Banks find a bid (BEN, ISU, NCM)

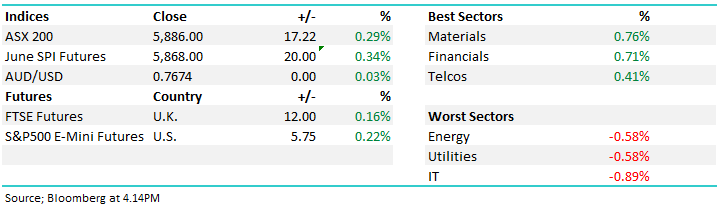

WHAT MATTERED TODAY

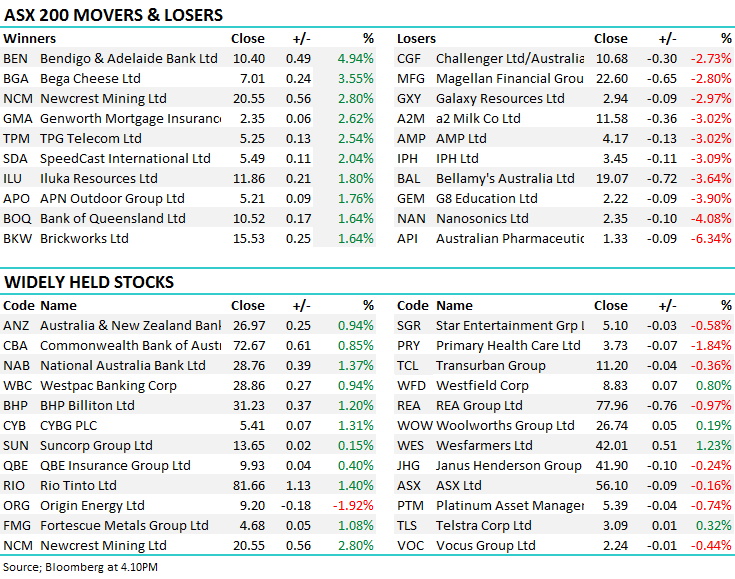

The bourse performed well on a slow news day today, as banks and miners lead the index higher. Banks, in particular the regionals in Bendigo and Bank of QLD, were shown a bit of respite from investors with the big four also finishing higher. ANZ announced a range of impacts to their half year results due out next week, pre-releasing the impacts of some known large items including the sale of their wealth business and restructuring charges that will be absorbed in the result. ANZ finished nearly 1% higher, with the announcement better than what the market was expecting, which also helped the other banks find some investor support ahead of their interim results.

Miners were also surprisingly strong despite weak commodity prices on Friday evening. Growth stocks were the losers today as the treasury yields edged higher, and tech stocks were weaker following the selloff in the US lead by Apple as Chinese sales expectations deteriorated. A number of companies announced some management changes today, with iSelect losing their CEO (more on this later), Myer closed 8.5% higher on the back of the appointment of John King to CE, and the embattled asset manager Blue Sky saw the departure of their MD Robert Shand and fell 10.4% on the news.

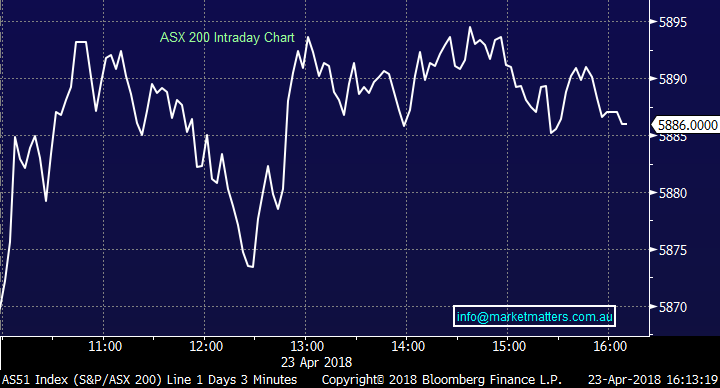

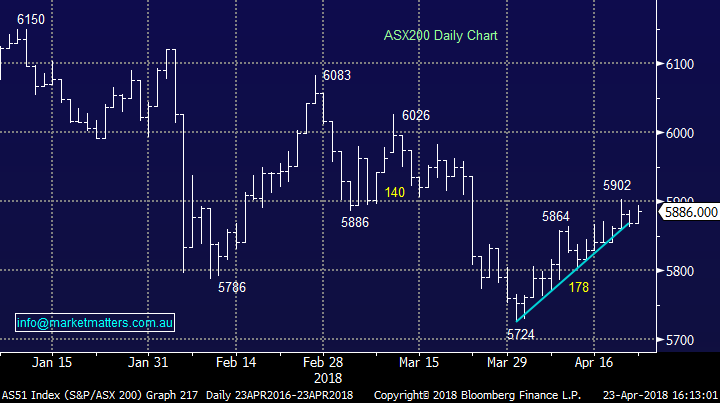

Overall the index added 17pts to 5886, up 0.29% on the day.

ASX200 Chart

ASX200 Chart

CATCHING OUR EYE

Broker Moves; Bendigo was the biggest beneficiary of broker moves today thanks to Goldman Sachs

- Regis Resources (RRL AU): Regis Resources Upgraded to Hold at Morningstar

- St Barbara (SBM AU): St Barbara Downgraded to Hold at Canaccord; PT A$4.50

- Bendigo Bank (BEN): Bendigo upgraded to Buy from

Bendigo Bank (BEN) Chart

iSelect (ISU) $0.445 / -55.5%; a difficult 12-months for the comparison platform hit another hurdle today following the resignation of MD & CEO Scott Wilson and downgrading EBIT guidance ~70% to $8-$12mil blaming a fall in lead generation and higher acquisition costs across all offerings. Doubts about iSelect’s ability to meet guidance have been noted since the half year result in February, which was much weaker than expected. Commentary from the company at the time was looking for a large second half skew in revenue which has since been derailed. The immediate resignation of Wilson also rubbed salt into the wounds of investors, a sign that all is not well within the company. Now down 80% from 12-month highs, ISU has been sick for some time.

iSelect (ISU) Chart

Newcrest Mining (NCM) $20.55 / +2.8%; finally some good news from the gold miner, announcing that approval has been received to use the old Cadia Hill open pit mine as a tailings dam after a dam wall collapsed back in early March. Although production had recommenced at the site using the southern dam, the approval now significantly increases tailing deposit capacity and will allow operations to ramp up again. While other gold miners were weak today, NCM pushed strongly higher on the news.

Newcrest (NCM) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/04/2018. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here