Overseas Wednesday – International Equities & Global Macro Portfolio (BIN, EHL, GOLD US, GOOGL US, JHG US, DBA US, ETPMAG)

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

Click on the link above to see all companies reporting today. I have covered the following in the recording below: BVS, CWY, APA, WOR

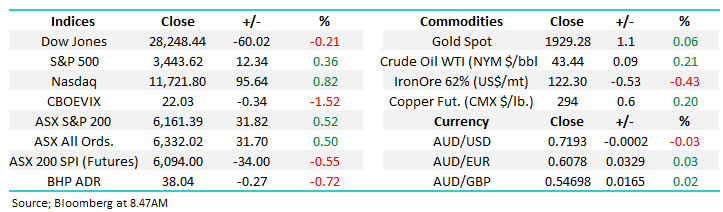

The ASX200 tried and failed yet again at the psychological 6200 level, it received a great initial leg-up from US stocks which should have been compounded by another net positive read through from companies reporting but with over 40% of the index finally closing in the red, even a good session by the Banking Sector wasn’t enough for the index to build on early gains - yet again we drifted lower through most of the day. The Healthcare Sector continues to struggle, heavyweight CSL is now down more than -12% since April which creates a meaningful headwind for a market attempting to rally to a new level of equilibrium. (CSL is the markets biggest index weight).

Another factor which caught my eye yesterday was some profit taking creeping into a few of the high flying names e.g. the following 3 stocks closed well off their respective intraday highs, Xero (XRO) -2.8%, Megaport (MP1) -4.8% and NEXTDC (NXT) -3.2%. However it wasn’t all tough going in IT sector with Afterpay (APT) surging another +11.8%, we mentioned in yesterday’s report that its first leg into Europe had been received in a fairly muted manner, well we certainly got the reaction MM expected on Tuesday with APT feeling stronger by the day.

Last week I mentioned that the longer we take to pop through 6200 the more likely the move was to fail, or at least initially. This “Gut Feel” is getting stronger almost by the day, especially after I “smelt” some profit taking coming into a few of the markets top performers. There’s no reason not to be long equities at present but we’re definitely skewing to a more neutral stance short-term. Overnight US stocks again closed in positive territory, but the SPI futures as is often the case followed Europe and are calling our market to lose all of yesterday’s gains on the open.

MM remains bullish equities medium-term.

ASX200 Index Chart

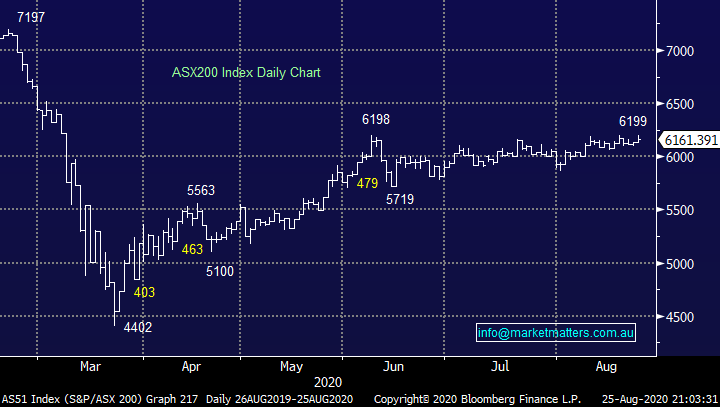

In our Afternoon Report yesterday I talked about Bingo’s (BIN) very pleasing result which sent the stock up +13.5%. The result was a beat on all metrics making the common bearish thesis around weak construction hurting earnings, reduced earnings putting pressure on the balance sheet and a likely forced equity raise simply all look wrong, going into yesterday BIN was showing a major 7.4% short position, if I was these guys I would be exiting stage left asap and it looks like some did yesterday.

Revenue held up nicely while earnings were driven by better synergies coming through from its $578m Dial-a Dump acquisition. I reiterate this was a very strong result given the complexities in the current operating environment – they even grew margins. Guidance was also strong moving into 2021/ 22 which should please investors, like ourselves: “Infrastructure activity is expected to increase by ~10%. Infrastructure is expected to remain strong for the foreseeable future and for BINGO will partially off-set the softness in the building sector.” Most importantly we’re still bullish initially looking for ~20% more upside.

Cleanaway (CWY) has also just released earnings this morning which look strong, talking to a good start to FY21.

MM is bullish BIN initially targeting ~$3.

Bingo Industries (BIN) Chart

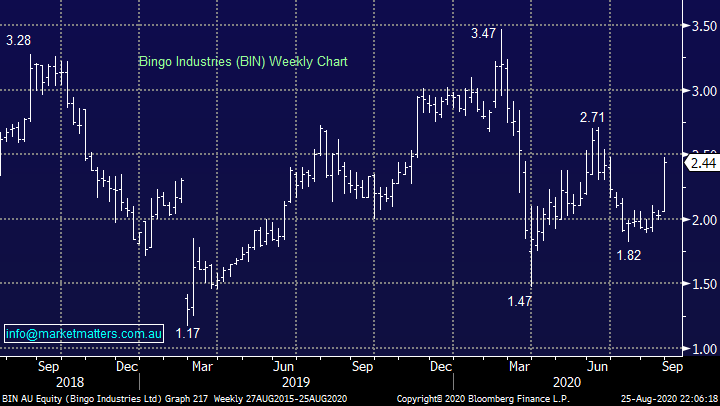

It’s important to MM that we present a balanced view on both the market and our performance hence this morning was the ideal opportunity to mention Emeco’s (EHL) return to the board yesterday after its capital raising i.e. partially offsetting Bingo (BIN).

EHL are raising $149m to buy back some of their more expensive funding, plus they extended the maturity of additional notes due in 2020. The raise is a 1 for 2.1 at 85c meaning its big for the company however post the raise they’ll have, $A56m cash, $A97m undrawn revolving credit facility ($153m total liquidity) plus $A267m debt due 2024. Net debt will fall from 1.5x EBITDA to 0.9x which gives it the best-looking balance sheet since listing. Importantly, it also reduces interest costs by $19m p.a. Also, encouragingly major share/bond holder Black Diamond committed to the raise plus they will sub-underwrite up to 3% of shares on issue post the offer, not major but it all helps.

While the raise is clearly dilutive, the balance sheet was one of the issues that EHL have grappled with for a while, MM believes the raise will be favourable and we plan to take up our entitlement at 85c. This has become a fairly aggressive position for MM but is was encouraging to see the stock close 8% above its raise price yesterday with 94% of institutions taking up their entitlement i.e. strong institutional support for the raise.

MM has an initial target for EHL ~$1.50.

Emeco Holdings (EHL) Chart

Overseas stocks

Overnight the S&P500 again registered a fresh all-time high, illustrating how fading any breakout in both stocks and indices requires careful consideration - the trend is most often your friend. The strength under the hood was again delivered by the heavyweight tech stocks with Alibaba (BABA) and Facebook (FB US) the two standouts both rallying ~3.5%. No change at MM we remain bullish stocks over the next 12-18 months although another small correction in the tech space feels close at hand, we’ve seen one every month since March’s panic low and so far August has been one-way traffic - at this stage we see no reason to expect the markets rhythm to have changed.

The FANG stocks are quality names who have seen their growth accelerate in major fashion by COVID-19, we believe the many “valuation” doubters should remain conscious that they are significantly cheaper than many lesser names were into the tech wreck of 2000.

MM remains bullish US stocks medium-term but short-term things feel a touch stretched.

US S&P500 Index Chart

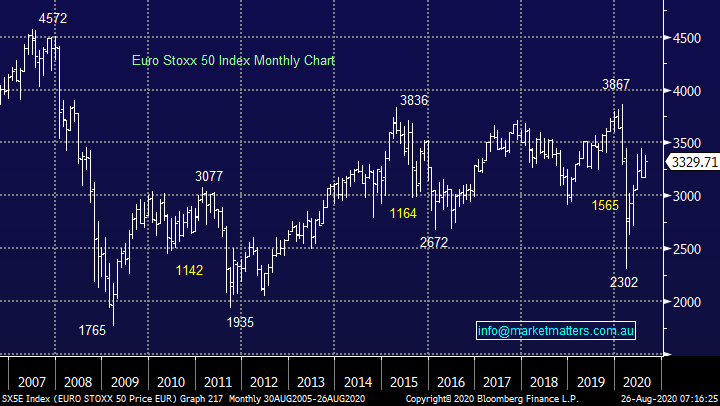

The European markets which the ASX is very highly correlated to is painting a very similar painting to ourselves i.e. struggling to add to its strong bounce since March but it still feels inevitable that it’s the likely path forward.

MM remains bullish European stocks.

Euro STOXX 50 Chart

MM International Portfolio

No change, MM continues to hold only 6% of our International Portfolio in cash, in other words we are “very long” global equities which feels correct as US stocks indices continue to make all-time highs. However as we anticipate an eventual migration back towards the “Value” end of town we are focusing on an ideal time to tweak our portfolio through taking some profits in some of our IT exposure if we can identify solid opportunities elsewhere. Please excuse the extended period of banging the same drum but there are 2 parts to this equation – firstly identifying what we plan to do and then secondly identifying the optimum time to execute.

MM International Portfolio: click here

Again we didn’t transact last week but as the divergences increase across the US market the time is approaching i.e. the internals are looking tired in the S&P500 with a diminishing number of stocks making fresh all-time highs over the last week e.g. Apple (AAPL US) and Tesla (TSLA US) are stand outs. We stress MM is bullish equities over the next 12-18 months hence it’s a case of what equities to own as opposed to should we buy stocks.

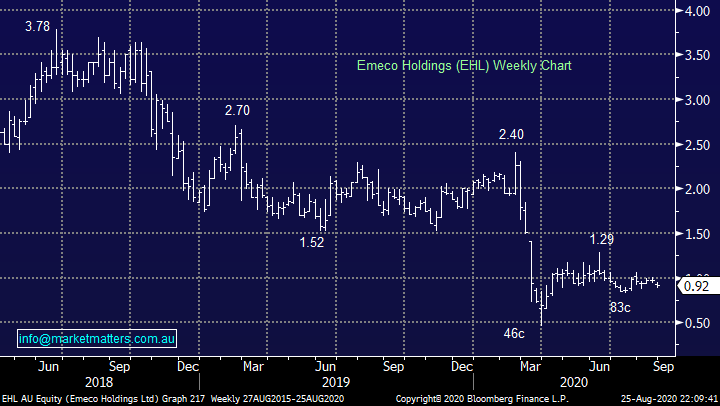

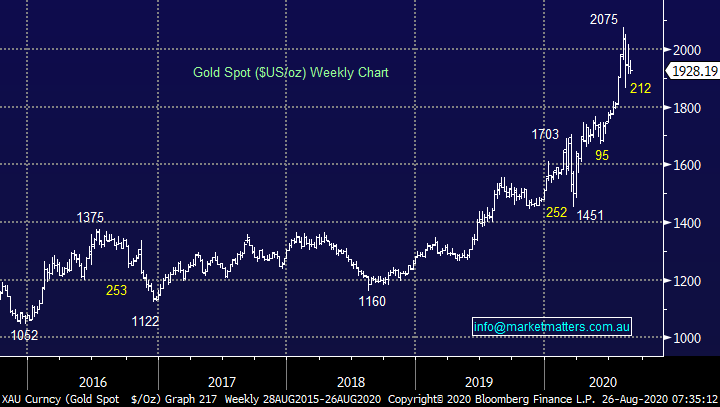

With our very low cash position its unlikely MM will buy fresh positions without switching but obviously never say never. At this stage taking into account the current mix of our International Portfolio the most likely rotation in the weeks ahead is from either a tech name, or a position that has lost its lustre, into a gold position but we want currently more fuel in the tank than today’s levels to rotate from a strong performer.

Hence at this stage we anticipate pressing the “switch” button when gold make fresh August lows, $US1,800 is our ideal target for the precious metal before it heads back towards fresh 2021 highs but that’s a reasonable 6-7% drop hence as always we are flexible looking for a reason to press the trigger.

Gold Spot ($US/oz) Chart

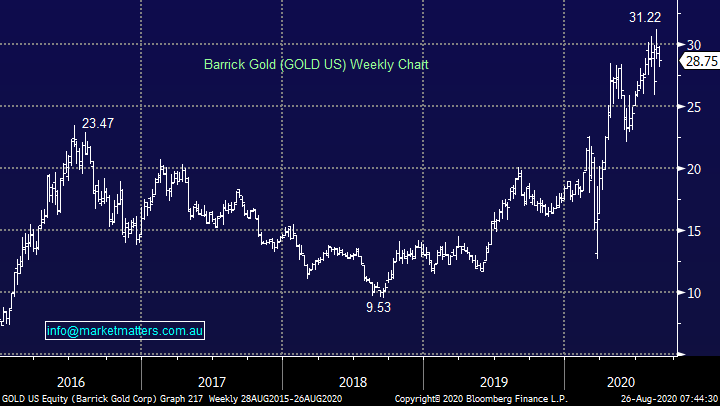

Barrick Gold (GOLD US) $US28.75

Barrick Gold (GOLD US) has corrected ~8% in-line with Golds 7% pullback, its approaching the time to lay the trap and wait.

MM is looking to buy Barrick Gold (GOLD US) into its current pullback.

Barrick Gold (GOLD US) Chart

We have the same 2 funding options on our radar:

Alphabet (GOOGL US) $US1605.85

We’ve held back on taking profit on Google, as subscribers know we feel the technology sector is approaching (not arrived) at a period of underperformance and probably a reasonable pullback short-term – Google remains our preferred candidate to help us de-risk towards the “hot tech space” and hence by definition we continue to prefer our positions in the likes of Apple (AAPL US), Alibaba (BABA US) and Microsoft (MSFT US) moving into 2021.

MM is considering when to take profit on our position in Google.

Alphabet Inc (GOOGL US) Chart

Janus Henderson (JHG US) $US20.95

Similarly, investment manager JHG remains in our sell sights, it has recovered strongly from its 2020 low but after more than doubling since March its started to struggle as outflows continue to disappoint. Hence MM is now neutral the stock technically while there are other, we sectors prefer fundamentally, hence it remains another prime candidate to help us increase cash levels.

MM is neutral JHG at current levels hence cutting the position makes sense.

Janus Henderson (JHG US) Chart

MM Global Macro ETF Portfolio

No change last week, MM’s Global Macro Portfolios cash position remains at 19%: Click here

After watching markets unfold through the week we are looking to increase our 2 smallest positions to 10% potentially on the same day as they are likely to both be depressed if we get a further countertrend bounce in the $US – our preferred option.

$US Index Chart

Invesco DB Agricultural ETF (DBA US) $US14.50.

We’ve been patient increasing our position in this agricultural ETF but as our reflation view slowly gathers momentum the opportune time to increase our exposure from 6% to 10% is approaching fast.

MM likes the DBA ETF at current levels.

Invesco DB Agricultural ETF (DBA US) Chart

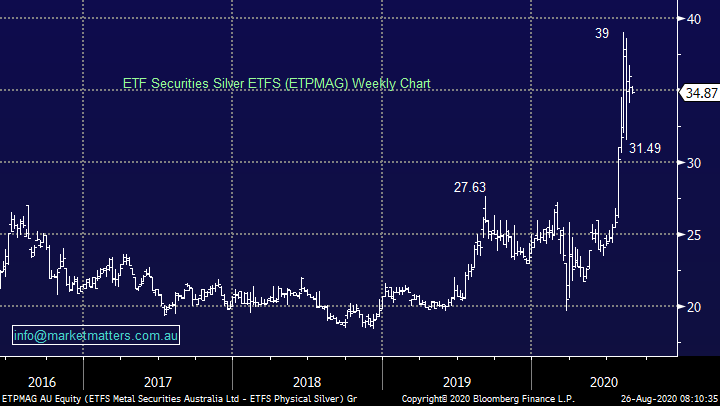

ETF Securities Silver Bullion ETF (EFPMAG) $34.87

Silver lived up to its volatile reputation by recently plunging over 20% in just a few days before retracing most of the drop almost as fast, we had been waiting for the pullback and went long at great levels, now as the precious metal consolidates we are looking to increase our position ideally into another test below $32.

MM is looking to increase our EFTMAG position around the 32 area.

ETF Securities Silver Bullion ETF (ETPMAG) Chart

Conclusions

MM is looking to tweak both of our International & Global Macro Portfolios as outlined above, we will be surprised not to see some “action” in the coming few weeks.

Watch for alerts.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.