ASX back up above 6000pts (WOW, EHE, REG)

WHAT MATTERED TODAY

A strong end to a fairly optimistic week for Aussie stocks outpacing their global rivals….putting on +1.54% for the 5 days – trading above, but just closing a whisker below the 6000 mark (a 5999.8 close for the ASX 200!!!) The market has now put on 214pts or +3.7% from the intra-day low of 5786 on the 9th Feb and the buyers are well and truly back into the fray. We’ve outlined our ‘short term’ bullish stance into the seasonally strong April/May period and to date that’s playing our nicely, and today the market teased with the 6000 mark. A break over this mark on Monday should bring in a move towards ~6250 before we should be conscious of getting off the equity train…

For the week, CSL led the healthcare sector higher after a massive result, Woodside put the kibosh on the energy stocks following their cap raise while there was some big underlying moves in companies that reported results….Overall a very big week on the desk, more so in terms of analysis than action however that’s largely because we’re content with our current positioning.

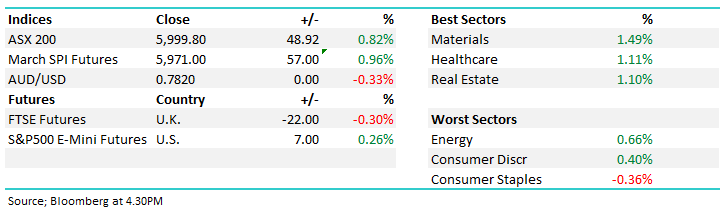

On the market today, the ASX 200 followed a decent overseas lead rallying +49pts or 0.82% to close at 5999.8!!! For those glass half full types, you’d call that a close of 6000.

ASX 200 Intra-Day Chart (@3.55pm)

ASX 200 Daily Chart (@3.56pm)

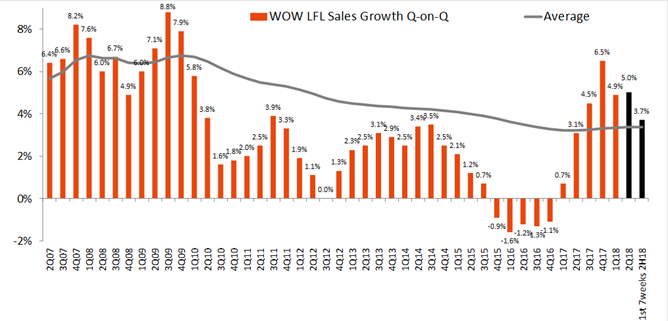

CATCHING OUR EYE

1. Woolworths (WOW) $26.92 / -2.60%; A decent result however trends are easing for the supermarkets division… LFL sales growth in 2Q18 a strong 5.0% (market expectations of 4.0% to 4.5%) – taking 1H18 LFL number to 4.9% (1Q 4.9%, 2Q 5.0%). Very good result. EBIT margins in Supermarkets also strong: +26bp to 4.7%. However slowdown in train evident in 1st 7 weeks of 2H18 with LFL sales +3.7%. BIG W showing green shoots but still early days yet with sales +1%, EBITDA +122% (off a low base) to $29m. NPAT +15% on pcp however that was below the market expectations hence the sell off in the stock. We have no real interest in Woolies at current levels.

Source; Shaw and Partners

Woolworths (WOW) Daily Chart

2. Regis Health (REG) $4.12 / +8.42%; two of the aged care stocks reported and they were both good. Regis, arguably the highest quality operator in the listed sector was slightly above mkt expectations however the commentary was better and the stock rallied nicely. Estia (EHE) was also strong adding +4.42% to close at $3.54. They reported a 1H18 NPAT of $20.3m, with an underlying NPAT of $23.5m. Re-affirmed guidance of mid-single digit EBITDA growth YoY. The aspect the mkt liked was around their balance sheet capability if further govt regulations impact the sector. EHE has capacity to make acquisitions if / when the Govt changes the funding model, putting massive pressure on the smaller players and creating opportunity for the larger operators.

Estia (EHE) Daily Chart

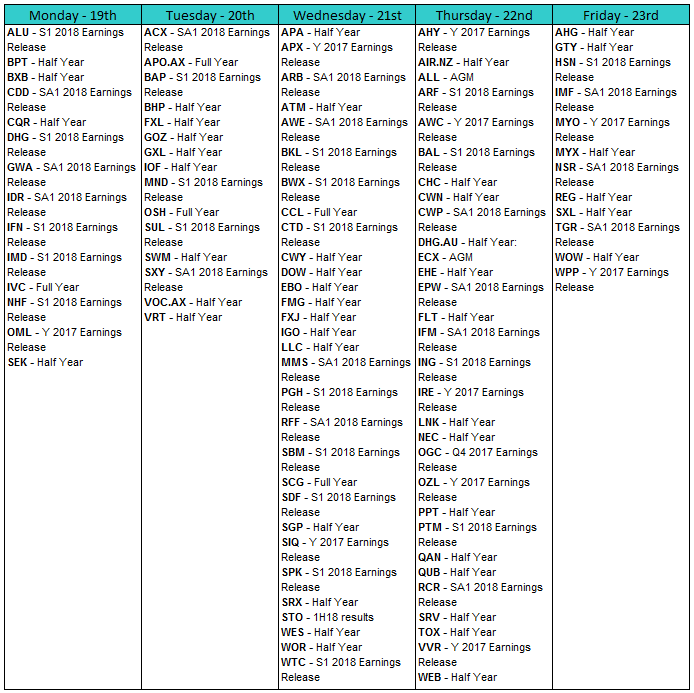

REPORTING THIS WEEK

OUR CALLS

No changes to the portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/02/2017. 4.30PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here