BWX rallies 35% on proposed management buyout (BWX, JHX)

WHAT MATTERED TODAY

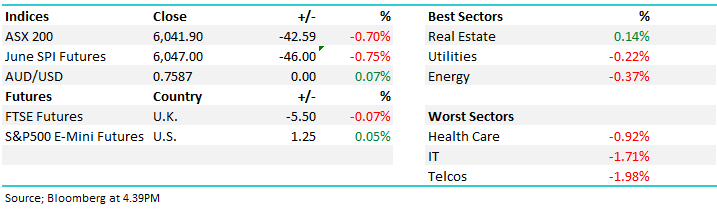

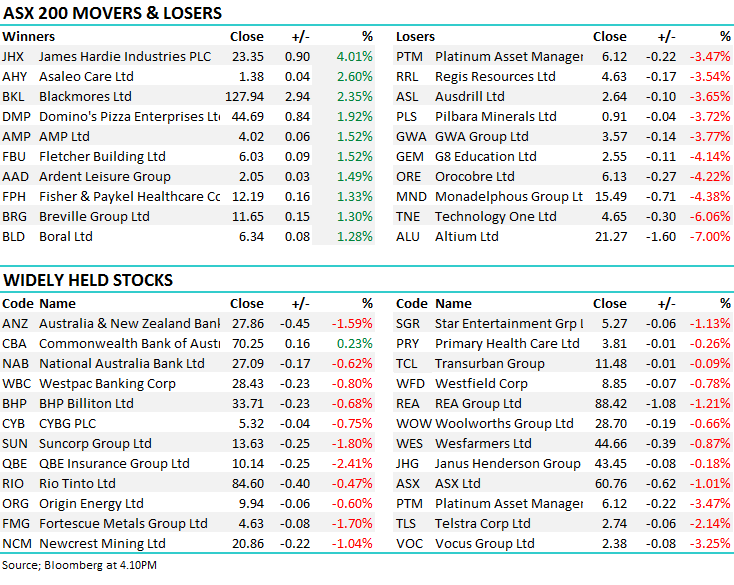

The Australian market continued to pullback from near 10-year highs today, underperforming the US market which rallied overnight (although we saw the bulk of it yesterday). Telcos, in particular Telstra, continued to head lower, the worst sector in the index again today while Real Estate was the top of the boards today which is unsurprising given the prevailing weakness. We also saw some divergence in the banks as CBA restored some of its premium to the other majors - the only big 4 that closed in the black with some BIG buy orders going through our desk today as the stock traded below $70. The stock closed up 16c or 0.23% to $70.25.

James Hardie was also strong following their full year results coming in higher than expected – more on this later. BWX, which we spoke about this morning was bid up strongly after coming back online post news of a proposed management buy-out. Healthscope walked away from both bids saying the they didn’t value the long term prospects of the business – the stock falling 2.44% following the news however the weakness was also a result of a profit downgrade. The stock was down sharply in early trade but recovered well from the lows– seems the market thinks their stonewalling of the bidders is simply a negotiating ploy – which it probably is.

Both APN Outdoor and Ohh!Media shares were sold off with a bidding war set to play out between the pair for outdoor advertising company Adshel, owned by another Aussie listed media company HT&E – falling -3.4% and -2.21% respectively, while HT&E shares jumped 5.26%.

Overall, the ASX 200 fell -42 points today, -0.70% to close at 6041 – the weakest day for a while.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; AMP caught a bid as Morgan Stanley tried to catch the falling knife, upgrading their rating to overweight – the other names in the space were weaker, PDL not helped by Morningstar’s downgrade, while the others tracked the market lower. MS saying AMPs $200m push into goals based strategies will guide them through the compliance storm that is brewing…

· AMP (AMP AU): Upgraded to Overweight at Morgan Stanley; PT A$4.50

· Comvita (CVT NZ): Downgraded to Underperform at Woodward Partners; PT NZ$6

· Pendal Group (PDL AU): Pendal Group Downgraded to Hold at Morningstar

AMP Chart

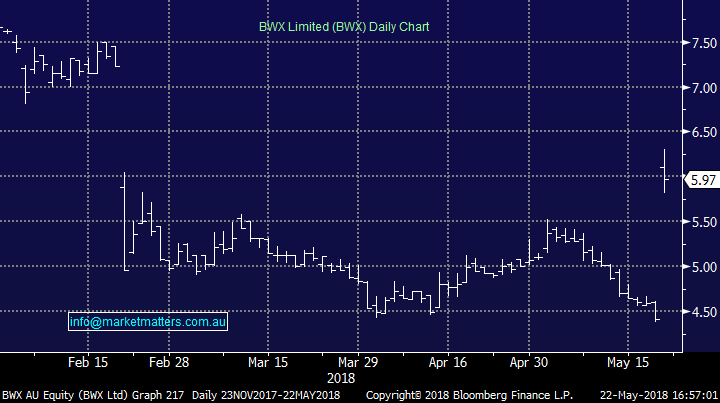

BWX Limited (BWX) $5.97 / +35.37%; The skin and hair care products company came back online today after the proposed management buy-out announced yesterday with the share unsurprisingly strong, although really, I would have thought they’d be stronger given the large short and the structure of the proposal being put forward. For those that missed it, the current CEO John Humble and the Finance Director Aaron Finlay with the support of private equity firm Bain Capital. The stock has had a tough run recently on the back of weak earnings and the shorts starting attaching post the recent downgrade – going from around 4% of the register in January to around 11% now….

BWX – Increase in Short Interest – 13m shares sold short

The key now will come from the major shareholders – the CEO owns around 11% from what I can tell while Bennelong Funds Management owns just shy of 20%, while Mark East who runs Bennelong also has 1m shares in his own name. The bid is either all cash ($6.60) or a combination of shares in an new entity and cash, however it seems an all cash bid is the more likely outcome given the composition of the register. I would have thought the number is closer to $7 but todays price action probably suggests otherwise…

Top 20 Share Holders

BWX (BWX) Chart

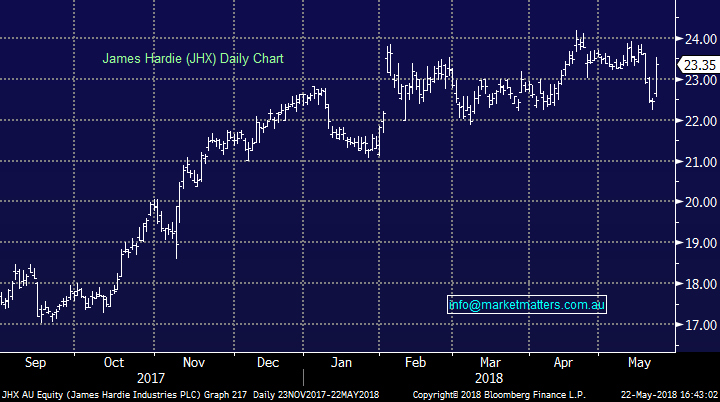

James Hardie (JHX) $23.35 / +4.01%; James Hardie printed a good set of numbers this morning and the stock rallied on the back of it. From an earnings perspective (adjusted operating profit) it was around a 4% beat to Bloomberg Consensus / $US291m versus $US276m expected however the top line (revenue) + margins etc were all pretty much inline with expectations. They had a tougher start to the year, and a better end (31st March year-end) with the US performing well. Interesting to compare James Hardie with Boral and clearly JHX doing a better job in the US at the moment.

James Hardie (JHX) Chart

OUR CALLS

No changes to the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/05/2018. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here