A big week of reporting starts with a few softies…(JBH, BEN, AMC, ANN)

WHAT MATTERED TODAY

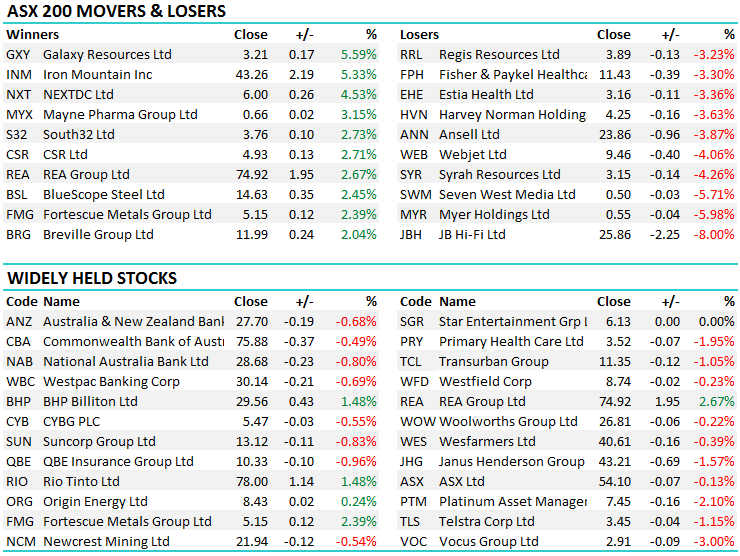

A fairly choppy session for Australian stocks today with early weakness being largely offset from afternoon buying in the resource names - BHP and RIO both up 1.48%, however it was Fortescue that saw most love adding 2.39% to $5.15 after being very resilient during last week’s market weakness. Reporting kicked up another gear today and this week we see more companies come to market with results. Obviously last week was dominated by global equity / bond mkt volatility so reporting took a backseat, however in aggregate, we saw around half the companies that reported beat, half miss and slightly more upgrades than downgrades as a consequence. By the end of this week these trends will become more valid.

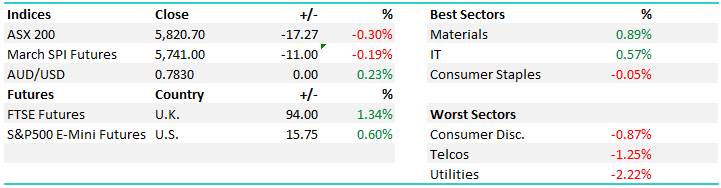

On the market today, the resources sector was best on ground adding +0.89% while the broader finished down -17pts or -0.30% to 5820 – however up from the session lows in early trade.

ASX 200 Intra-Day Chart

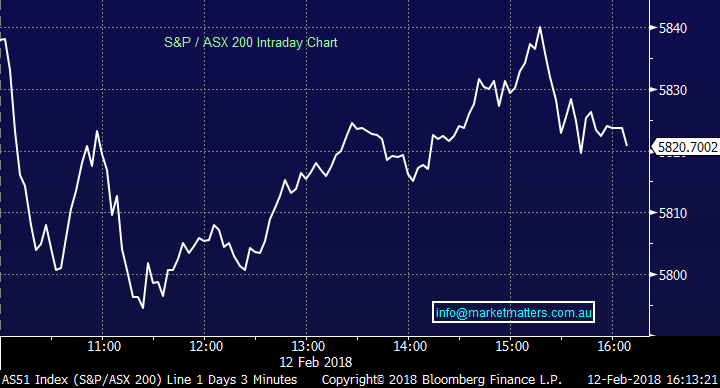

ASX 200 Daily Chart

CATCHING OUR EYE

A good spread of companies reported today, with more to come throughout the week;

1. JB Hi Fi (JBH) $25.86 / -8%; Probably the headline act today and the stock was down -8% to $25.86 despite delivering numbers that were inline in terms of earnings and dividend (1H NPAT of $151.7m versus ~$150m consensus) and a dividend of 86cps which was higher than expected, however the underlying metrics were not as strong, and the outlook was less upbeat. The main issue is around margins, with JB clearly maintaining sales momentum but discounting is underpinning it – and that’s a trend the mkt doesn’t like. That put pressure on the overall EBIT margin which was 6.12% vs 6.91% a year ago with the Good Guys being the main culprit printing 3.82% v 5.42% a year ago. So maintaining / growing sales is one thing but having to discount to get them was clearly front and centre in terms in the mkts reaction today.

JB Hi Fi Daily Chart

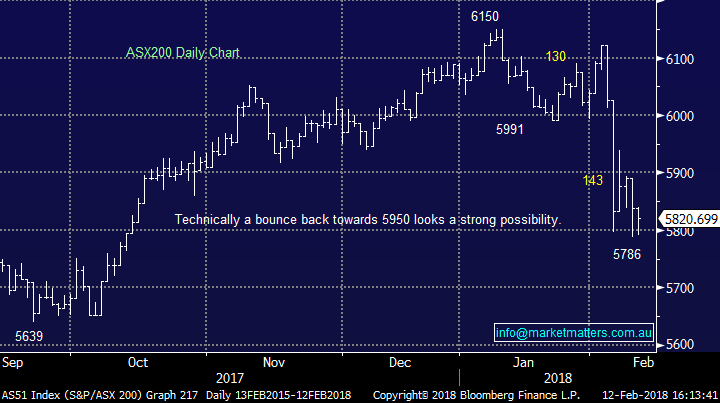

2. Bendigo Bank $11.00 / -2.05%; Missed slightly in terms of earnings today ($232m v $235m expected) while the dividend of 35cps was inline with expectations. The stock underperformed the sector down ~2% probably a result of bad debts ticking up in their commercial book. Overall, a reasonable result from BEN but nothing to get excited about + importantly nothing that is likely to prompt outperformance of the sector in the coming months.

Bendigo Daily Chart

3. Ansell (ANN) $23.86 / -3.87%; Result was inline + they upgraded guidance which would normally be a positive, however it’s more a result of external factors like lower US tax rate and the impact of the share buy-back over and above actual strong performance in the business. No one holds ANN for the divi however that was a slight miss (20.5 v 23cps), while they also talked about cost pressures from rising inputs which was another negative. The stock was down -3.87% to $23.86. We like ANN closer to ~$20.

Ansell Daily Chart

4. Amcor (AMC) $14.38 / +0.56%; Another result that was broadly in line with expectations however a few headwinds playing out for AMC that were clearly obvious. As with ANN, rising input costs are obvious while some patchy demand from some emerging markets facing businesses was also a theme. Some swings and roundabouts which point to a lower quality of result (lower tax rates etc) however guidance was reasonable which got the stock up off the session lows to close up +0.56% to $14.38

Amcor Daily Chart

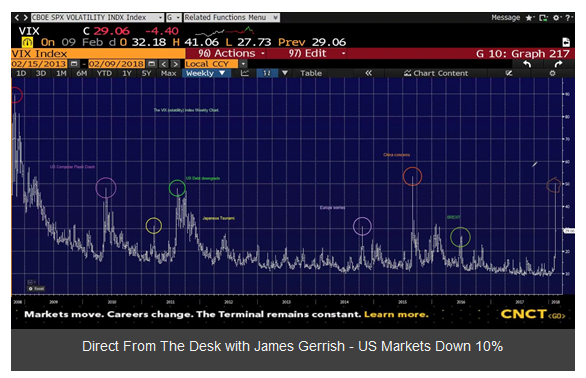

Update on market volatility & our positioning with James Gerrish – CLICK HERE

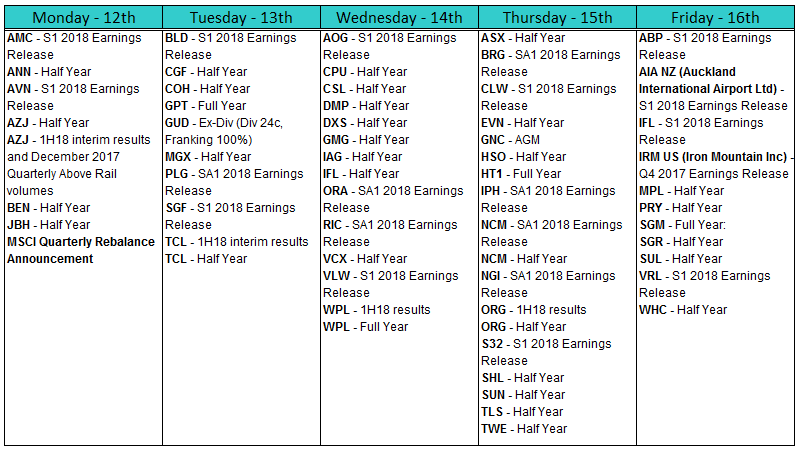

REPORTING THIS WEEK

OUR CALLS

No changes to the portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/02/2018. 5.19PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here