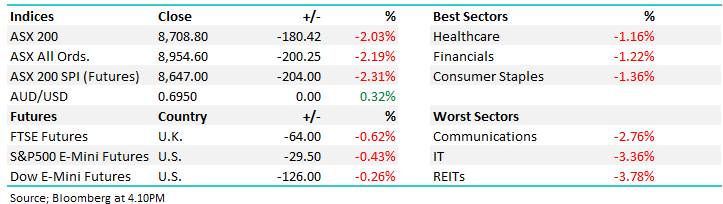

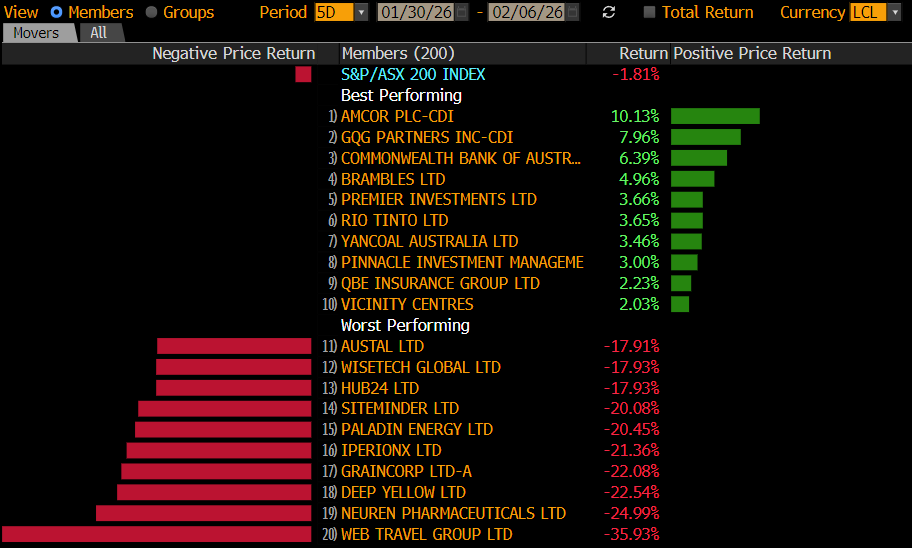

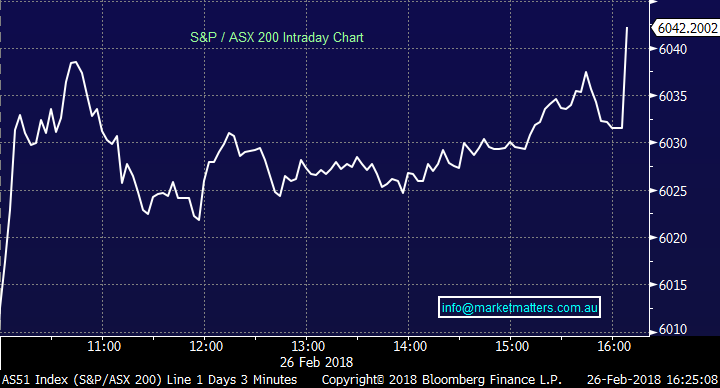

Banks get their mojo back (QBE, BSL, SIV, GEM)

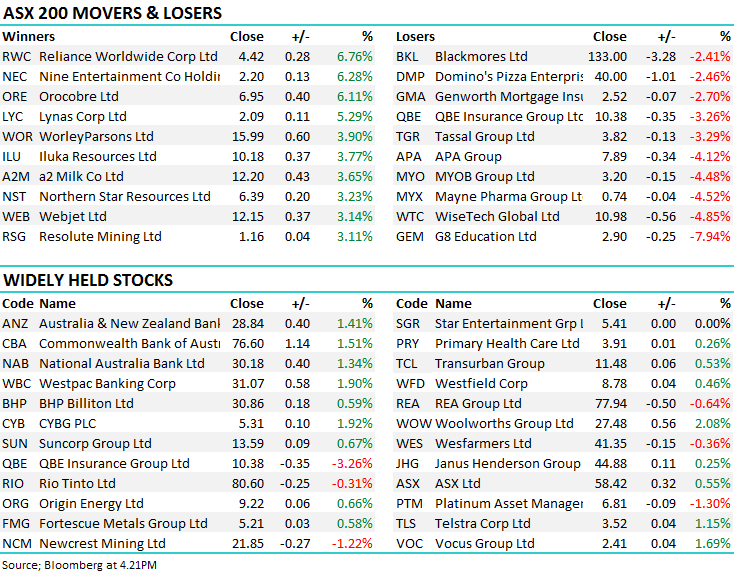

There was actually a lot on the radar today despite reporting season cooling down this week - another couple of days and we’ll be done. All up it’s been good, more upgrades than downgrades and better outlooks in aggregate. A ‘tick’ thus far. QBE was out with results which is a stock we own and they fell -3.26% - another ‘difficult’ update from QBE despite ripping the band aid off late in January with some big write-downs (non-cash). It seems that with every announcement they make it becomes harder to keep the faith with this company - it’s sort of like a child that shows so much promise but just stumbles – drops the ball right at the wrong moment! More on their result later.

On the flipside, some decent buying in the Lithium space today with our position in Kidman Resources (+4.55%) starting to look good while Iluka (ILU) was also strong adding +3.77% - our two best performers in the resource space, while Webjet continued to cop some buying after a very good update last week, adding another 3.14% to close at $12.15. We own from $9.54.

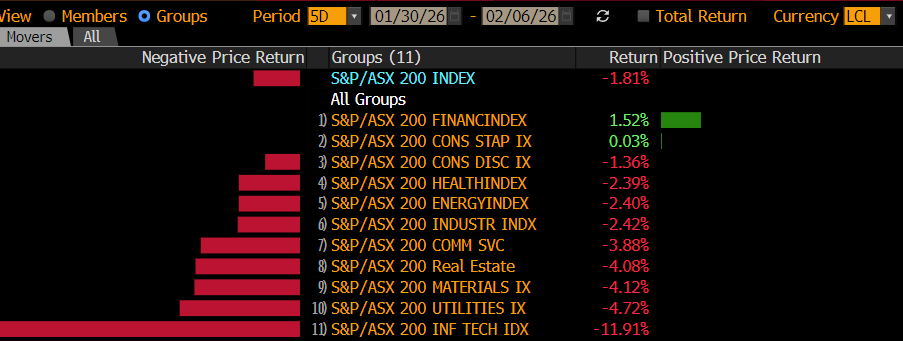

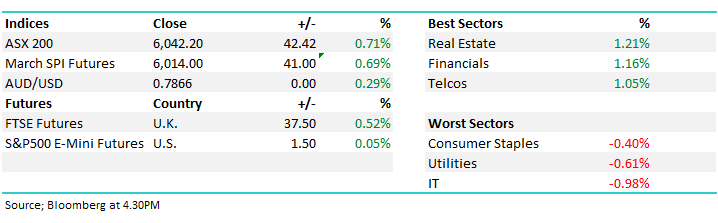

The banks are such an influential component of our market and today they found form with the big 4 contributing half the gains on the ASX 200 (+20 index points for the big 4)…which is nice and fits into our thinking around seasonality leading into April / May high. We published the seasonality chart for the sector this morning – and again here highlighting our bullish stance on the banks which started to play out last week and again on the market today. Westpac was particularly strong adding +1.90% today to close at $31.07 while the rest of the majors were up more than ~1.30% - a good result in a market that traded strongly up through the 6000 market to close at 6042 – up +42pts or 0.71%.

Australian Banking Sector Seasonality

In the Weekend Report we flagged our expectation that banks would start to outperform their resource cousins, highlighting a BUY NAB & SELL BHP trade on the belief that NAB will outperform BHP in absolute terms over the next 2-months.

· In early 2016 NAB was trading about $9 above BHP, today we’ve seen an almost $10 transformation with BHP almost $1 above NAB.

· NAB / Australian Banks usually surge in March / April while BHP advances slowly, its switch time for those traders out there

Today that trade put on 0.75% as NAB outpaced the move higher in BHP.

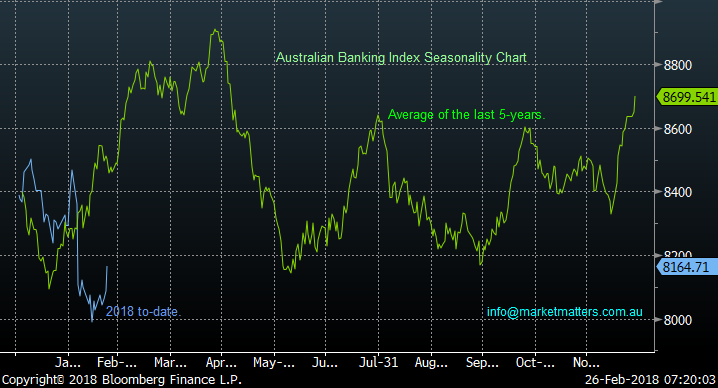

Looking at the intra-chart of the ASX 200 today showing strong buying into the close – there was a big line down on the match in the FUTURES / 2k lots which made for a very strong close which is good sign of underlying strength. I’ve had many conversations over the past week or so about the mkt drop we’ve just seen, and our positioning towards it ~20% cash going in – very little coming out of it meaning that we’re now more or less fully committed to stocks - looking for selling opportunities rather than buying opportunities. In short, the punch through 6000 is bullish technically and now targets ~6250 as a minimum, or ~3.5% higher. Easy to see that happening if the banks continue to cop a bid and the resources tread water at least…

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

QBE Insurance $10.35 / -3.26%; A stock that simply continues to test ones patience even though they pre-released numbers in January. In short, the result was a messy one and the dividend of 4cps was the main miss in terms of market expectations – however, they are starting to walk their talk. The main issue for QBE over the years has been their inability to predict with any certainty likely earnings – it’s a big business with many moving parts. Pat Regan (CEO) is now simplifying the business and the announcement today around the sale of their Latin American operation I thought was supportive of that direction. In terms of the numbers today, they were mostly known so that wasn’t the issue – it’s seems the market was of the opinion at the last update in January they may have been downplaying things – which unfortunately they weren’t. There are 2 main things that drive QBE earnings; Underwriting results and Investment returns, and both of these aspects have an improving outlook. In terms of trade today, they actually opened well in the morning, trading as high as $10.91, only to fade and close lower.

QBE Insurance

Bluescope Steel (BSL) $15.84 / 2.26%; A good set of numbers from BSL today, marginally exceeding their upgraded guidance set in December of last year – exactly what you need to do when you’ve enjoyed such a strong run in share price. They were saying underlying EBIT of $460m and delivered ~$480m today plus their guidance was good. That said, it’s very hard to get excited about BSL here.

Bluescope Steel (BSL)

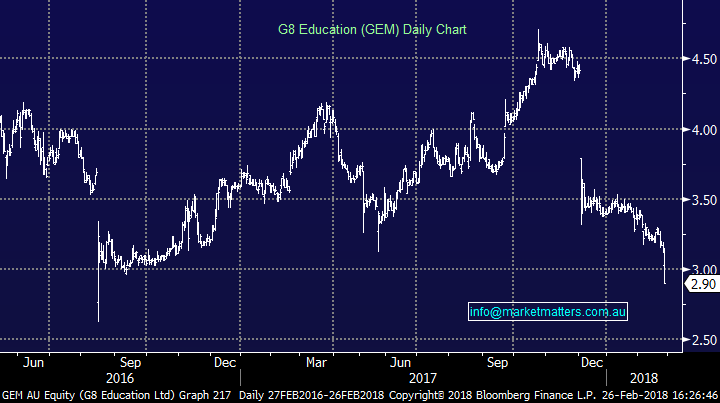

G8 Education (GEM) $2.90 / -7.94%; whacked today and this is a stock we discussed as a potential income play a few months ago but on further analysis, gave it a wide birth. They missed on most metrics and the very poor recent run for the early childhood company continued. The main issue today was not the miss in terms of profit (underlying of $93m v $100m exp) but occupancy which is still weak suggesting no real turnaround / improvement in the offing. There will be a time to buy this one, but just not yet.

G8 Education

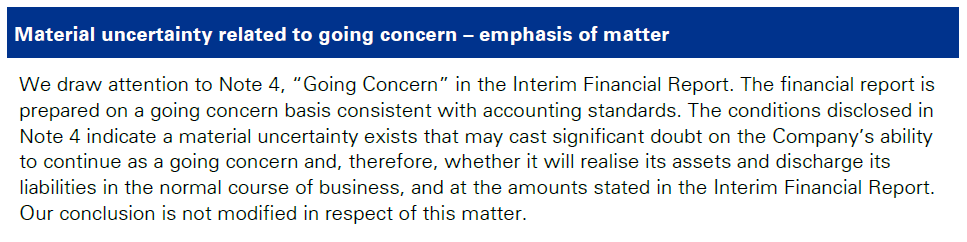

Silver Chef (SIV) $4.78 / -28.34%; is another one to keep an eye on after they reported results, announced some questionable restructuring, declared that they had breached lending covenants (but had secured a waiver in December) while their Auditor showed very little confidence in their books. We’re not followers of this stock however it’s never good when KPMG includes the below discloser. Silver Chef shares fell -28.34% today to close at $4.78. This one has a smell about it!!

Silver Chef (SIV)

OUR CALLS

No changes to the portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here . Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/02/2018. 5.15PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here