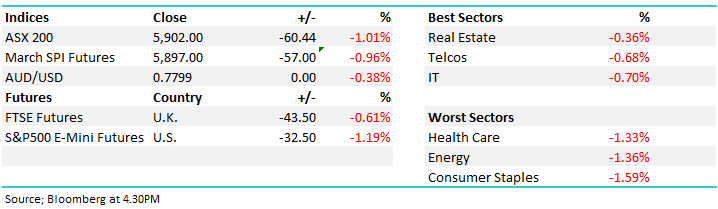

Trump’s loses economic guru – stocks drop 1% (CBA)

WHAT MATTERED TODAY

Yesterday afternoon we wrote…What Trump Slump? Markets regain their mojo – however the red across the tape today clearly shows that said mojo has come and gone pretty quickly. All was looking reasonable for a good day today, futures were slightly higher, a major broker has upgraded CBA and a weaker $US had prompted some buying in the material stocks overnight, however the resignation of Gary Cohn, Trumps Economic Adviser sent US Futures sharply lower and we followed suit. That suggests the market's knee-jerk interpretation of Gary Cohn's resignation is that neither he, nor anyone else, was able to convince Trump that unfocused tariffs on steel and aluminium imports are a bad idea. The follow-up headline saying the U.S. is considering broad curbs on Chinese imports and takeovers will add to concerns the apparent easing of trade tensions on Tuesday was a mirage.

From an investment standpoint, there is now the obvious struggle in determining whether or not Trump is more interested in U.S. stocks escaping their recent volatility and returning to record highs, or levelling what Trump has long considered an uneven playing field for global trade. Cohn's resignation suggests the president's priorities may have shifted decisively from the former to the latter.

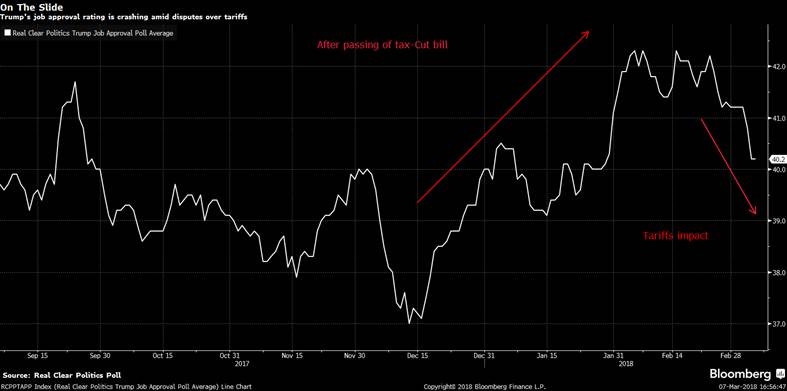

Interesting to see Trumps approval ratings are now on the slide – he’d hate that I would have thought!!!

That interpretation of Cohn’s resignation will get tested tonight in the states with US Futures trading down -1.25% at time of writing pricing a negative start at least, while Asian markets were also weaker today, but not by as much. Our market was sold off early, bounced up around midday then tracked lower into the close. It seemed no one wanted to go home long today!

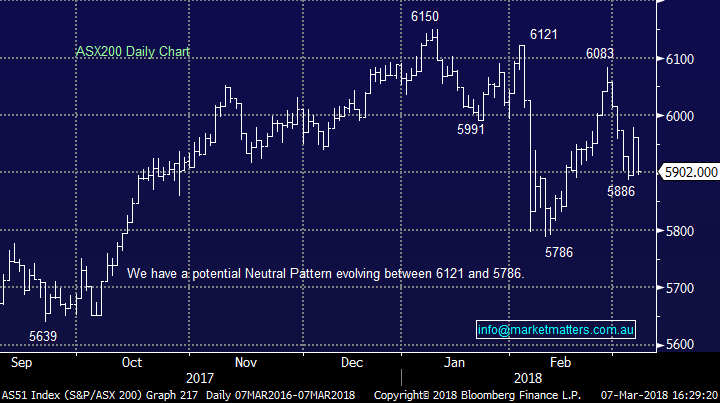

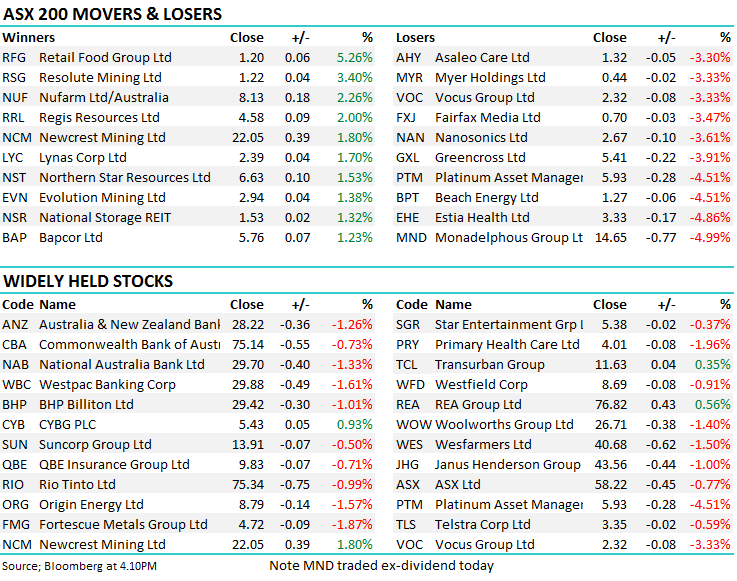

Overall, the S&P/ASX 200 Index finished -60 points lower giving back most of yesterday’s gains – this index now at 5902 points - a drop of -1.01% - red right across the sector landscape today!

ASX 200 Chart

ASX 200 Chart

CATHCING OUR EYE

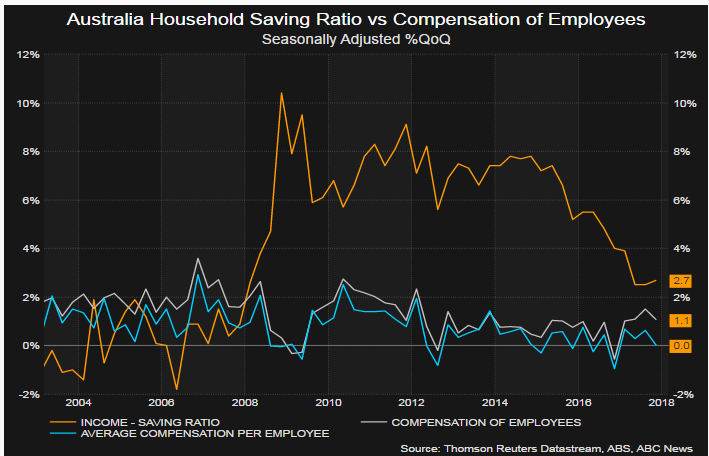

1. Aussie GDP; Was out today and missed expectations for Q4 however there was some upward revisions on prior numbers which helped to offset the miss. The main issue was around non-dwelling construction , so the building of stuff that you don’t live in which took 0.5% off the GDP number. All in all, Real GDP rose 0.4pc over the quarter, but stepped down 2.4pc over the year, well below the long-term average of closer to 2.9pc. A rise in consumer spending helped offset a drag of net exports and slowing construction.

Total wage growth over the quarter rose 1.1pc, reflecting strong jobs growth, while average earnings flat lined.

This is a good chart highlighting household savings (orange line) versus movement in wages

2. Commonwealth Bank (CBA) $75.14 / -0.73%; Was weaker today however outperformed the banks after Bank of America raised it to a buy. He reckons that the ~7% underperformance to peers NAB and ANZ since June last year is too much and concerns around a potential money laundering case are now reflected in the price. They now have the most bullish call on the street with a PT of $87.50. In terms of the wider sector, they share our view saying that the Australian banking sector is closer to oversold than overbought!! That sounds a bit ‘grey’ but that’s about as high conviction in terms of language you’re ever likely to get.

Commonwealth Bank (CBA) Chart

OUR CALLS

No trades on the MM Portfolios today.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/03/2018. 5.15PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here