Markets whimper into the weekend…but a better week overall! (IFL)

WHAT MATTERED TODAY

A better week for the ASX with the mkt bouncing up despite a higher than expected inflation print coming from the US on Wednesday night – often the mkt stirs itself up into a worry about a particular event, but when it does, then as investors / traders we should be thinking about it from a different angle – I guess that’s the challenge at the moment, to think about things in counter consensus way! Thinking back to two weeks ago, the market was optimistic about the path ahead in 2018 – not a lot of airtime about the prospect of a 10% - short sharp correction for stocks. We have called a correction for some time – it hasn’t stopped us from investing but we’ve done so with caution, and now funnily enough, the headlines into the recent drop are around how ‘cautious’ everyone was before this happened. I’m not a naturally negative person, and I do jump on Sky Business from time to time…some recent clips below for those that are looking for something to watch since Married at First Sight is not on until Sunday….however it never ceases to amaze me how intelligent we all seem after the fact (tongue in cheek). I’m a cynic and it’s hard to change!!!

Anyway we go into the weekend with a better frame of mind, although the close today was weak and I’m pretty sure the volatility is not over yet!

My Tuesday Mornings SKY cross…CLICK HERE

My Wednesday Mornings SKY cross…CLICK HERE

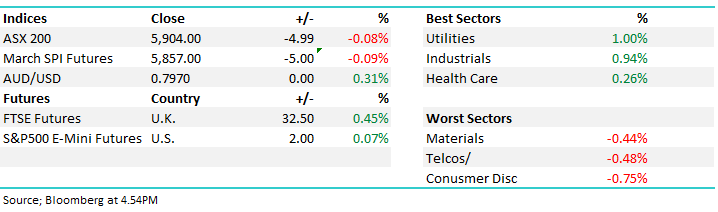

The ASX 200 was down -5pts today or -0.08% to close at 4924

ASX 200 Intra-Day Chart

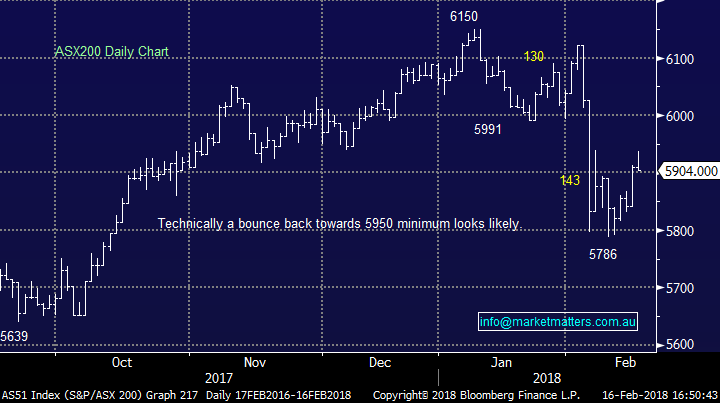

ASX 200 Daily Chart

CATCHING OUR EYE

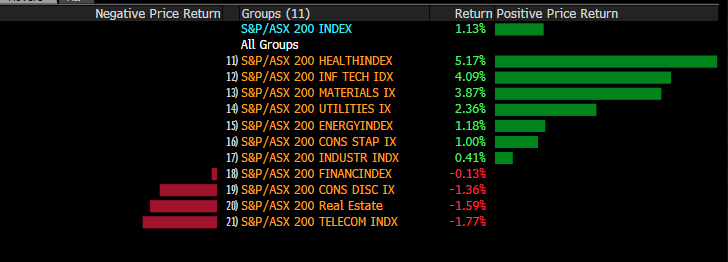

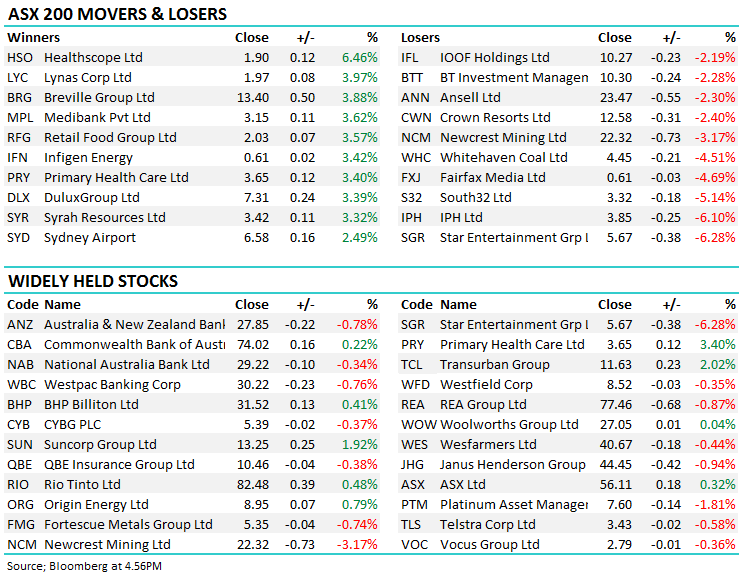

1. Market Performance; Looking at sectors over the past week, Healthcare stocks had a cracker courtesy of CSL’s strong result but it was those usual defensive names that struggled.

ASX sectors for week

Source; Bloomberg

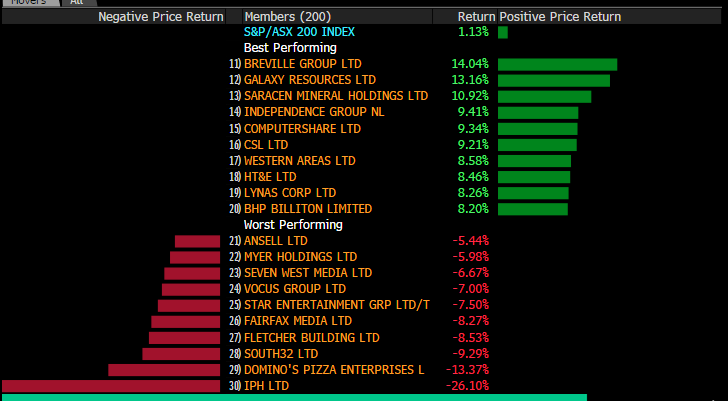

In terms of stocks, the most volatile company in the 200 (GXY) had a good week – the personification of risk on / off it seems while BHP also made the cut on the positive side of the ledger…

Source; Bloomberg

2. IOOF Holdings (IOF) $10.27 / -2.19%; A poor day of trade for IFL despite what I thought was a reasonable result. Here are my thoughts post the conference call….but without running numbers yet.

The top line was good which is to be expected given the expansion of the business, but still, it was good. It seemed the market was focussed on 2 things. Adviser departures and margins. The adviser departures are a negative, but not that surprising and there is a difference between adviser departures and funds departures. If you’ve got an old adviser network, as ANZ did (the business they bought) then change can be a big issue for them and someone thinking about retiring may bring it forward, however, a retiring adviser doesn’t take FUM, they pass it on internally. The margin compression is more a concern but it is a trait across the industry – we’re certainly experiencing it. (que the tissues!) Cost cutting was ok but there is only so long costs can be cut, and if we have a theme of okay top line growth, but deteriorating margins at a time when costs are coming out, what will happen when there are no more costs to cut? Organic growth was also low.

All up – a decent result in terms of the headline numbers but the underlying composition was a tad weak. They did good on the conference call about allaying mkt fears associated with the ANZ acquisition...We own it in the Growth Portfolio

IOOF Daily Chart

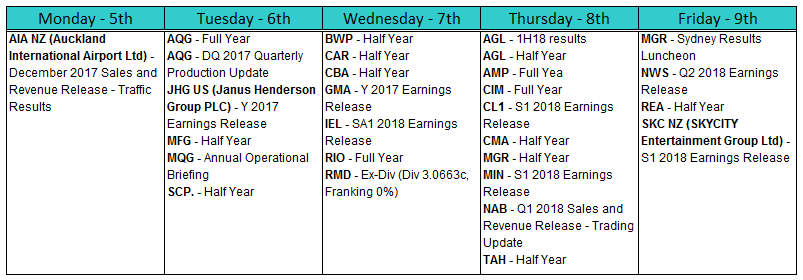

REPORTING THIS WEEK

OUR CALLS

No changes to the portfolio today…

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/02/2017. 4.56PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here