Markets start the week on the front foot (WPL, IVC, SEK, BXB)

WHAT MATTERED TODAY

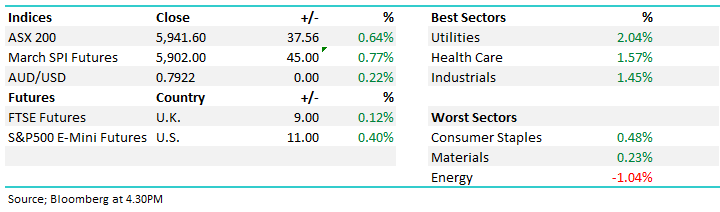

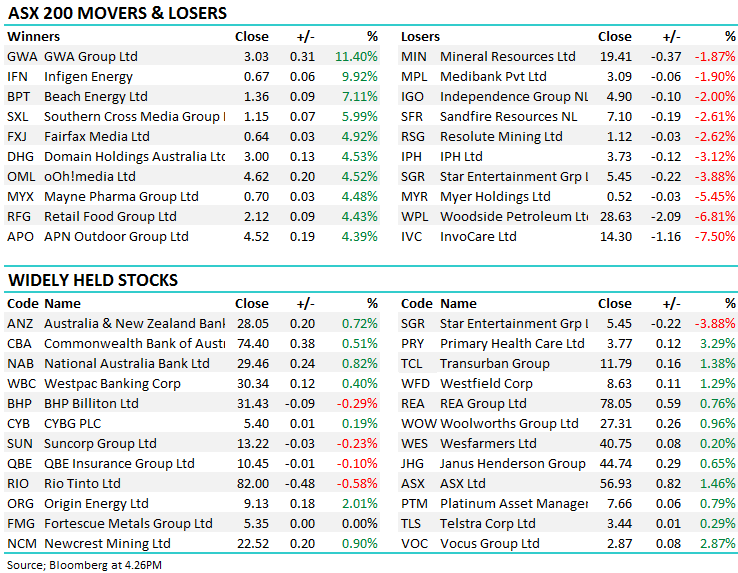

Reporting dominated the market today with some reasonably big ranges for those companies out with results. Overall the market was weak on open, largely a result of selling amongst the resource plays while the banks bucked their recent trend and provided good support – the mkt rallying well from the 10.30am low this morning, closing near its highs – up 37pts or +0.64% to close at 5941. The typical defensive style sectors did best, Utilities & Healthcare while the energy stocks were hit after Woodside came back online post their massive $2.5bn capital raise – the stock declined by 6.81% to close at $28.63 – a poor result – more on that later.

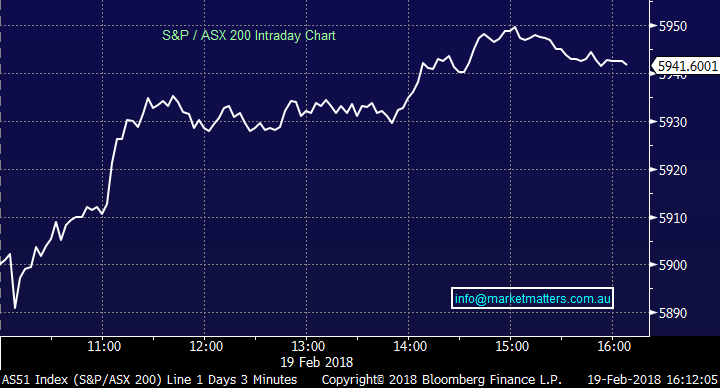

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

1. Woodisde Petroleum (WPL) $28.63 /-6.85%; 90% of institutional shareholders took up their entitlement under the current offer at $27 a share on a 1 for 9 basis, leaving a shortfall which was auctioned off - with a settlement price of $29.60, a premium of A$2.60 to the offer price of A$27.00 per share, and a discount of 1.7% to the theoretical dividend adjusted ex-rights price ("TERP") of A$30.11 per share. I would have thought the shares would do better today however there was obvious selling to fund new stock being issued at $27.00.

As a retail shareholder, a few key aspects to consider; The renounceable rights have commenced trading today under code WPLR. A holder can elect to take them up, sell them on market before the 28th Feb, or if no action taken, they go into a book and the proceeds flow back to holders. The settlement of the Retail Entitlement Offer is the 15 March 2018. We’ll keep you posted on what we intend to do with our holding before the cut-off date.

Woodside Daily Chart

2. Seek (SEK) $20.50 /1.94%; Reported a 1H result that was in line with expectations however they increased guidance which the market liked. All metrics were strong for SEK with revenue growth of +26%, EBITDA growth +20% - NPAT at 103m which was inline. In terms of guidance, they reaffirmed revenue growth of 20-25% but importantly, they expect EBITDA growth of 14-15% which is an upgrade from 12%. All up a good result, the only slight issue was around higher than expected cost growth.

Seek Daily Chart

3. InvoCare $14.30 / -7.5%; the funeral provider was hit hard today after reporting decent full year numbers (in line with expectations) however they downgraded guidance to “low single digit 2018 operating EBITDA,” mostly subdued due to some sites being refurbished during the year - obviously a disappointing growth outlook as the market was looking for a ~8% through 2018.

IVC has done a good job of increasing margins but it seems to have come at the expense of market share which fell over 2017. As grim as it sounds, IVC is in a market we like, as the population ages there will be natural growth in the business model. The push for IVC to pre-sell funerals also holds risk as inflation between sale and delivery (of the body) will impact margins. However, now over 20% below it’s all time high set in November last year, IVC is beginning to look interesting here.

Invocare Daily Chart

4. Brambles (BXB) $9.74 / 1.14%; The market took the result poorly in the first instance, however the company did a good job of talking things up on the conference call – and the stock rallied from the lows. Revenue was $2.75bn with the market expecting $2.8bn, in constant currency terms, growth was c5% which was inline - importantly, the Nth American CHEP business returned to volume growth (around +2%) and the emerging mkts division was good . Anyway, we’re not a big fan of BXB at current levels – not a lot to get excited about but a reasonable result nonetheless.

Brambles Daily Chart

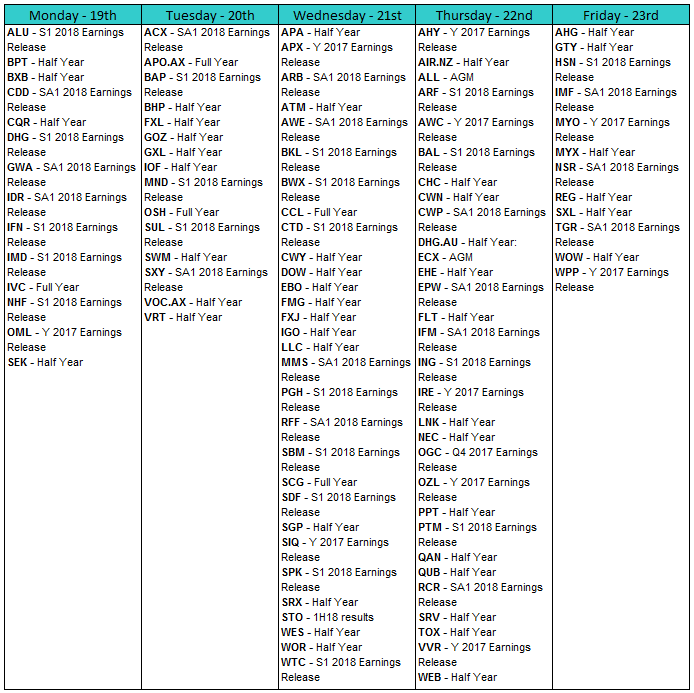

REPORTING THIS WEEK

A big week in terms of reporting – stocks in our portfolio include; FMG, BHP, AWC, OZL, PPT, WEB all out with results. I’m also pretty keen to see IGO, LLC, PPT, and Woolies.

Last week, we had a slight skew of beats to misses in terms of earnings, 8 to 6 in the larger cap space, while more of them beat v missed in terms of the dividend. Aggregate growth expectations for FY18 have fallen from 8.4% to 6.8%, largely driven by CBA which missed given AUSTRAC provisioning. All up, reporting is doing OK with a few decent results out today to kick off this parade…

OUR CALLS

No amendments today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/02/2017. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here