Trump Takes Aim – China Retaliates – Stocks Drop (ORE)

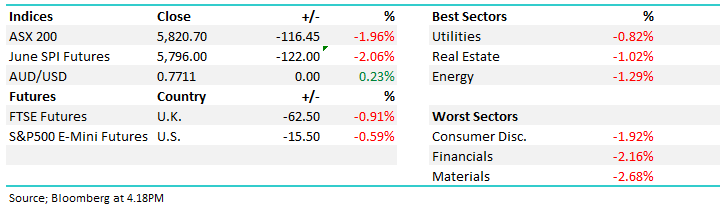

WHAT MATTERED TODAY

Unfortunately today can only be described as extremely ugly as we witnessed the potential start of a damaging trade war:

Round 1 – Trump plans to levy $US60bn worth of tariffs against China which resulted in the Dow plunging 724-points overnight.

Round 2 – China counters by slapping tariffs on over 120 US products including pork and wine.

This is poor news on a global level with no clear winners when the 2 superpowers start playing Russian roulette with our short-term economic future. In the scheme of things the olive branch of exemptions that the US offered Australia and the EU around 2pm is irrelevant when China and the US are going head to head – they account for such a meaningful proportion of global economic trade and any disruption / uncertainty that prevails will clearly hurt. Jerome Powell (Fed Chair) mentioned the risks to economic growth that would be created by a trade war earlier in the week when outlining the Feds thoughts around their recent rate hike – suddenly a few hours later markets are talking about potential rate cuts – that’s called market volatility!

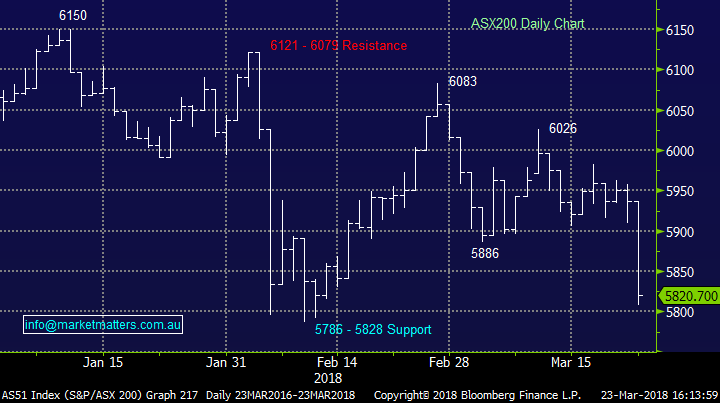

The ASX200 was ‘only ‘down ~80-points prior to the China counter but as the news crossed our Bloomberg screens we saw another -40-points in a matter of minutes, following US futures down around 1% and suddenly nobody was talking bargain hunting! The market is still above the lows we saw in February but a close back above 5900 is now required to become vaguely bullish from a technical perspective.

So after the initial sell off the market tried to pull itself out of its rut – but if you blinked you missed it – then China was out and the market slid lower for much of the day. By the close, the ASX 200 had lost -116pts or -1.96% to close at 5820 – which was a better effort than the combined US drop overnight (-2.52%) and the decline in US Futures today (-0.62%) – so we outperformed, but that’s little consolation.

ASX 200 Chart

ASX 200 Chart

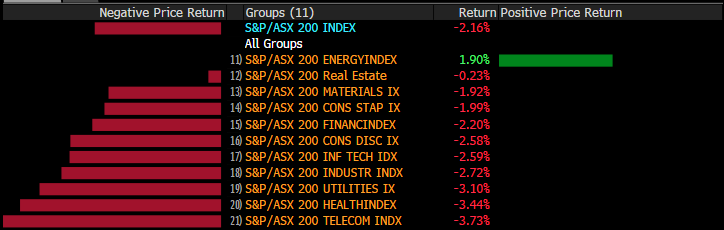

WEEKLY PERFORMANCES – ASX 200 & SECTORS

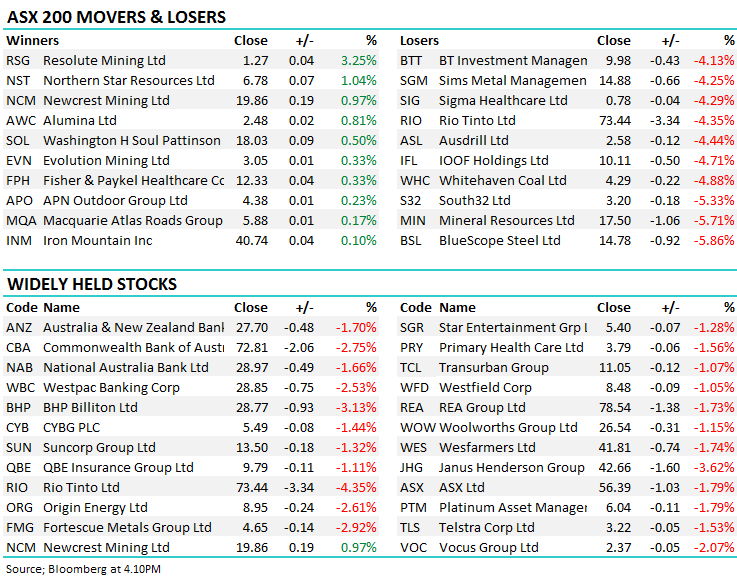

The oil sector was the best on ground for the week + it outperformed today with Woodside (WPL) only down -0.34% compared to BHP -3.13% and RIO -4.35%. With the exception of a little doomsday buying in the gold sector there was little to focus on with a positive bent – the path of most pain would probably be a 1% gap up on Monday but that assumes Trump is quiet tonight, a big ask at present.

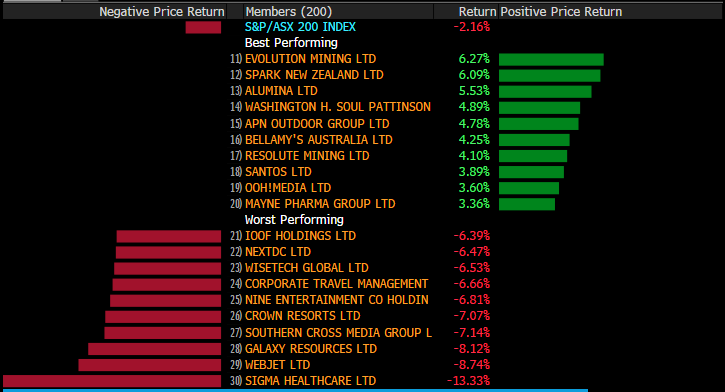

WEEKLY PERFORMANCES – ASX 200 & STOCKS

On a stock level there was very little green although our holding in Alumina maintained its bullish rally for the week + again today adding another 0.81%, a good result in such a weak market.

OUR CALLS

We followed through with our planned purchase of Orocobre (ORE) today around $5.80 – the stock closed at $5.83

Orocobre (ORE) Chart

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here . Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/03/2018. 4.40PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here