Chinese President Xi Jinping offers solace – underpinns buying (AWC)

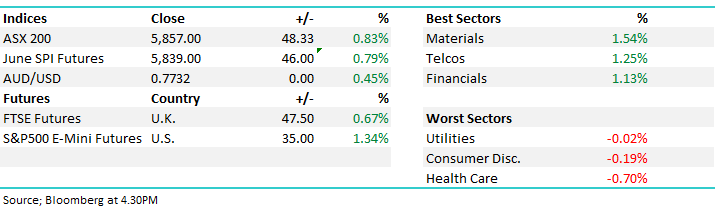

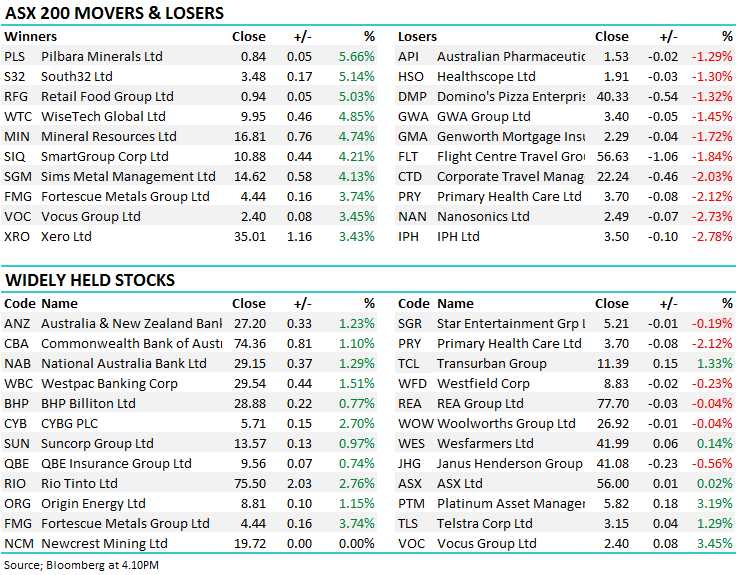

WHAT MATTERED TODAY

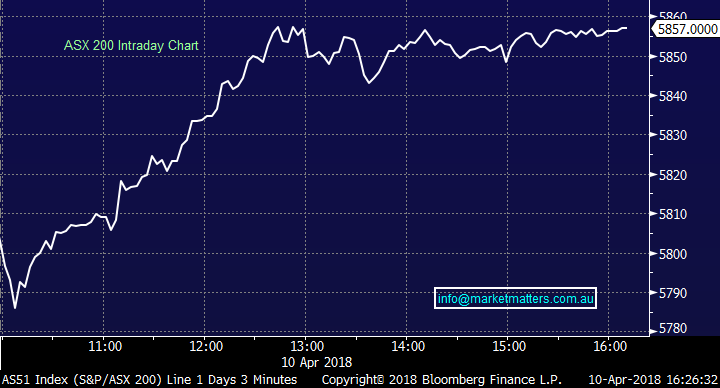

Stocks were back in favour today after the ASX opened down (-23pts at the low) but was bid up fairly strongly throughout the session. Initial weakness was overcome early with a ‘bullish’ speech by Chinese President Xi Jinping ignited buying in Asian equities while US Futures quickly put on +300pts – the market rallying +72pts from low to high ultimately finishing up +48pts or +0.83% to 5857 – the best one day reversal I’ve seen in a long time (6th March to be exact) + it fits the thesis we’ve written about in the weekend report + reiterated this morning saying that…. Our overall short-term bullish outlook for stocks is based on old fashioned valuations as we move into the US reporting season. We’ve witnessed a 10% correction in stocks against a backdrop of earnings growth - the elastic band feels ready to snap back. The US market is now offering the best value in over 3-years as it trades on 16.74x forward earnings compared to over 20x in January – dropping to 15x expected in 2019 based on current earnings forecasts. Our own market is on 15.56x expected with forecast earnings growth of 5%...which looks okay. (Resources 11.1%, Banks 1.7%, everything else 5.2%).

Unfortunately while we have Mr Trumps trade war and overall personal uncertainty simmering away in the background the markets overall valuation is likely to be capped but the pessimism - optimism tussle looks to have gone too far and we can easily see equities rally back towards at least 18x forward earnings

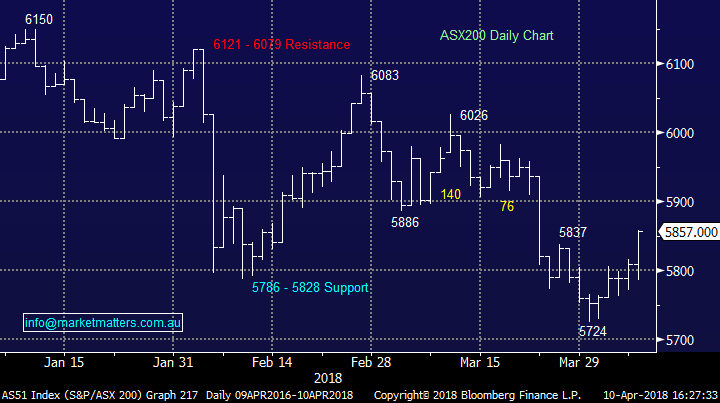

We can easily envisage a bounce by the ASX200 to the 5850 area but a close above 5900 is still required for us to become bullish short-term.

We got that move today, now we need some follow through tonight in the US – more than the +300pts the Australian market has already factored in during today’s session. Just on the index more broadly, consensus (the aggregation / average of all analyst expectations) see the ASX 200 trading at 6270 by year end. UBS moved today to reduce their year-end target (marginally) / 6250 but still flirting with consensus as most do. Based on consensus v todays close, the market has another 7% in it. We’re always cautious about consensus – and generally go against it, however it’s good to keep a handle on the streets expectations…for now, it remains marginally bullish, but less so than it was early in the year.

Price Targets for ASX 200 by year end

ASX 200 Chart

ASX 200 Chart

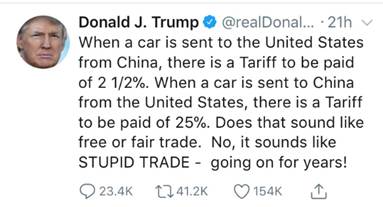

CATCHING OUR EYE

Xi Jinping (Chinese President); Put a bid tone under stocks today pledging a “new phase of opening up” in his keynote address Tuesday to the Boao Forum for Asia, China’s answer to Davos. While the speech offered little new policy, Xi affirmed or expanded on proposals to increase imports, lower foreign-ownership limits on manufacturing and expand protection to intellectual property -- all central issues in Trump’s trade gripes. “Human society is facing a major choice to open or close, to go forward or backward,” Xi told hundreds of investors gathered on the resort island of Hainan, in a speech that didn’t mention Trump’s name. “In today’s world, the trend of peace and cooperation is moving forward and the Cold War mentality and zero-sum-game thinking are outdated.”

This was clearly a bullish / consolatory speech – a potential olive branch and the market liked it...Trump has been quiet on trade today, with his last tweet nearly a day ago….(below)

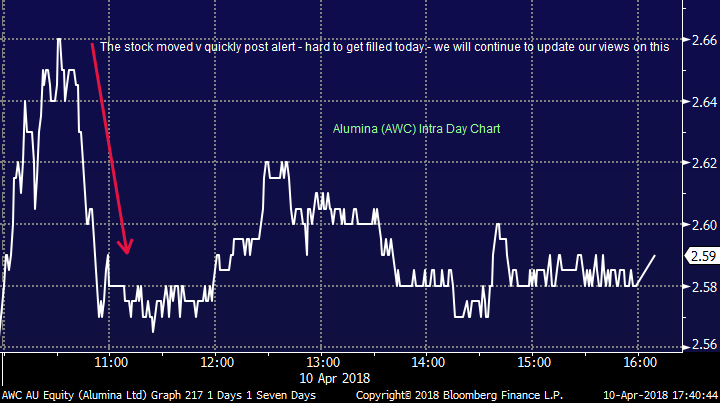

Alumina $2.59 / 1.97%; Did exactly as we predicted this morning with the stock opening with a bang and we sent the alert out – filling the MM position at $2.64 – however it didn’t last long there and sellers really took hold quickly. We failed to get many shares done across the broader portfolios we manage (through Shaw and Partners) and no doubt like many subscribers, it feels like we missed the boat today. Unfortunately that happens in markets, and today was an example of how quickly stocks can move. We’ll continue to update our views on AWC in the coming days…

Alumina (AWC) Intra Day Chart

Alumina Chart

OUR CALLS

We sold Alumina (AWC) from the MM Growth Portfolio today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/04/2018. 5.04PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here