A tough week for stocks however we did outperform the US (ILU, AWC, REA)

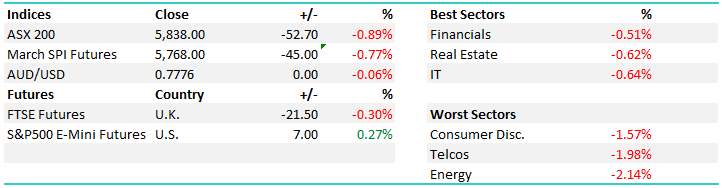

WHAT MATTERED TODAY

A very big week on the desk comes to an end with the ASX 200 down by -4.63% in aggregate which is obviously a weak result however when we hold it up against the Dow Jones with an 8.88% decline on the week so far and the S&P 500 which was off by 8.54% for the 4 days, we should feel a little better about ourselves! As we said in the weekend report last Sunday, we expect the Australian market to outperform other global bourses into any correction and that has certainly played this week by a large margin.

Today the market finished down -52pts however that was up +52pts from the session lows on the ASX 200 – not a bad result. Financials found some love today with the banks very resilient, NAB closing higher while the others were down smalls. The big 4 only detracting -2.89points from the overall index - not a bad result at all!

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Writing the AM report this morning, the DOW was down 400 – then 500 then 600 and finally finished down over 1000pts implying another very significant bout of weakness on our mkt today. That weakness played out early with the SPI trading down -140pts at the low before decent buying stepped in and the mkt grinded higher throughout the session – so although we were weak in aggregate, buyers dominated much of the day. One of the interesting comments we made this morning which is worth re-printing for those that missed it – and it’s the main reason why we bought stock into today’ s weakness was around the movement in volatility overnight, and the fact it diverged with the mkt performance. The DOW was whacked another 1000pts trading down near the weekly low, yet the volatility index stayed well below the panic levels seen earlier in the week…settling at 33.46 versus the 50 weekly high.

Interestingly the Fear Index / Volatility (VIX) is trading significantly below the panic earlier in the week which adds to our confidence in the view that we are seeing a short-term buying opportunity in stocks.

Fear Index (VIX) Daily Chart

We saw the opposite of this play out before the recent market drop, where the market was grinding higher yet so too was the volatility index – implying something more sinister was at play. While we’ve been cautious the mkt for some time looking for a decent correction and holding high cash levels as a result, it’s hard to say we predicted the magnitude of the drop over such a short period of time – I doubt many did.

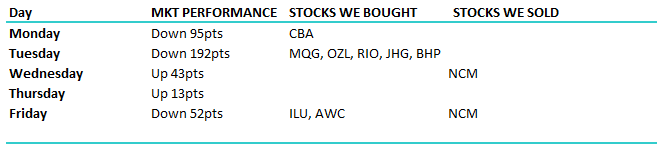

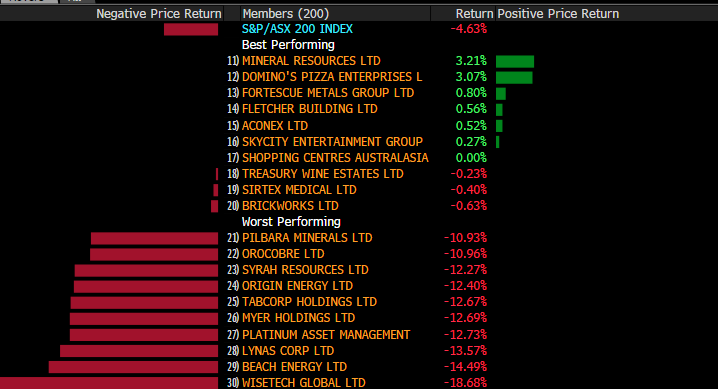

The more important aspect in all of this, is retaining flexibility across portfolios to ensure we have the ability to buy weakness as it prevails - we had this flexibility during the week and we added the following shares across the MM Portfolios on three different days – not all positions are showing gains yet however we’re comfortable with the approach. This morning we bought Iluka (ILU) and Alumina (AWC).

Our activity this week

CATCHING OUR EYE

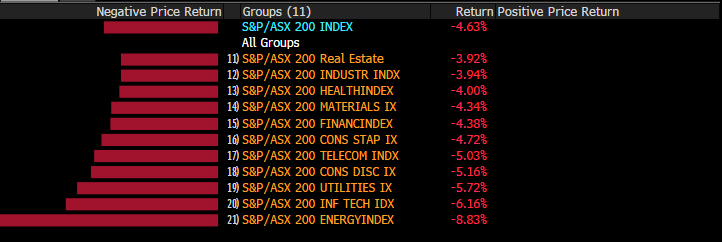

1.Market Performance; Looking at sectors, Energy was the biggest drag on concerns that higher rates will stifle growth (and demand for energy) while the defensive areas usurpingly did best – Real Estate and the like which is sort of counterintuitive given the reason for the mkt weakness was higher interest rates!!

Source; Bloomberg

Mineral Resources delivered a good set of numbers this week and that drove that share price higher, however v ’interesting to see the defensive qualities of Fortescue (FMG) with the stock coming up marginally higher on a torrid week.

Source; Bloomberg

Fewer stocks reporting today however we did see REA Group out with numbers + a few others while Myer dished up a 3rd downgrade…ouch!!!

2.REA Group (REA) $72.97 / $2.04 – delivered a very good result today with underlying NPAT up 21% to $147.3m which was inline with expectations however the outlook was probably better prompting small upgrades – this is a stock priced on a BIG multiple however it’s got huge pricing power, a main competitor that has just lost its CEO and main driving force (maybe) and it looks set to continue to deliver double digit growth.

REA Group Daily Chart

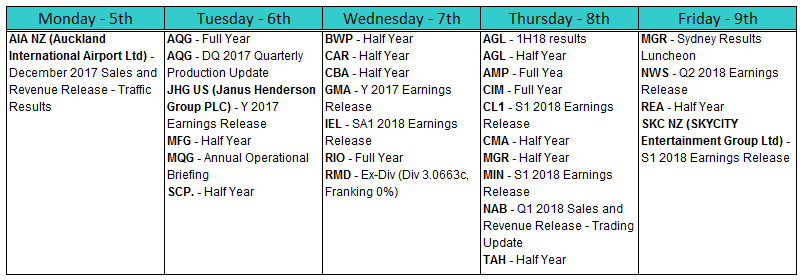

REPORTING THIS WEEK

OUR CALLS

We bought Iluka & Alumina in the Growth Portfolio today

Iluka Daily Chart

Alumina Daily Chart

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/02/2018. 5.09PM Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here