NAB fails to match ANZ – market momentum continues (NAB)

WHAT MATTERED TODAY

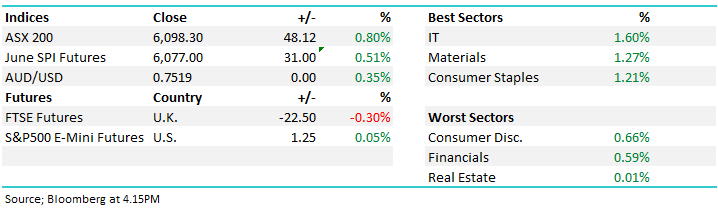

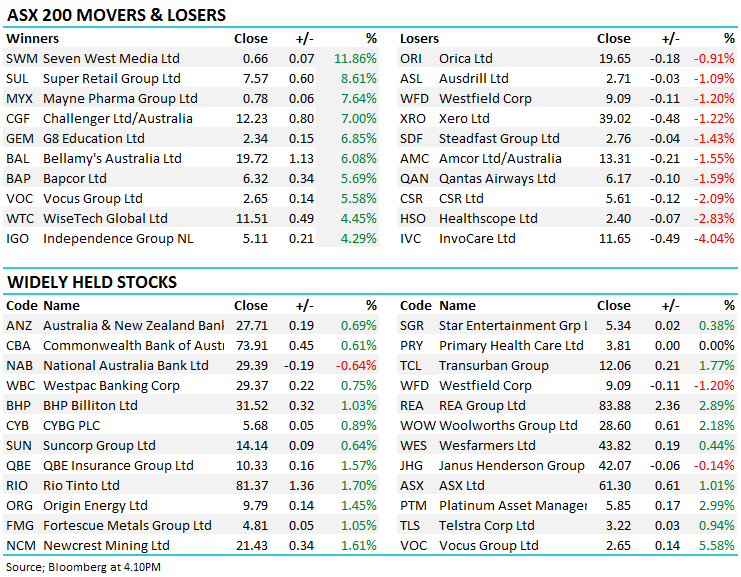

The market powered on today, once again finding good buying early and sustaining the strength throughout the day. What was particularly significant was the outperformance relative to the US market which we spoke about in the morning report – it fell ~0.7% meaning we outperformed by ~1.4% in today’s trade alone, and US futures not showing too much excitement as we rallied- the outperformance continues!!! The big four, baring NAB, were higher, while resources also moved up in the day, our switch from Macquarie (+0.74%) to Independence Group (+4.29%) bearing fruit today.

The big Macquarie Conference continued to have a bearing on stocks prices today for those that have presented – pretty much the who’s who in the listed company space – SWM which presented yesterday added a further 11.86% today after yesterday’s +2.6%, Challenger (also yesterday) put on 7% today, Super Cheap Auto added a cool 8.61%, G8 Education put on 6.85%, Citadel up 6.14%, Oz Minerals added 2.81% and yesterday’s purchase IGO added another 4.29% - it appears only buyers were listening today, and most focus was targeted towards stocks that have been under pressure of late – perhaps an element of reassurance playing out after a liquid lunch….

Overall, the index added +0.80% today, up +48pts to 6098pts on the ASX 200 – now just 152pts from our 6250 target. We’d expect some short term consolidation from here after a stellar 5 days…

ASX200 Chart

ASX200 Chart

CATCHING OUR EYE

Broker Moves;

- Clean TeQ Holdings (CLQ AU): Rated New Buy at GMP; PT C$2

- Gage Roads Brewing (GRB AU): Rated New Speculative Buy at DJ Carmichael

- InvoCare (IVC AU): Cut to Equal-weight at Morgan Stanley; PT A$12.60

- Namoi Cotton (NAM AU): Downgraded to Hold at Morgans Financial; PT A$0.51

- Nine Entertainment (NEC AU): Raised to Outperform at Credit Suisse; Downgraded to Sell at Morningstar

- Seven West (SWM AU): Downgraded to Hold at Morningstar

- Sheffield Resources (SFX AU): Rated New Outperform at RBC

- Steadfast (SDF AU): Downgraded to Hold at Morningstar

- Woolworths Group (WOW AU): Raised to Hold at Morgans Financial; PT A$25.87

National Australia Bank (NAB) $29.39 / -0.64%; NAB reported this morning coming in slightly below expectations driven mostly by increased costs (+3%) and weak revenue growth, while also accounting for $755M of restructuring charges in the half. The cash earnings excluding one-off charges of $3.3bln represents a decline on the last corresponding period of 0.2%, only saved by low bad debt charges (which is good) – although the quality of loans seems to have deteriorated somewhat as past due loans increased ~8% to $2.427bil. Along with the result, NAB placed a for sale sign on MLC, their financial advice business, continuing their efforts to divest following the sale of 80% of their life insurance business in October last year as the bank looks to simplify operations.

NAB was weaker today as should be expected when a bank increases revenue by less than the increase in costs, however it wasn’t all bad news. The market isn’t looking for high loan growth numbers, as highlighted by the response to ANZ’s result earlier in the week, but efforts to reduce costs and simplify the banks will be rewarded. In this case the benefits will materialize slower than expected, hence the small move lower today. All-in-all a result that threw up little surprises barring the uptick in personnel costs, and a dividend that was in line with market expectations at 99cents, NAB looks like it’s on the right path (just)!

National Australia Bank (NAB) Chart

OUR CALLS

No changes to the portfolio’s today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/05/2018. 4.30PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here