Ah Telstra – hit on another earnings downgrade! (TLS, HSO, STO)

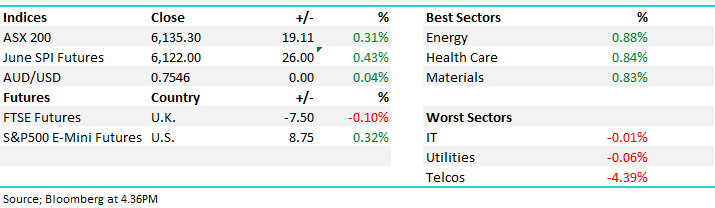

WHAT MATTERED TODAY

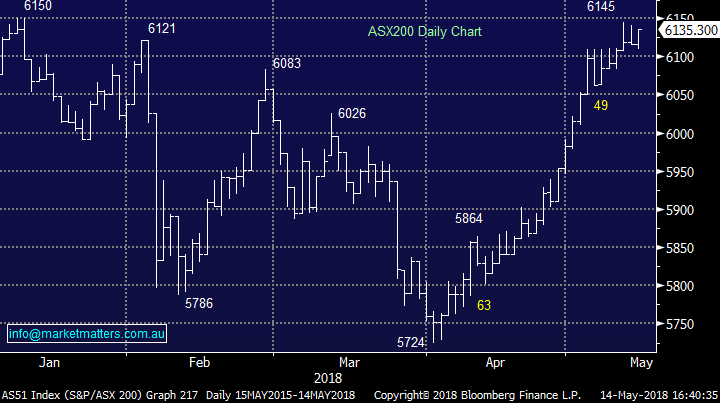

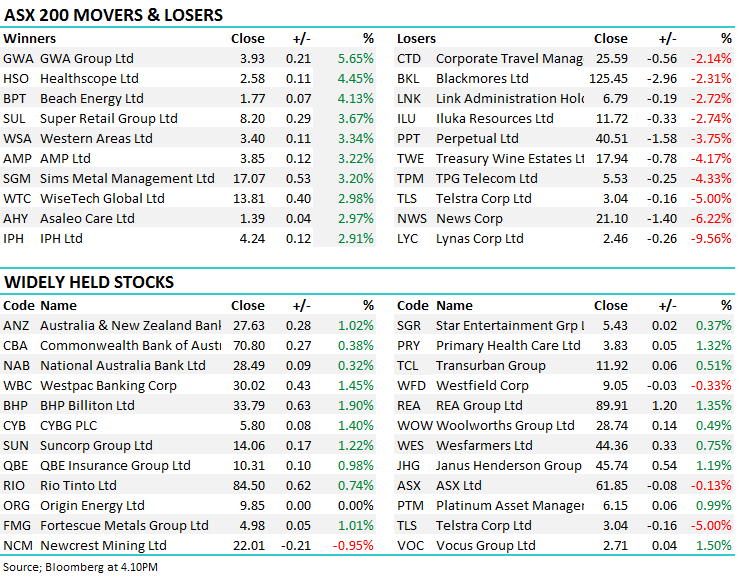

The market finished just shy of a 10-year high again today– closing half a point below the 6135.8 mark set on January 9 this year, prior to that it was January 2008! To go along with the gains, we also saw ~11points come out of the index between dividends from ANZ & MQG, both companies held much of the dividend today. CBA saw the back of their CFO Rob Jesudason who is heading to a blockchain/crypto firm in Hong Kong – now the 6th executive role they will have to fill following the arrival of new CEO Matt Comyn in March, CBA performed in line with market today, up +0.38% to close at $70.80.

TLS gave commentary around their FY18 result, pointing to EBITDA coming in at the lower end of guidance – more on this later. We also discuss the new Healthscope bid.

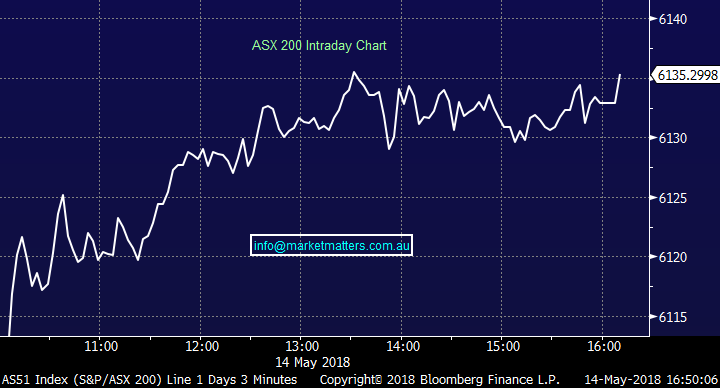

The S&P/ASX 200 index rose 0.3 percent to close at 6,135.30, the highest since Jan. 9.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

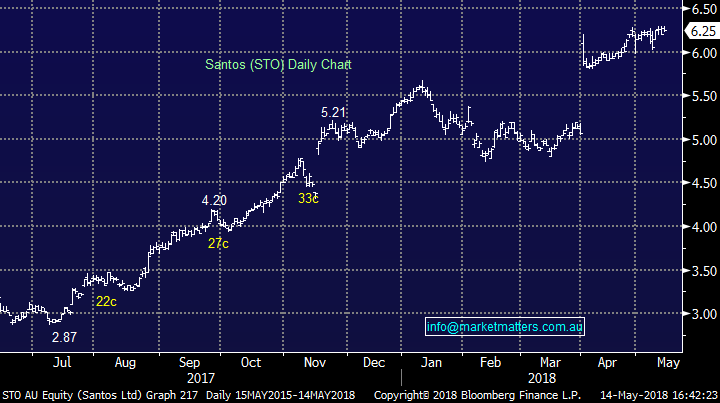

Broker Moves; Citi put out a note today on Santos taking into consideration the rise in Oil price in Aussie dollar terms, saying that Harbour Energy would now need to pay $A7 a share to compensate for the higher prevailing prices. STO is still trading at a discount to the bid price of $6.50, closing today at $6.25.

Santos (STO) Chart

ELSEWHERE…

· Alumina Upgraded to Hold at Morningstar

· IOOF Holdings Upgraded to Buy at Morningstar

· REA Group Downgraded to Sell at Morningstar

· Western Areas Upgraded to Sector Perform at RBC

· GrainCorp Upgraded to Outperform at Credit Suisse; PT A$8.80

· Super Retail Upgraded to Buy at Goldman; PT A$9.45

Telstra (TLS) $3.04 /-5.00%; Off sharply today following the update to their FY18 outlook to investors this morning, indicating that earnings will come in near the lower end of guidance at $10.1b, around 2% below consensus numbers. Although a better outlook was shown for Net Income, investors also got their first taste of declining margins in the mobile business showing average return per unit (ARPU) falling 3.6% in the quarter alone. While user numbers increased, any benefit was offset by the decline in ARPU which is concerning considering the rise in lower cost options in the market. The CFO, Warwick Bray, noted revenue is in decline “because of the more generous plans in the market” – something to consider if your mobile plan is up for renewal! They are cutting costs and this is dropping down into a higher than expected free cash flow forecasted in the future + they confirmed their dividend of 22cps was safe for now, the market seemed to hang it’s hat on the negative trends underpinning the result.

Telstra (TLS) Chart

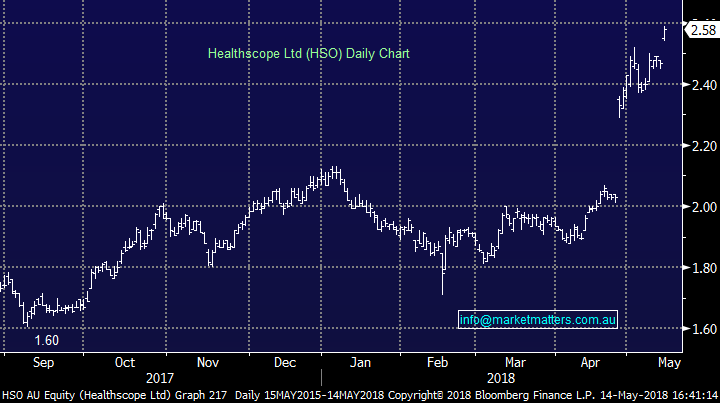

Healthscope (HSO) $2.58 / +4.45%; Up today after confirming a second party had now come to the table with their own takeover proposal. A fuse was lit under HSO in April following a $4.11bil offer from a group of institutions the private equity firm BGH had pulled together, and now Brookfield Asset Management has offered $4.35bil or $2.50/share, just shy of 6% better than the original. Brookfield is a large Canadian based global asset manager that already has a significant footprint in the Australia’s hospital industry, owing the leading constructor in Multiplex, and a facilities management business in Brookfield GIS that services 11 hospitals. HSO climbed well above both offers today in anticipation of a bidding war to come between the two parties – and any other bidders that may yet come to the table. Brookfield’s bid is subject to a “level playing field condition” which prevents any new bidder gaining due diligence without presenting a higher bid, and without agreeing to vote in favour of any offer that is unanimously accepted by the Healthscope board – a bit of a mouthful but really just aimed a de-railing some of the BGH bid’s exclusivity clauses.

The Healthscope board has much to consider, and will probably look to bide their time given that a third player in NorthWest Healthcare REIT is likely to enter the fold. Another Canadian player, NorthWest has a large global hospital real estate position, and took up 10% of Healthscope shares through a derivative deal about a week ago signalling that they would like to add Healthscope’s real estate portfolio to their books.

Healthscope (HSO) Chart

OUR CALLS

No changes to the MM Portfolios today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/05/2018. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here