Defensive names are in favour, Santos rejects takeover (STO)

WHAT MATTERED TODAY

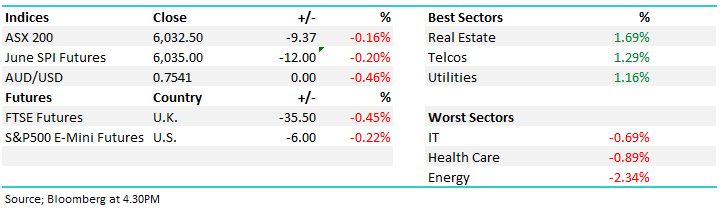

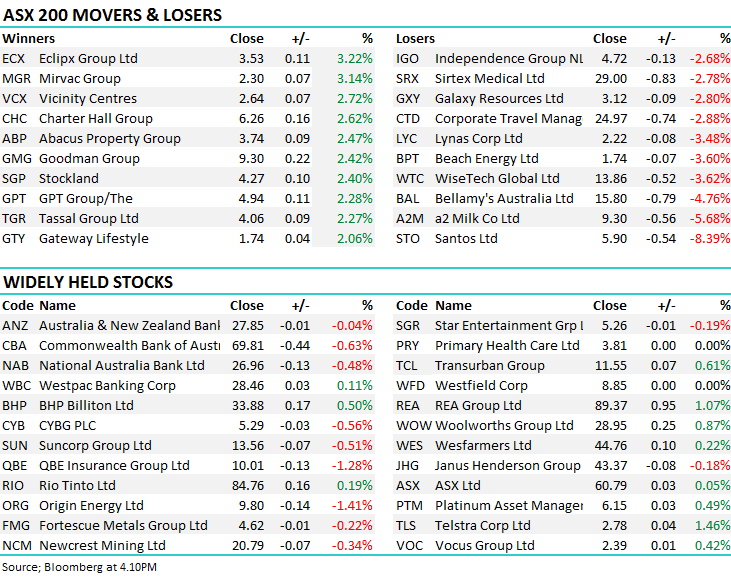

The index was choppy early, edging higher in the first hour before heading lower from at around 11am onwards which coincided with Santos resuming trade after snubbing the harbour bid. It was the real estate names that supported the market once again today with 7 of the top 8 performers in the ASX200 being REITs – Eclipx took out the top spot, catching a bid after we discussed it in today’s income report – click here to read. Along with the REITs, it was the other defensive sectors that were in favour today – even the Telcos lead by Telstra had a rare day in the sun! Energy was weak, driven lower mainly by Santos rejecting the Harbour Energy takeover over.

Overall, the market closed 9 points lower, -0.16% to 6035 points.

A quick rundown of today’s trade from James Gerrish – Direct From The Desk after market close today

ASX200 Chart

ASX200 Chart

CATCHING OUR EYE

Broker Moves; Wilsons turned neutral on CSL as brokers continue to chase the stock higher. BWX downgraded to a hold at Shaw & Partners – likely pre-empting a move that hasn’t occurred yet closer to the $6.60 takeover offer – the offer/price target is now 13% higher than the stock price.

· Bapcor (BAP AU): Rated New Buy at William O’Neil & Co Incorporated

· BWX (BWX AU): Downgraded to Hold at Shaw and Partners; PT A$6.60

· CSL (CSL AU): Downgraded to Hold at Wilsons; PT A$181.34

· Growthpoint (GOZ AU): Rated New Neutral at JPMorgan; PT A$3.20

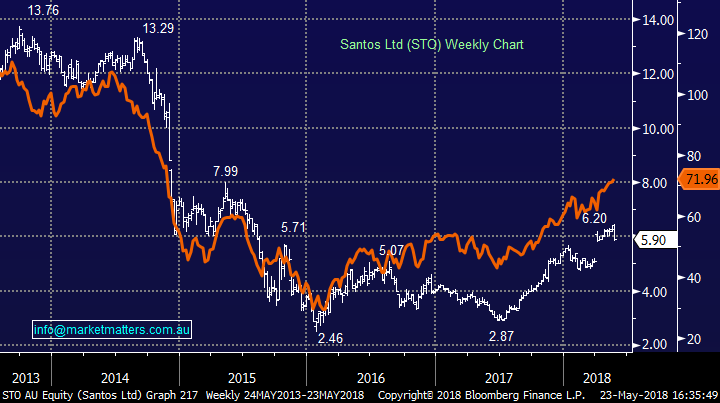

Santos (STO) $5.90 / -8.39%; last night the Santos board walked away from the Harbour Energy takeover offer of $7 and the stock got hit today fairly hard, although it could have been worse if not for a strong Oil price - the stock tumbling more than 8% in early trade and failing to recover throughout the session. The bid from US based group is said to be their final offer and the end of a lengthy process that started with a $5.30 bid back in November – the final bid was ~60% higher than the Santos price before the original bid and Harbour probably have every right to be peeved. Some will sight the last time

Santos copped a bid in 2015, the price was at a similar level, $6.88, and after they rebuked it the stock traded to a low of $2.46 in 2016. The difference at this stage being a buoyant Oil price that has allowed STO to print more cash and pay off more debt than they thought possible.

Harbour also wanted a greater level of hedging while Santos wanted less. Seems like Santos might be bullish the oil price at current levels and that’s the reason why they stayed firm. It’s always dangerous to extrapolate current conditions out into the future – let’s hope STO have not just called the TOP!

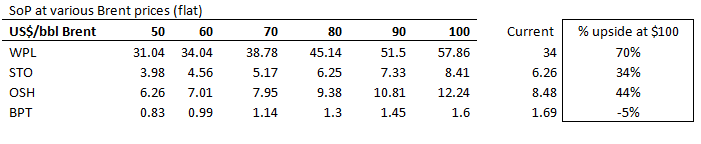

Oil price sensitivities

The above gives some idea around sensitivities to the Oil price and where STO should trade while the chart below overlays STO with the Crude Price .

Santos v Crude Oil Chart

OUR CALLS

No changes to the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/05/2018. 4.35PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here