Sellers win a second straight day (BLA)

WHAT MATTERED TODAY

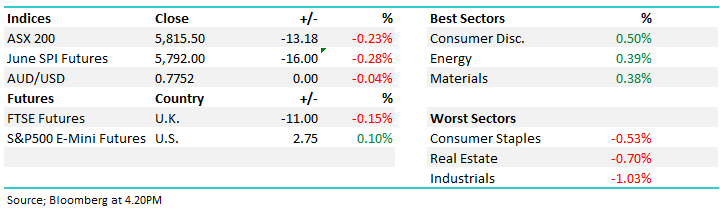

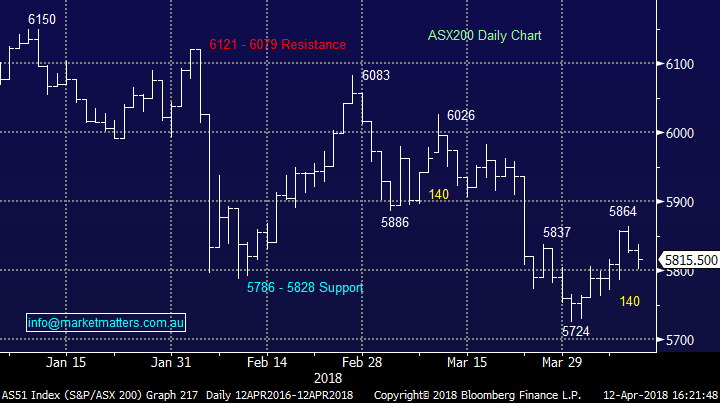

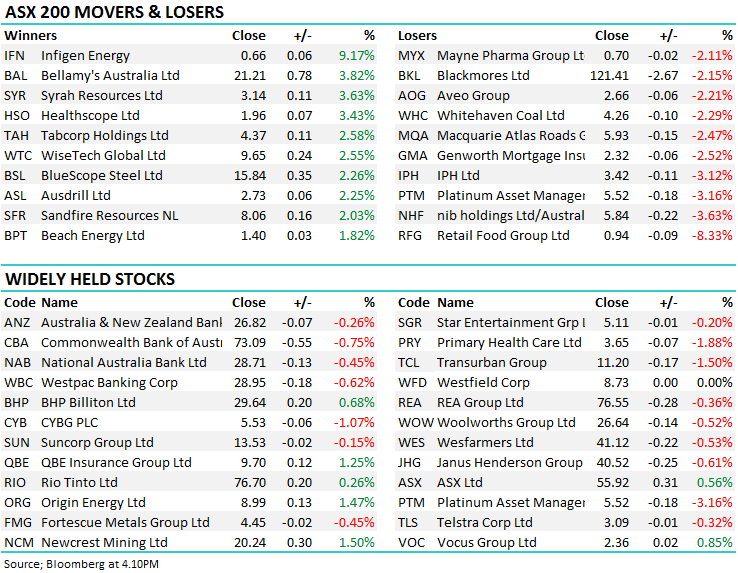

A very choppy day, particularly in early trade by the ASX with the market sold on open only to rally +35points in short order before dropping the (exact) same amount with the futures hitting a low of 5777 twice. A gradual grind higher followed with the market eventually finishing down -13pts at 5815 – the banks on the nose again offset by strength in the retailers, energy and material stocks. Calls from Donald Trump on military action against Syria said to be the catalyst of the overnight weakness which hit our market today – however on the desk this morning, it seemed like an overseas selling reducing exposure to Australia with the FUTURES market very much leading stocks.

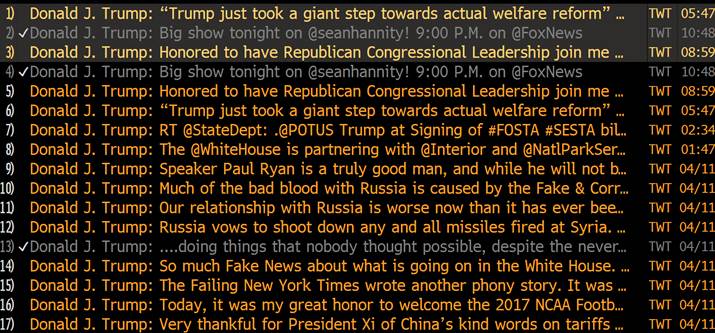

A bit of a sad day really and a poor representation of the times, however below is the list of Tweets from Trump in the last 24 hours – I now have a screen on my Bloomberg that tracks his account – the phrase ‘give yourself an upper cut’ comes to mind however its market moving stuff – so best to know rather than not!!

Trumps Tweets - last day or so

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; We were including this sporadically in the past however the feedback has been good here so I’ll continue to include broker moves. While we’re often on the other side of the crowd, we see the value in tracking what the crowd is doing and broker moves are important considering – so, we’ll continue to add to the afternoon reports …

* South32 Upgraded to Hold at Morgans Financial; PT A$3.72 - Stock up 1.76% to $3.46

* Origin Energy Upgraded to Buy at Citi; PT A$10.06 – Stock up 1.47% to $8.99

* AGL Energy Upgraded to Neutral at Citi; PT A$21.28 – Stock down -0.19% to $20.92

* AMP Upgraded to Buy at Morningstar – stock up 1.69% to $4.80

* BT Investment Upgraded to Buy at Morningstar – Stocks down -1.57% $9.41

* Rio Tinto Upgraded to Add at Morgans Financial; PT A$81.51 – Stock up 0.26% to $76.70

* Rio Tinto Downgraded to Sell at Morningstar - Stock up 0.26% to $76.70

* Rio Tinto Upgraded to Buy at CLSA – Stock up 0.26% to $76.70

* Sims Metal Upgraded to Overweight at JPMorgan; PT A$17.20 – stock up 1.02% to $14.80

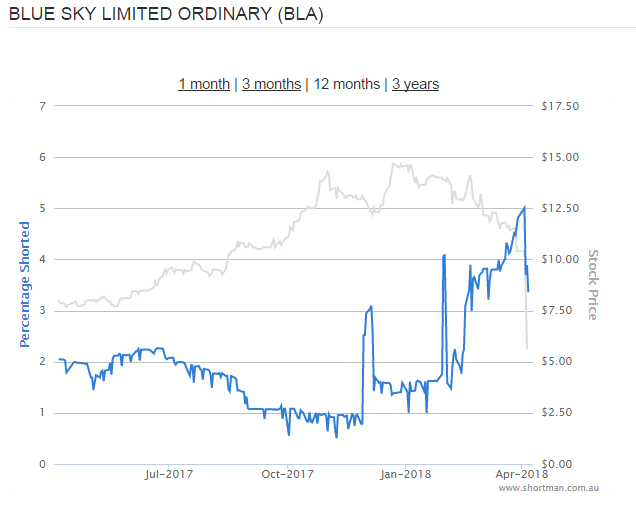

BlueSky (BLA) $5.37 / +1.13%; A very interesting interview from Alan Kohler with the CEO of BLA today which is getting some airtime –and putting more pressure on the CEO and the business model generally. Now we see comparisons being made to Babcock and Brown which is never good however that’s probably a sign that the vortex of most pain is close. The alternative asset manager performed reasonably well today and is now up +20% from the intra-day low last week however seemingly well short of what the stock should have produced given the short cover that’s started to occur.

At the time of the initial Glaucus attack about 5% of the shares on issue were shorted, this had fallen to 3.3% (or 2.6Mil shares) at the latest update 3 days ago. To put this in context, that average daily volume of the company is around 400,000 shares (much more recently), and shorts had covered 3 times this amount in under a week. This suggests that although there is a large amount of stock to be bought back, natural selling continues and I dare say that the short view hasn’t fully played out yet - the question being whether or not the sellers will outlast the buyers here. This is fast becoming a big media story and the negativity is rife – Kohler posing the Q today of whether or not BLA can survive the shorts? The simple answer, yes, we think they will and the short covering in the last few days has highlighted that. Although we have no interest in the stock, remember that negativity is at its extreme at the bottom.

I would think the short term bounce we’ve seen play out in recent days, will be met with another wave of selling before an eventual low is formed – the stock will then likely chop around in the doldrums for months / if not years.

Shorts on BLA

BlueSky (BLA) Chart

Market Matters Video Update; I spoke with Harry Watt about our market views. Click here to see today’s video.

OUR CALLS

No trades in the MM Portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/04/2018. 5.04PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here