Aussie stocks regain their mojo

WHAT MATTERED TODAY

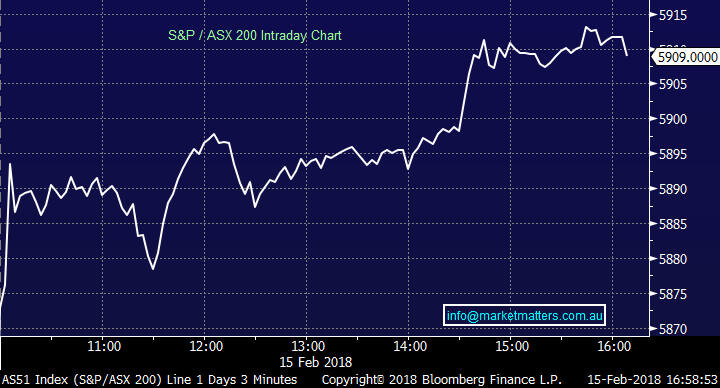

The bulls re-emerged today as the threat of a higher CPI result in the US came and went. The result was actually higher than mkt expectations but as we suggested yesterday afternoon, this morning, and on many notes in the past, when the mkt thinks a certain way, then the opposite reaction generally plays out.

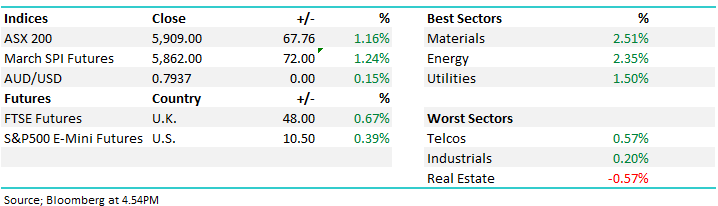

It seems the reflation trade is alive and well and it was those reflation stocks that did best in today’s trade. Resources led the +1.16% bounce that played out with the ASX putting on 68pts to close at 5909 – our 5950 shorter term target is now very much in play. We used the recent weakness as a buying opportunity which is always a challenge at the time however, we’re not resting on our laurels.

The recent mkt volatility highlights some big imbalances in the system which will come to bare in a more aggressive way at some stage in the future - we think this year, however the flush out that occurred in early Feb has most likely rattled the weak longs in the mkt for now. Perhaps we get a more stable mkt now with defensive yield investors buying more suitable assets like bonds, that are returning more palatable yields, while equity investors can focus on allocating capital into companies that will do well in this type of environment.

Anyway, one hot day certainly doesn’t make a summer, and we’re now putting our buyers hat in the cupboard and dusting off our ‘sellers get up’. We continue to think that 2018 will be a volatile year, however in that environment, buying in the face of extreme pessimism and selling when the mkt regains a level of comfort will be key. Doing exactly what the crowd isn’t, what feels totally uncomfortable may yield the best results this year.

Reporting continued to dominate today and collectively, the results were reasonably weak – yet the mkt still rallied. Today markets focussed on the macro, rather than the micro and stocks rallied. As suggested earlier, the material stocks did best, Fortescue (FMG) up an impressive 5.69% to close at $5.39 while BHP and RIO were both in a purple patch – adding 4.56% and 4.06% respectively.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

A v’short report this afternoon – we’ll make up for it tomorrow with better coverage of results.

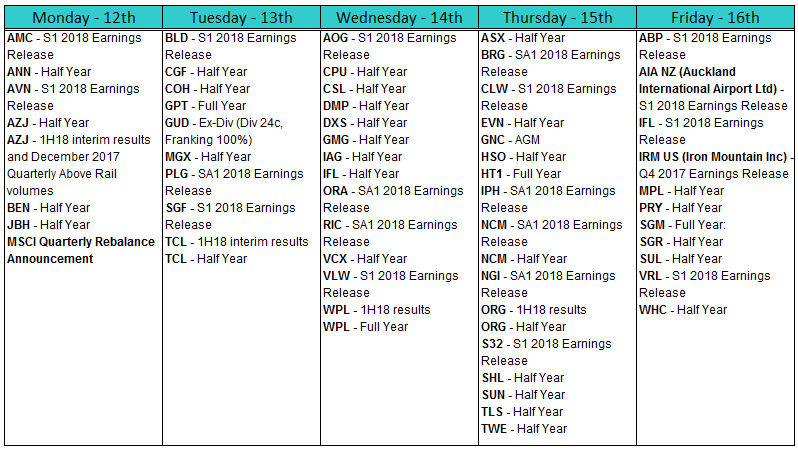

REPORTING THIS WEEK

OUR CALLS

No changes to the portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/02/2018. 4.56PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here