Clydesdale eyes off Virgin Money, the market awaits the Budget (WBC, CYB)

WHAT MATTERED TODAY

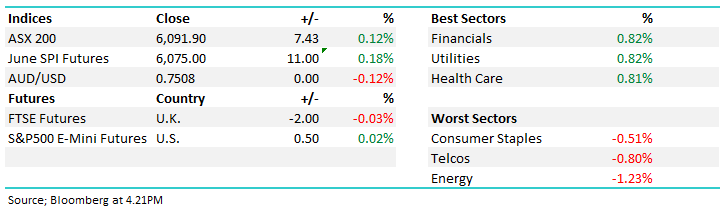

All eyes appear to be on tonight’s Federal Budget with low volumes and a lack of direction seen across the board today. For the fourth day in a row the market poked its head above 6100 but failed to close ahead of the milestone. As suggested in the AM report this morning, the market feels a touch “tired” around the 6100 area and a few more day’s consolidation &/or a pullback towards 6040 would not surprise.

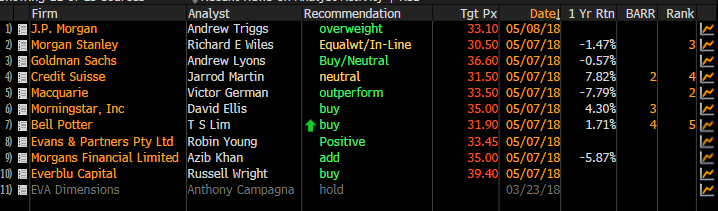

Banks were firmer today with Westpac the strongest link on the back of yesterday’s strong result - the bearish UBS report on the bank now a distant memory after it seemed WBC CEO Brian Hartzer tore apart the data set that was used to support the rationale…UBS have a SELL and $26.50 PT on WBC (not shown below as they have pulled the feed from Bloomberg it seems) while the rest of the market sits well above that – Bell Potter the latest to upgrade WBC to a BUY from hold yesterday…We remain keen in the banks into the current vortex of negativity and can see the next leg higher in the market largely being driven by buying in the sector.

WBC Broker Calls

Westpac (WBC) Chart

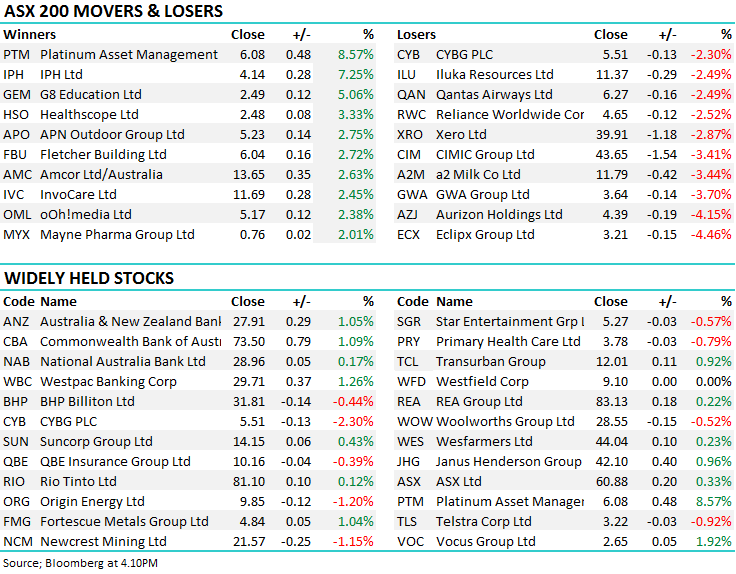

Looking elsewhere, the resource stocks saw some selling after a period of strong performance in recent times however we continue to think that a short term top courtesy of a resurgent US currency is a short term headwind. Overall the ASX 200 closed up 7 points or 0.12% to 6091, around 20 points below the intra-day high.

ASX Chart

ASX Chart

CATCHING OUR EYE

Broker Moves; Platinum was helped higher on upgrades from two brokers, rare good news for an asset manager. Woolworths was slightly softer after Shaw & Partner’s Danny Younis questioned the supermarket’s multiple and lack of growth.

- REA PT Raised to Street-High on Expected Ad Growth, M&A: Morgans

May have agent-oriented service within 6-9 months

- Premium Hike Cap Plan May Hurt Australia Health Insurers: MS

Medibank Private, NIB have price targets cut on margin concerns

- Platinum Asset Surges Most in Eight Months on Return to Inflows

April inflows ~2.5% annualized rate: Morgan Stanley

- Woodside May Take Short-Term Hit on Potential PRRT Changes: Citi

Economics of Scarborough and Browse could be questioned

- Westpac Gains for Two Days After ‘Old School’ Earnings Result

Can achieve underlying revenue growth in FY18: MS

- Woolworths Ltd. shares don’t deserve 45% premium to market because company is set to deliver only 4%-9% profit growth in FY19, Shaw and Partners analyst Danny Younis says in report.

ACTIONS:

· Woodside Downgraded to Sell at Citi; PT A$28.68

· Origin Energy Downgraded to Neutral at Citi; PT A$10.13

· Decmil Rated New Buy at Citi; PT A$1.45

· Platinum Asset Upgraded to Buy at Ord Minnett; PT A$6.50

· Platinum Asset Upgraded to Neutral at Credit Suisse; PT A$5.50

· Woolworths Group Cut to Sell at Shaw and Partners; PT A$27.75

· Macquarie Group Reinstated Buy at Shaw and Partners; PT A$117

· Macquarie Group Upgraded to Neutral at Citi; PT Set to A$110.25

· Kogan Rated New Buy at UBS; PT A$10.60

· Qantas Downgraded to Sell at Morningstar

· Alumina Downgraded to Sell at Morningstar

· Aurizon Downgraded to Underweight at Morgan Stanley; PT A$4

· Westpac Upgraded to Buy at Bell Potter; PT A$31.90

Clydesdale (CYB) $5.51 / -2.3%; CYBG was weaker today following news of a potential merger between the UK bank and Richard Branson’s Virgin Money. The proposal sees an all scrip offer to Virgin Money shareholders that would have valued Virgin at a ~31% premium had their share price not run 14% in the last few days, which looks like some market participants new of the impending announcement. As of last night’s CYB close, it was equivalent to a ~15% premium for VM holders. The deal looks like a good fit for both parties, it merges a strong personal banking group in Virgin Money with a business banking focussed Clydesdale. Virgin is also light on in terms of a digital footprint, while CYBG has its own digital banking business. This announcement is early days in the process and the ultimate deal is a long way off, however as with a lot of businesses that embark on a large corporate transaction that will bear fruit in the long term, the short term share price can suffer. Our $6.00 price target for CYB was looking good…now less so. We hold CYB in the Growth Portfolio and will be watching the progress closely.

CYBG Plc (CYB) Chart

OUR CALLS

No changes to the MM Portfolios today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/05/2018. 4.35PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here