Telstra upgrade sparks some buying (TLS, WES)

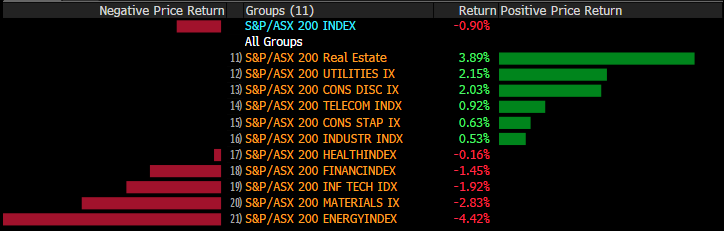

WHAT MATTERED TODAY

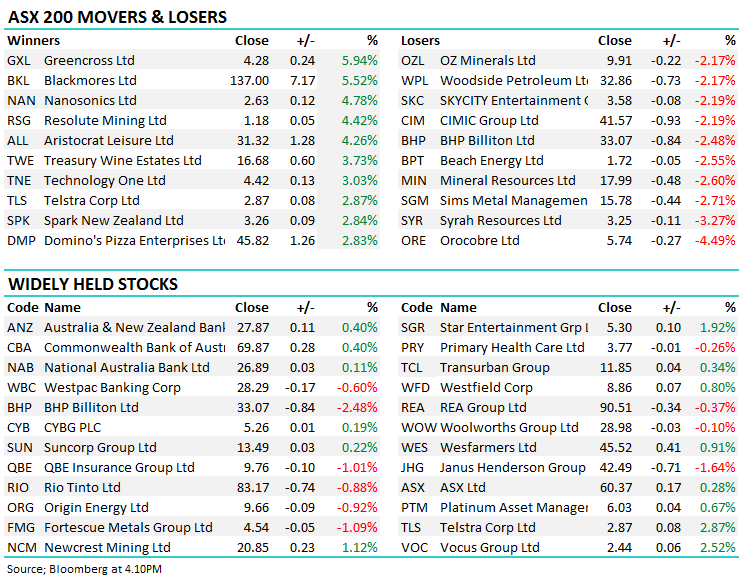

Another day where the market bounced from session lows – closed near enough the highs with some obvious rotation out of the resource stocks towards the dark side - the banks doing okay with ANZ & CBA +0.4%, NAB +0.11% while WBC finished lower by -0.60% versus BHP -2.48%. Brace yourself – Telstra (TLS) was upgraded today by UBS and rallied +2.87% to close at $2.87 – the biggest daily gain for over a year from what I can see. I discuss todays trade – TLS, WES and the Lithium space in a brief recording here

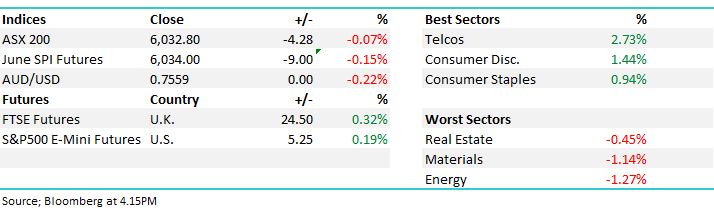

Overall, the ASX 200 lost -4 points today, although that was +16pts from the daily low and just 6 points from the high.

ASX 200 Chart

ASX 200 Chart – Aussie market looks like it ‘wants’ to go higher in the short

CATCHING OUR EYE

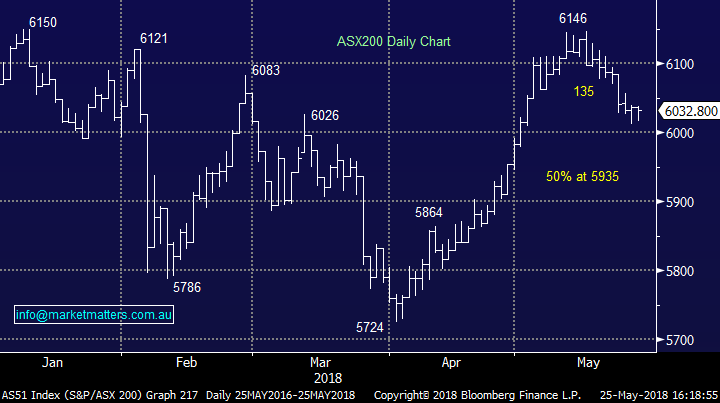

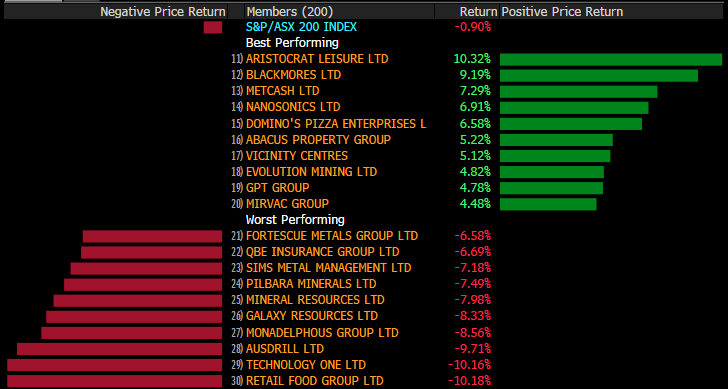

Weekly Moves – Stocks & Sectors;

The defensive sectors did best this week while money is now starting to come out of the recently hot resource / energy names. The failed bid for Santos not helping.

Sector moves over the week

In terms of stocks, Aristocrat (ALL) a clear standout on an earnings upgrade while Vicinity (VCX) – the property co we hold in the Income Portfolio did well.

Stock moves over the week

Broker Moves; Telstra saw some love from UBS today, who upped their price target to $3 and threw a buy on the stock. The report sighted the optionality Telstra has with wireless broadband and 5G networks, and noted that a lot of downside appears to be priced in, particularly with risk to the dividend – I couldn’t have said it better myself. They have a strategy day on the 20th of June that will outline the next steps the big telco will take including how it plans to spend the $3b strategic war chest they have to tackle the changes in the market.

UBS theorizes the capital will be used to buy spectrum and begin work on 5G capability, while also pushing into wireless broadband to steal customers back from the NBN – a double benefit for TLS, more customers and likely lower NBN wholesale costs as user numbers decline. Telstra got as high as $2.92 / +4.66% today before settling at $2.87 / +2.87%, it will be interesting to see if the buying follows through and we see a reasonable (ongoing) bounce.

Telstra (TLS) Chart

Elsewhere…

· Aristocrat (ALL AU): Upgraded to Outperform at Credit Suisse; PT A$35; Downgraded to Sell at Morningstar

· LendLease (LLC AU): Downgraded to Hold at Shaw and Partners; PT A$18.71

· Reliance Worldwide (RWC AU): Raised to Add at Morgans Financial; PT A$5.46

· Webster (WBA AU): Webster Downgraded to Hold at Bell Potter; PT A$1.80

Wesfarmers (WES) $45.52 / +0.91%; announced the sale of their UK Bunnings arm Homebase today to private equity group Hilco Capital, bringing an end to what has been a costly exercise. The deal struck seems to favour Wesfarmers significantly, taking a huge $2b worth of lease obligations along with a seemingly endless capital drain off the books, whilst also entitling them to 20% for the proceeds when Hilco inevitably sell the business. The sale is another decisive action from the new CEO Rob Scott, who has only held the job since late last year, who has moved to divest Coles & the coal business in a less is more approach. The sale itself shows good capital management, cutting off a business that was haemorrhaging money, and although it will likely go cash flow positive eventually, it will take a lot of investment to get it there first – Hilco’s problem now.

Wesfarmers (WES) Chart

OUR CALLS

No changes to the MM Portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/05/2018. 4.36PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here