Broker moves in focus today (GEM, STO)

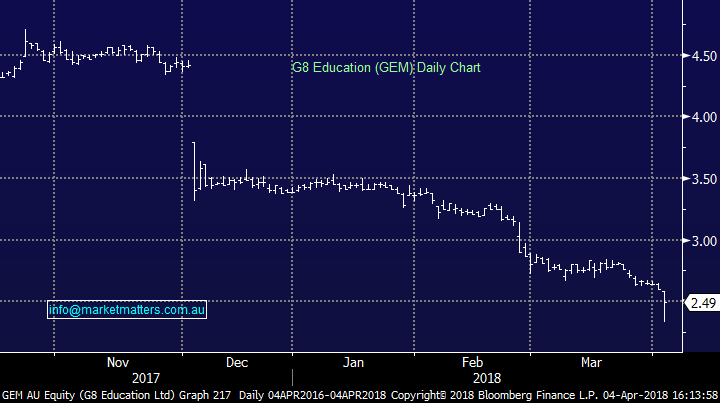

WHAT MATTERED TODAY

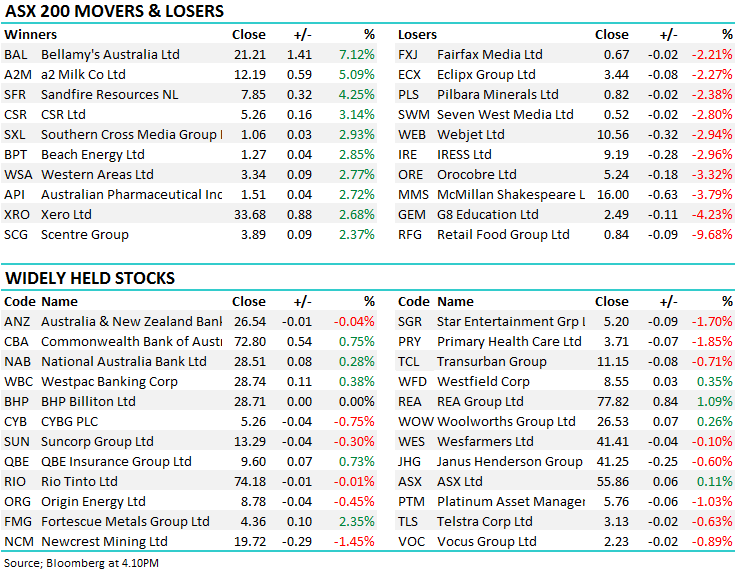

A bullish day overall despite the market only adding +9pts, it was the strong move up from the daily lows (+34pts) that caught the eye - CBA interesting here and its starting to look reasonable from a technical standpoint as it enters a seasonally strong period (as discussed in the last few reports). We had a decent order to fill today on the buy side of CBA – over 100k shares and there was no real appetite from funds we speak to be a seller of any size. Two things worth mentioning here – the public sentiment remains weak, which we know but there’s no real appetite to sell volume at these levels which tells us that CBA is susceptible to a strong bounce on the hint of a slight sentiment shift (to the upside). Elsewhere the resources were fairly neutral today, Blue Sky (BLA) came back online post the short report we discussed late last week and fell 18.56%, while G8 Education (GEM) was battling a broker downgrade from Morgan Stanley + news that it’s ex-Chair has been charged by ASIC.

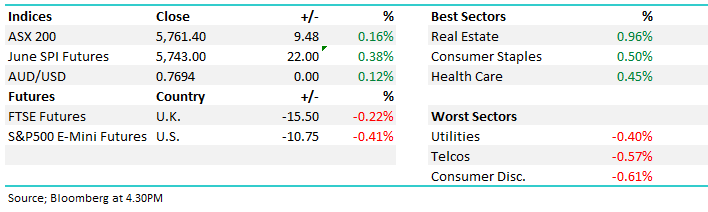

On the market today, the Real Estate stocks did best – a sector we covered in today’s income report (click here) while the retailers were weak despite a better than expected retail sales print. By the close the ASX 200 had added +9pts or +0.17% to 5761 – another decent result overall given the negativity first up.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

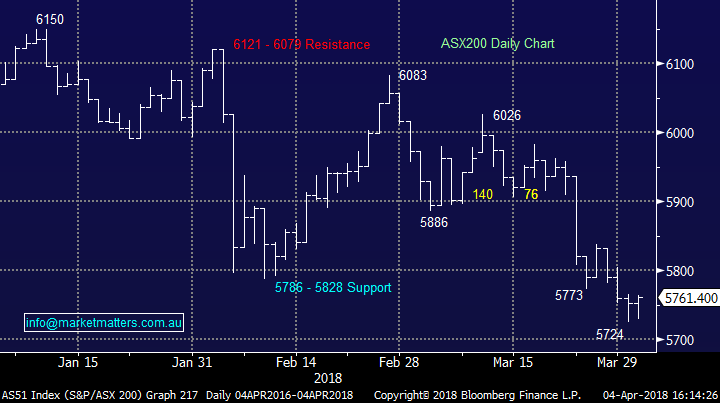

Broker Moves; A reasonable amount on the docket today with JP Morgan wielding most weight with their negative calls on G8 Education and Japara having most impact…

- BHP (BHP AU): BHP Upgraded to Sector Perform at RBC - CLOSED FLAT at $28.71

- Carsales.com (CAR AU): Carsales.com Upgraded to Neutral at Credit Suisse; PT A$13.50 – FELL -0.37% to $13.32

- CSL (CSL AU): CSL Upgraded to Buy at UBS; PT A$175 – ADDED +1.18% to $157.84

- Estia Health (EHE AU): Estia Health Rated New Neutral at JPMorgan; PT A$3.55 – FELL -1.49% to $3.30

- G8 Education (GEM AU): G8 Education Cut to Equal-weight at Morgan Stanley; PT A$2.80 - FELL -4.23% to $2.49

- Japara (JHC AU): Japara Rated New Underweight at JPMorgan; PT A$1.80 – FELL -3.38% to $2.00

- Regis Healthcare (REG AU): Regis Healthcare Rated New Overweight at JPMorgan; PT A$4.45 – ADDED 1.39% to $3.65

In terms of G8, JP Morgan downgraded their occupancy assumptions now expects a 77.7% occupancy level in 2018, versus a prior forecast of 78.8%. While it is seen recovering slightly to 79% in 2019, it is weaker than its previous expectation of 80.5%. We’ve talked about G8 a number of times as an income investment, however the earnings are simply too volatile / unpredictable at this juncture.

In terms of the Chairs run in with ASIC,the SMH reporting that Hutson has been charged with attempting to pervert the course of justice, following an ASIC investigation of G8’s takeover bid for Affinity Education in 2015. G8 has not been named but clearly not a good look!!

G8 Education (GEM) Chart

Santos (STO) $5.84 / -0.85%; Reports this am that Harbour Energy’s bid for Santos may still face issues from Australia’s Foreign Investment Review Board, given sensitivities in the nation’s gas sector – it’s a political issue so anything can happen and that explains the discount to the bid price – today the stock was lower reflecting the uncertainly.

Santos (STO) Chart

OUR CALLS

No trades in the MM Portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/04/2018. 5.04PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here