The ‘Trump Slump’ continued today (SEK, RFG)

WHAT MATTERED TODAY

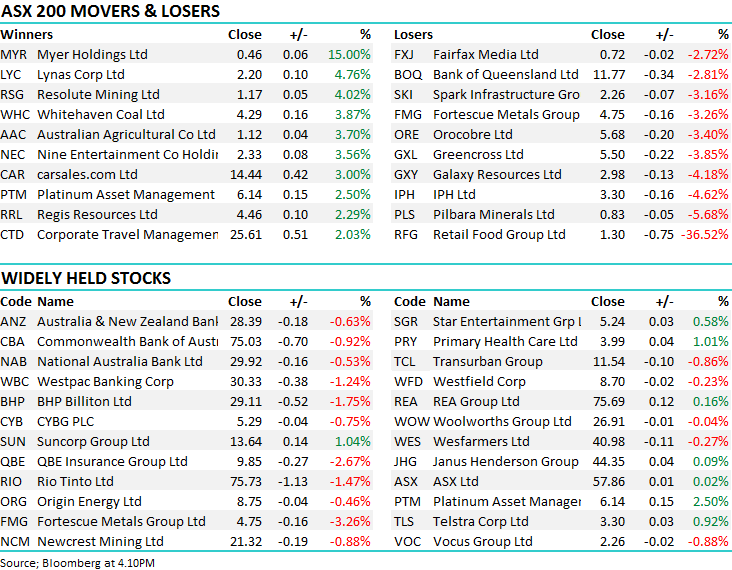

A pretty soft session really for Aussie stocks tracking Asian markets + US Futures lower throughout the day – a void of any buyers and the mkt simply sold into an rallies with sellers dominating in aggregate. It seems buyers are on the sidelines awaiting more info on 1. American tariffs and the next Trump Tweet and 2. The Italian election + it’s a massive week on the global data front with the headline act being Friday's US payrolls print with the market having shown its extreme sensitivity to wages data in early Feb! US Futures were off around 0.5% in our time frame and that saw us simply track them lower throughout the day.

Overall, the S&P/ASX 200 Index finished 33 points lower to 5,895 points - a drop of 0.57%. Most weakness amongst the utilities stocks while the Telcos has a rare day in the sun with Telstra actually up +0.92%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATHCING OUR EYE

1. Aussie Earnings Season; We’ll stop harping on about earnings season soon given it’s now done and dusted however there was a good article across my Bloomberg screen today that is worth cherry picking for some interesting stats…

- Bloomberg; The number of sell recommendations as a percentage of total ratings, fell to 18 percent on Feb. 28, the lowest since May 2016. That’s down from 20 percent when reporting season kicked off Jan. 29. MM; That suggests to me that the market / analysts are now the most bullish they have been in the last couple of years which is a concern.

- Bloomberg; Of the 118 companies on Australia’s benchmark index that reported a surprise this season, about 58 percent were positive, led by industrials and financials, according to data compiled by Bloomberg. Investors also reaped the benefit of improved payouts, as forecast by Bloomberg last month, with 32 positive dividend surprises outnumbering the 24 negative distribution results, according to Macquarie Group Ltd. One exception on the earnings front was Australia’s mining industry, which is led by BHP Billiton Ltd., the world’s biggest. The sector “dominated some of the largest misses, disappointing on cost performance in particular,” Macquarie analysts said in a Feb. 27 note. MM; So the macro backdrop is reasonable for commodities however there are some clear headwinds in the offing . Costs are clearly now rising and if we get a situation where global growth expectations taper off on ‘trade war concerns’ and the outlook for US inflation ticks up – which is a clear bi-product of protectionism (US prices go up, wages go up, taxes go up), which theatrically should see higher rates and a higher $US which is obviously a negative for commodities – some clouds building on the horizon.

- Bloomberg; 22 companies posted moves greater than 10 percent in a single session after reporting earnings. Excluding moves spurred by takeover offers, 14 firms saw increases of 10 percent or more, while eight had a similar decline. MM; We know volatility is here (clearly) and we expect more of it even outside of earnings season.

- Bloomberg; The health-care sector posted the biggest increase in price targets over the period, rising an average 5.1 percent. Consumer staples clocked the next biggest advance while utilities had the biggest decrease. A2 Milk Ltd. won the biggest increase in price target from analysts -- 55 percent to A$4.78 -- after it posted a twofold increase in first-half profit and a partnership with New Zealand’s Fonterra Cooperative Group Ltd. On the opposite end, IPH Ltd.’s price target was slashed 21 percent to A$4.55 amid a decline in intellectual property filings. MM; Healthcare surprised us after such a significant move higher in recent years. CSL, Resmed and Sirtex the stars. Utilities as expected were weak. A2 simply had a cracking result!

…Reporting season now over!

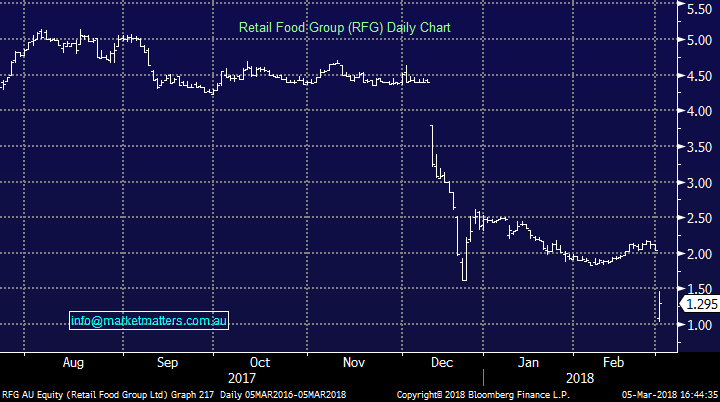

2. Retail Food Group (RFG) $1.295 /-36.52%; What a disaster this has been in the last few months with the stock plummeting from ~$4.50 to $1.295 today and the company is now closing at least 10 stores, they announced a massive write-down of goodwill, has an army of unhappy Franchisee’s and the potential for some unhappy bankers too which is probably more of a concern with debt of $260m. This is now a deep value play but with absolutely no certainty on where it might end up…As means of a refresh, they own Michel's Patisseries, Donut King, Gloria Jeans, Crust Pizza and Brumbies Bakeries amongst others and simply this is too risky to do anything with – best to avoid given debt + it seems the earnings model is also broken.

Retail Food Group (RFG) Chart

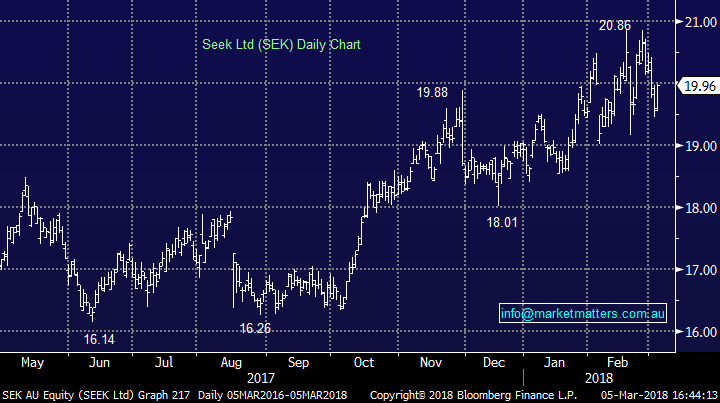

3. Seek Ltd (SEK) $19.96 / +1.89%; announced today that they will acquire the final 13.75% of SEEK Asia from News Corp, funding the transaction from existing debt. The move is clearly a long term push to divest away from the Australia & New Zealand business that has been performing so strongly. Although the transaction will be accretive to earnings after FY18 net of interest, the move does not come without it’s risks. The Asian job industry is becoming increasingly competitive, and while we can see a significant uplift in volume similar to what has helped the ANZ business perform outstandingly, the intense competition in the Asian market will pose risks to margins in the future. Alongside this, it is increasingly likely that the peak of job ads in Australia and NZ is near, if it hasn’t come already (Aus saw a -0.3% decline in job advertisements MoM according to data released today). On these metrics, it would be hard to justify any positions in Seek at these levels, now trading on FY19 PE of ~30x.

Seek (SEK) Chart

OUR CALLS

No trades on the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/03/2018. 5.15PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here