would. That’s also relevant to Magellan (MFG) which was strong today however the cynic in me merely thinks it’s another sign of unfounded euphoria. Why do Fund Managers get the best flows when markets are trading at 10 year / all-time highs? More on the fund managers below.

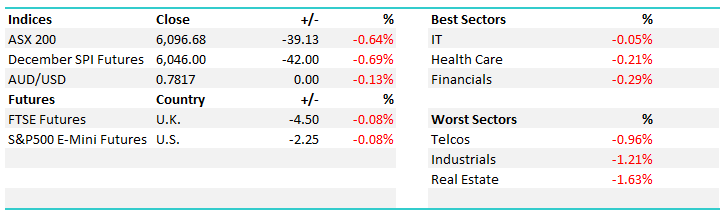

On the market today all sectors ended lower, with Real Estate targeted the most, falling 1.63%. We had an overall range today of +/- 54 points, a high of 6150, a low of 6096 and a close of 6096, down 39pts or -0.64%

ASX 200 Intra-Day Chart – morning optimism sold into AGAIN

ASX 200 Daily Chart – tight ranges, and market finishing well off highs – suggests our mkt is exhausted – pullback imminent

TOP MOVERS

1. Syrah Resources (SYR) $4.53 / -5.03%; Hit today on news that their proposed graphite processing facility in Louisiana is a no go with the community against it and causing enough angst to have the deal scuttled. Not a huge setback for SYR given they had other sites earmarked as well (apparently) however as the most shorted stock on the boards, the 5% drop in share price makes a good story. The company will give a more wide ranging update on the 30th January. We don’t own

Syrah Daily Chart

2. Resources: Staying on the resource theme, it was interesting to see a sharp turnaround in their fortunes today, particularly the base metals plays like Oz Minerals (OZL) which fell by 3.83%. Always worth remembering that commodity coys are volatile – they have big moves on both sides of the ledger. RIO also a case in point that traded a long way below the session highs – a big turnaround and a move that would generally see follow through for the next few days – ditto for Oz Minerals.

Oz Minerals Daily Chart

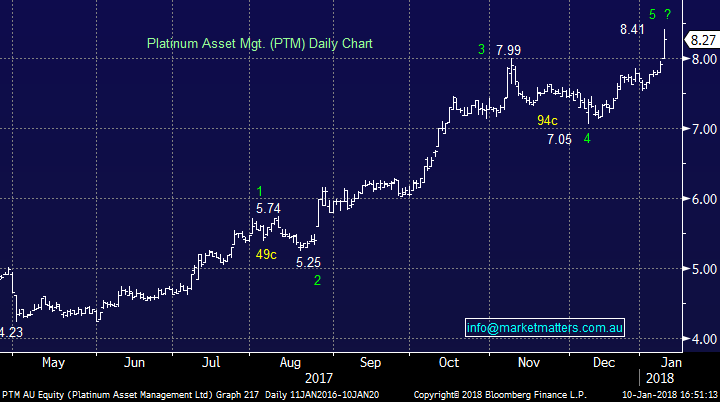

3. Platinum (PTM) $8.27/ 4.55%; $80m of new FUM in December is a good effort from Platinum and well above what the market was expecting – the shares have had another very good session today. Fund Managers are high beta plays on the equity market and when mkts are strong they a very leveraged to it through 1. Good returns increasing overall FUM & 2. Typically more inflows in a strong market = more FUM. That’s what’s happened to PTM and other fund managers. Current broker consensus on PTM below with Morgan Stanley the latest to fall on their sword, and go from an equivalent SELL to a HOLD after the stock has just run $4. We held this stock – tried to pick to bottom of it and ultimately got stopped out for a loss (frustrating) however the rationale was around mkt positioning – that simply the mkt hated the stock and the bad news was priced in – and any upside move would be big. The move in PTM even though we’re not on board is a good illustration of how stocks can move when the mkt is positioned against them. We recently bought Perpetual (PPT) in the Income Portfolio looking for similar move.

Platinum Daily Chart

4. Magellan Financial Group (MFG) $27.70 / 4.69%; And finally, Magellan who everyone now knows after they spent $20m sponsoring the Ashes series. They too have had good FUM for December, mostly insto flow of $495m which is lower margin while they got $3m of retail flow. I think our desk saw better retail inflow than Magellan in December….however I’ll be interested to see the retail flow for Jan post Ashes – we’ll be able to see pretty easily if the advertising worked. I’ll come back to you around this time next month. They did have good ads though – as someone said on Twitter yesterday (you can follow me @jamesrgerrish) if you like – I need a few more numbers – that the best part of the ad was the sad face of the investor who only has Australian shares! Anyway, that’s pretty accurate however could an international fund manager sponsoring the cricket be another sign??

Magellan Daily Chart

OUR CALLS

Within our Income Portfolio, we trimmed NAB by 4.5% leaving a 7.5% weighting. We retain a 10% weighting in the MM Growth Portfolio.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/01/2018. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here