Iluka reports strong numbers (ILU, CTX)

WHAT MATTERED TODAY

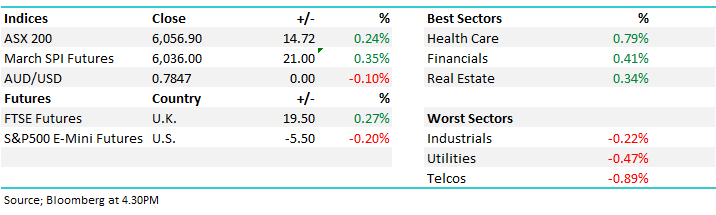

The ASX opened with a bang this morning but finished with a whimper as sellers took control from around lunchtime onwards. Perhaps it’s the looming testimony tonight from the new Fed Chair Jerome Powell who will provide testimony to the House Financial Services Committee in Washington – the market is still fresh with ‘rate hike’ concerns and if Powell is more optimistic on the US economy and thus interest rates than current positioning suggests, focus could easily turn to higher rates, and lower equities. We doubt that will happen and Powell will maintain a steady approach however it’s clearly in the back of our minds. The ASX has now experienced a rally of +297pts / +5% from the Feb 9 low to today’s morning high and we’d now be expecting a period of consolidation following a fairly positive / hectic reporting season, before a push to our ~6300 target.

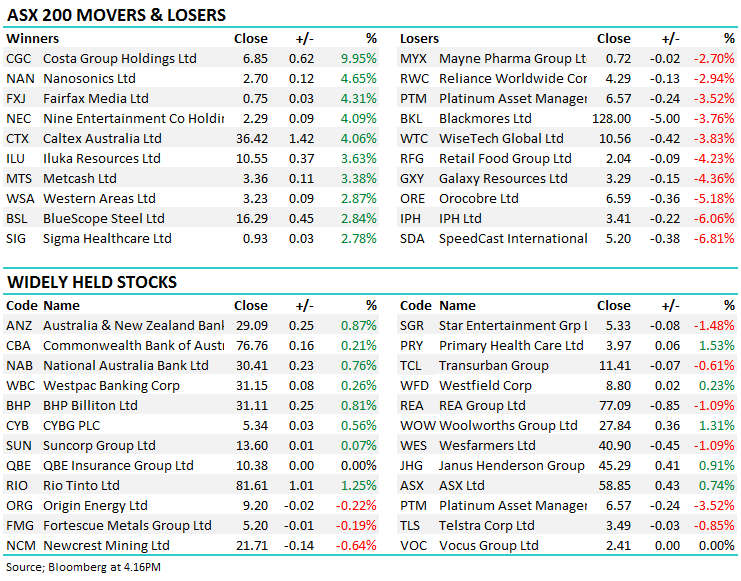

Overall today, banks were again the backbone of buying although they traded off their earlier highs…ANZ and NAB two of the best. The material space was good with a standout performance from Iluka (ILU) / +3.63% to $10.55 after they delivered a strong set of FY17 results. We owned this stock and sold into the morning strength at $10.79. Elsewhere, Fortescue saw the best of it early courtesy of Iron Ore strength overnight, however a ~1.50% drop in Asia during our session was enough to rejuvenate the sellers and the stock closed down 1c at $5.20 after being as high as $5.33 early on.

The ASX 200 closed up +14pts or 0.24% today, around 27pts from the early high. A 6056 close. **Note, Alumina (AWC), a position we hold traded ex-dividend today for US 9.3cps or around A11.5cps**

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

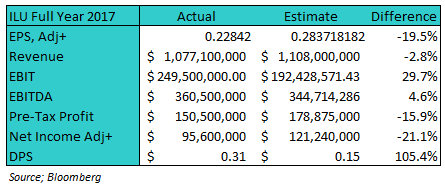

1. Iluka Resources (ILU) $10.55 / 3.63%; A very good FY result today and the stock is clearly kicking goals internally supported by a backdrop of improving external demand / commodity price tail winds for mineral sands…They had the best earnings (EBITDA) since 2012 and their dividend blew expectations out of the park. Net profit was down and below expectations on the headline number however there were one-offs / write-downs in there that are non-recurring. All up, the numbers below probably don’t tell the full story, but they’re strong in the areas that count + importantly they guided well for 2018 onwards…That said, the stock rallied hard yesterday and again this morning on the result and simply, we saw the opportunity to take a nice ~17% profit. We sold into the morning strength within our Growth Portfolio however this is a stock still firmly on the radar.

Iluka (ILU) Chart

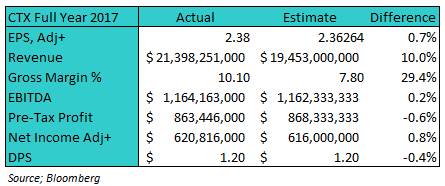

2. Caltex (CTX) $36.42 / +4.02%; A solid set of numbers from CTX today with a slight beat across most metrics particularly in terms of top line revenue. Gross margins were higher but that sample size was one analyst so take that with a grain of salt! A number of things going on at CTX at the moment in terms of their strategic direction which they will soon make decisions on, mostly around how they hold assets – whether or not they spin out the property assets into a separate vehicle + a few other things.

The numbers here – pretty much all in line with expectations.

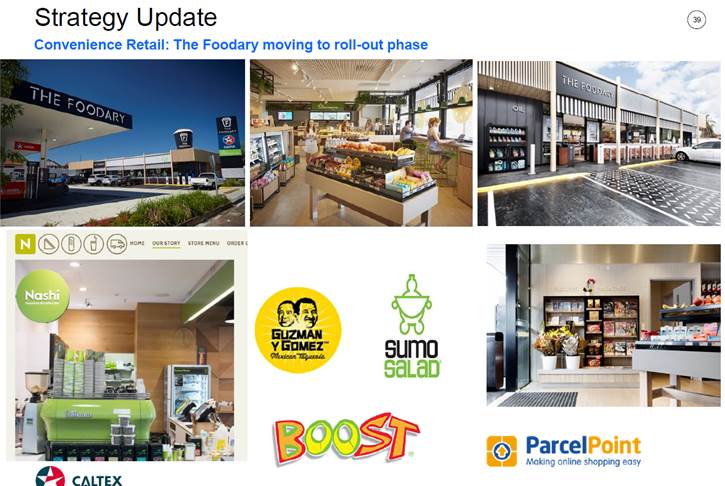

One interesting aspect is around their Foodary roll out which provides a different experience to fuel / product retailing as they team up with well-known brands – making the ‘servo’ more a destination / hub. Some quick samples below which are part of their pilot program.

Caltex Daily Chart

OUR CALLS

We sold Iluka (ILU) this morning from the MM Growth Portfolio locking in a nice ~17% profit.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/02/2018. 5.15PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here