Is Don, is not always good! (DMP, MYR, WPL)

WHAT MATTERED TODAY

The market tick tacked in and out of positive territory today, ahead of the much discussed – mused about – pondered CPI print in the US this evening, while Woodside announced a big $2.5bn cap raise & CBA traded Ex-dividend for $2 fully franked taking 13pts points off the index – so, not a bad effort really. In terms of the CPI print tonight, expectations are for a 1.9% increase in the headline number including food and energy, but the mkt is clearly scared about the prospect of a stronger print coming on the coat tails of a bigger uptick in wages recently. A few points worth noting here;

1. When the mkt is all thinking the same, the talking heads are discussing it at length on both sides of the Atlantic, the response / reaction is probably not what the consensus thinks it will be. We wrote about the risk in crowded trades this morning and the concept rings true ahead of tonight’s release. If traders have now positioned themselves for a higher print, then the reaction to a higher print can actually be a higher mkt as hedges are unwound – we saw that outcome play out during BREXIT and Trumps surprise victory.

2. The market seems to be drawing a long bow between the timing of an increase in wage growth and the direct implication on inflation. Clearly higher wages does lead to higher inflation (over time) however it’s certainly not an exact science. During the 1990s, inflation fell as wages gained, and the same thing happened in the mid-2000s and there isn’t a lot of evidence that supports the concerns that a uptick in wages will have an almost immediate impact on inflation.

We don’t know what the outcome will be tonight, and the subsequent market reaction, however it gives me more confidence that the market has been focussed so heavily on it leading into the print.

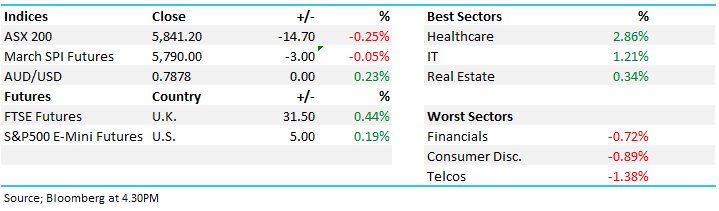

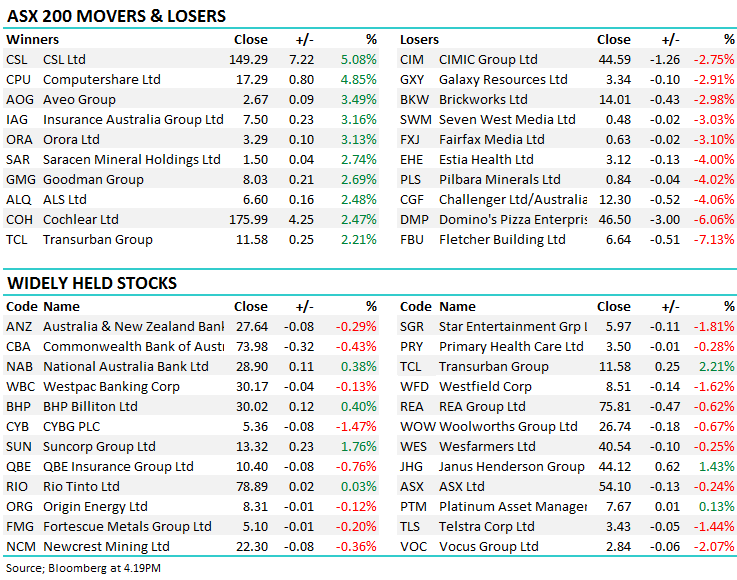

The mkt was okay today, a good result from CSL underpinned strong buying across the healthcare sector while Telstra dragged the Telcos down. The ASX 200 closed down -14pts or -0.25% to 5841.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

1. Domino’s Pizza (DMP) $46.50 / -6.06%; the fast food chain was hit hard despite reaffirming full year guidance at their half year result today. Despite a sizable 17% increase in profit on pcp to $59 mil, the numbers weren’t enough to match the market’s lofty expectations which was set at around $69.5 mil for the half, missing 1H18 EPS estimates by a huge 15.8%. They reckon that good momentum in the first month of the calendar year is enough to provide confidence of meeting full year guidance, however clearly the market doesn’t believe them. DMP is one of the most heavily shorted stocks in the ASX at the moment, at around 16% of available stock highlighting the negativity in the market. Although we like going against the grain we think that Don is being too optimistic in the groups full year assumptions. To give some flavour here, it needs second-half Ebitda growth of 28%-30%, which is likely to have to come from margin expansion given sales growth is expected to be 10%-16%. Either prices will go higher or costs will come down…maybe E10 can be subbed in place of premium unleaded in the delivery vehicles – wages can’t go any lower surely!

Dominoes Daily Chart

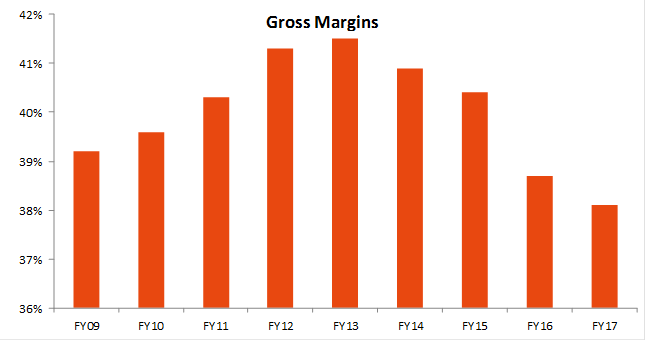

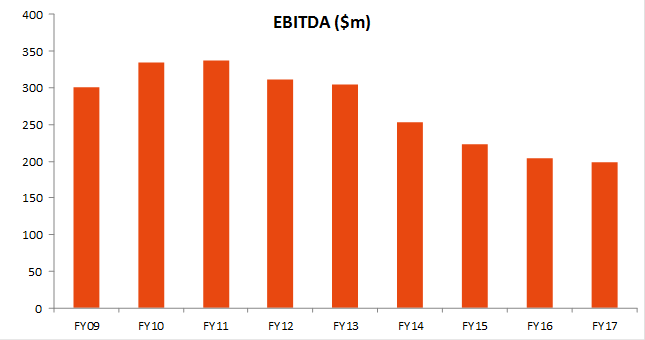

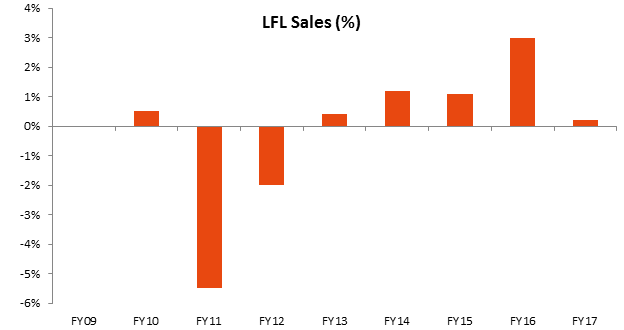

2. Myer (MYR) 54.5c / +1.87%; Myer CEO, Richard Umbers, announced his resignation today amid a poor string of trading updates, the latest announced just 5 days ago. His near 3-year tenure has seen the stock fall over 50% as he lead a ‘turnaround story’ that has so far failed to drive better results. The stock rallied on the news, most likely because it may renew veteran retailer and largest MYR share holder Solomon Lew’s push to overthrow the board and seize control. To give some context around Myers woes, a quick look at trends since listing tells an interesting story – thanks to Danny Younis from Shaws, for the charts…"impatient" for turnaround indeed!!!!

Myer Daily Chart

3. Woodside (WPL) $31.08 / halted; Announced results plus a big cap raising today to fund a new acquisition. Firstly, the stock will likely be under pressure when it comes back after the institutional raise even though the results released today were good. The 1 for 9 raise at $27.00 is a 10% discount to the last price, however it’s a big issue ($2.5bn), and the money is being raised to buy assets that won’t produce earnings for a number of years. All up, we like the rationale for the transaction which will give them greater control and ‘synergies’ between assets, however it also shows their hand in terms of growth. These guys will now have a big pipeline of projects that need funding, and therefore dividend expectations will need to change. We’ll need to do some work here however it may no longer be suitable for this portfolio – but we’ll make that call when more information is available.

In terms of the result, briefly, NPAT was US$1024M vs expectations of US$1013M and the Final DPS us 49c, vs expectations of 48c. The only real surprise, and it is a big one, was the acquisition of Exxon’s 50% (potentially subject to BHP pre-emptive for half) interest in the Scarborough gas field offshore WA. This is the rationale from the company

Woodside Daily Chart

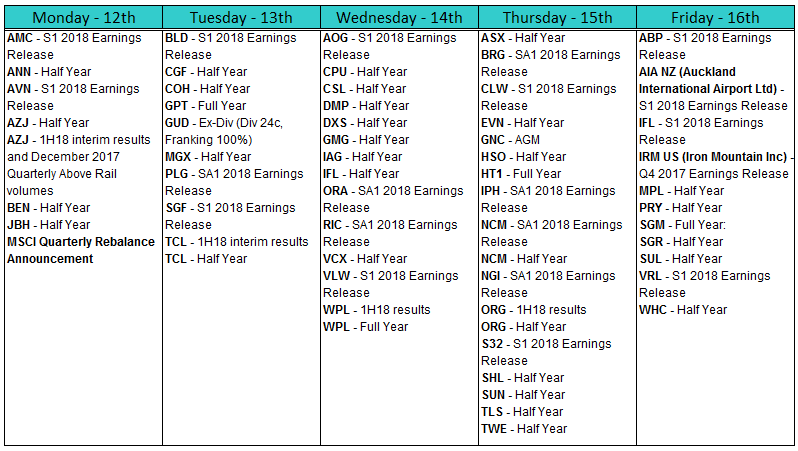

REPORTING THIS WEEK

OUR CALLS

No changes to the portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/02/2018. 4.19PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here